St 100 Online 2023-2026

What is the ST-100 Form?

