Ny Form Tr 579 Ct 2019

What is the NY Form TR 579 CT

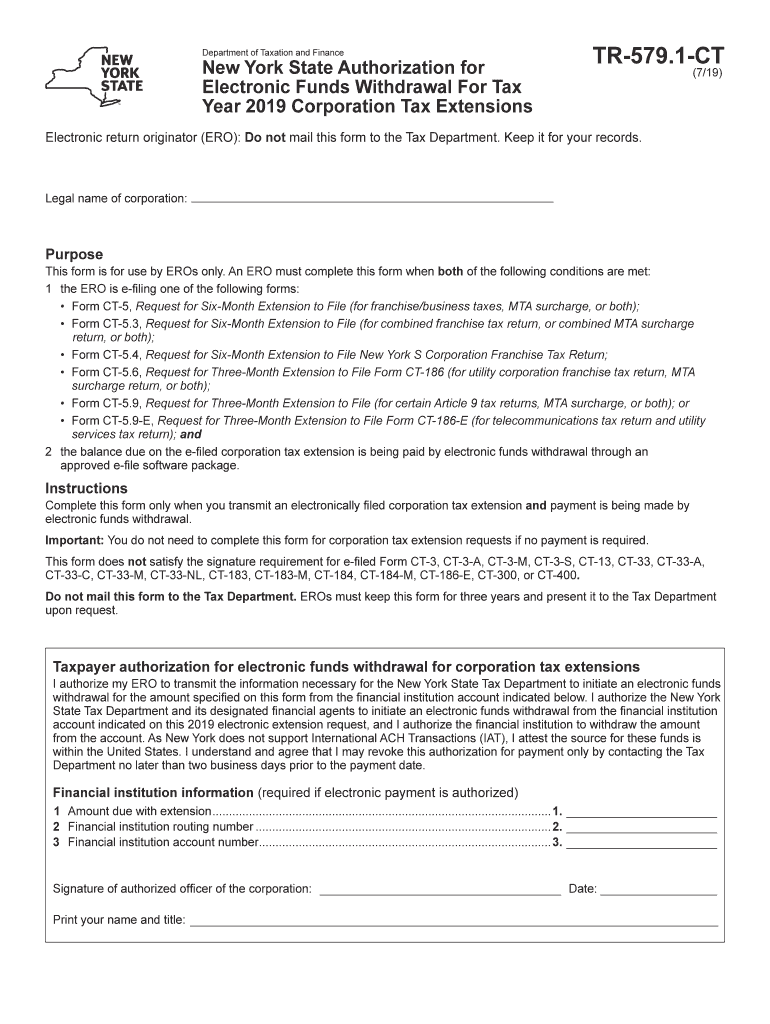

The NY Form TR 579 CT is a crucial document used in the state of New York for tax purposes. This form is primarily utilized by businesses and individuals to report certain financial information to the state tax authorities. It serves as a means for taxpayers to declare their income and calculate any taxes owed. Understanding the specific requirements and purpose of the TR 579 CT is essential for compliance with state tax regulations.

Steps to Complete the NY Form TR 579 CT

Completing the NY Form TR 579 CT involves several key steps to ensure accuracy and compliance. Start by gathering all necessary financial documents, including income statements and expense records. Next, carefully fill out the form, ensuring that all sections are completed accurately. Pay special attention to any calculations, as errors can lead to delays or penalties. Once the form is filled out, review it thoroughly before submission to confirm that all information is correct.

Legal Use of the NY Form TR 579 CT

The legal use of the NY Form TR 579 CT is governed by state tax laws. This form must be completed and submitted by the designated deadlines to avoid penalties. The information provided on the form is used by the New York State Department of Taxation and Finance to assess tax liabilities and ensure compliance with state tax regulations. It is important to note that failure to file or inaccuracies in the form can result in legal consequences.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the NY Form TR 579 CT is vital for compliance. Typically, the form must be submitted by a specific date each year, coinciding with the annual tax filing season. Taxpayers should be aware of any changes to deadlines, as these can vary from year to year. It is advisable to mark these important dates on a calendar to ensure timely submission and avoid potential penalties.

Required Documents

To successfully complete the NY Form TR 579 CT, certain documents are required. Taxpayers should gather all relevant financial records, including W-2 forms, 1099 forms, and any supporting documentation for deductions or credits claimed. Having these documents readily available will facilitate a smoother filing process and help ensure that all information reported is accurate and complete.

Who Issues the Form

The NY Form TR 579 CT is issued by the New York State Department of Taxation and Finance. This government agency is responsible for administering the state's tax laws and ensuring compliance among taxpayers. The department provides resources and guidance on how to properly complete and submit the form, helping taxpayers navigate the requirements effectively.

Examples of Using the NY Form TR 579 CT

Examples of using the NY Form TR 579 CT include various scenarios where individuals or businesses report income or claim deductions. For instance, a self-employed individual may use the form to report earnings from freelance work, while a small business might use it to declare revenue and expenses. Understanding these examples can help taxpayers recognize when and how to utilize the form effectively in their financial reporting.

Quick guide on how to complete ny tr 5791 ct 2019

Manage Ny Form Tr 579 Ct effortlessly on any device

Web-based document management has become widely adopted by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Ny Form Tr 579 Ct on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Ny Form Tr 579 Ct with ease

- Find Ny Form Tr 579 Ct and select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with features that airSlate SignNow offers specifically for this task.

- Create your signature using the Sign tool, which takes only a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, cumbersome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and eSign Ny Form Tr 579 Ct while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ny tr 5791 ct 2019

Create this form in 5 minutes!

How to create an eSignature for the ny tr 5791 ct 2019

How to generate an electronic signature for the Ny Tr 5791 Ct 2019 in the online mode

How to create an electronic signature for the Ny Tr 5791 Ct 2019 in Chrome

How to generate an electronic signature for signing the Ny Tr 5791 Ct 2019 in Gmail

How to create an eSignature for the Ny Tr 5791 Ct 2019 right from your smartphone

How to create an eSignature for the Ny Tr 5791 Ct 2019 on iOS devices

How to create an eSignature for the Ny Tr 5791 Ct 2019 on Android OS

People also ask

-

What is tr 579 ct and how does it relate to airSlate SignNow?

TR 579 CT refers to a specific tax regulation that may require businesses to process documents electronically. airSlate SignNow enables users to efficiently handle such documents with electronic signatures, ensuring compliance with TR 579 CT while simplifying the signing process.

-

How can airSlate SignNow help with the TR 579 CT documentation process?

With airSlate SignNow, you can streamline the documentation process related to TR 579 CT by using a secure eSignature solution. This allows for faster turnaround times and reduces the need for physical paperwork, making compliance easier.

-

What are the pricing options available for using airSlate SignNow for TR 579 CT documents?

airSlate SignNow offers flexible pricing plans tailored to different business needs, including options for those handling TR 579 CT documents. You can choose from monthly or annual plans, all designed to provide cost-effective solutions.

-

What features does airSlate SignNow provide for managing TR 579 CT paperwork?

airSlate SignNow includes features like customizable templates, robust security measures, and real-time tracking, all essential for managing TR 579 CT paperwork. These features help you maintain organization and ensure that documents are completed correctly.

-

Can airSlate SignNow integrate with other tools to support TR 579 CT compliance?

Yes, airSlate SignNow integrates seamlessly with numerous business applications to support TR 579 CT compliance. This allows you to connect your preferred tools, making it easier to manage and process the required documents efficiently.

-

What are the benefits of using airSlate SignNow for TR 579 CT document signing?

Using airSlate SignNow for TR 579 CT document signing offers signNow benefits, including increased efficiency, enhanced security, and improved user experience. These advantages can signNowly reduce the time and effort required to complete compliance-related tasks.

-

Is airSlate SignNow user-friendly for non-technical users handling TR 579 CT?

Absolutely! airSlate SignNow is designed with user experience in mind, making it accessible for non-technical users handling TR 579 CT documents. Its intuitive interface allows anyone to send, sign, and manage documents without prior technical knowledge.

Get more for Ny Form Tr 579 Ct

Find out other Ny Form Tr 579 Ct

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament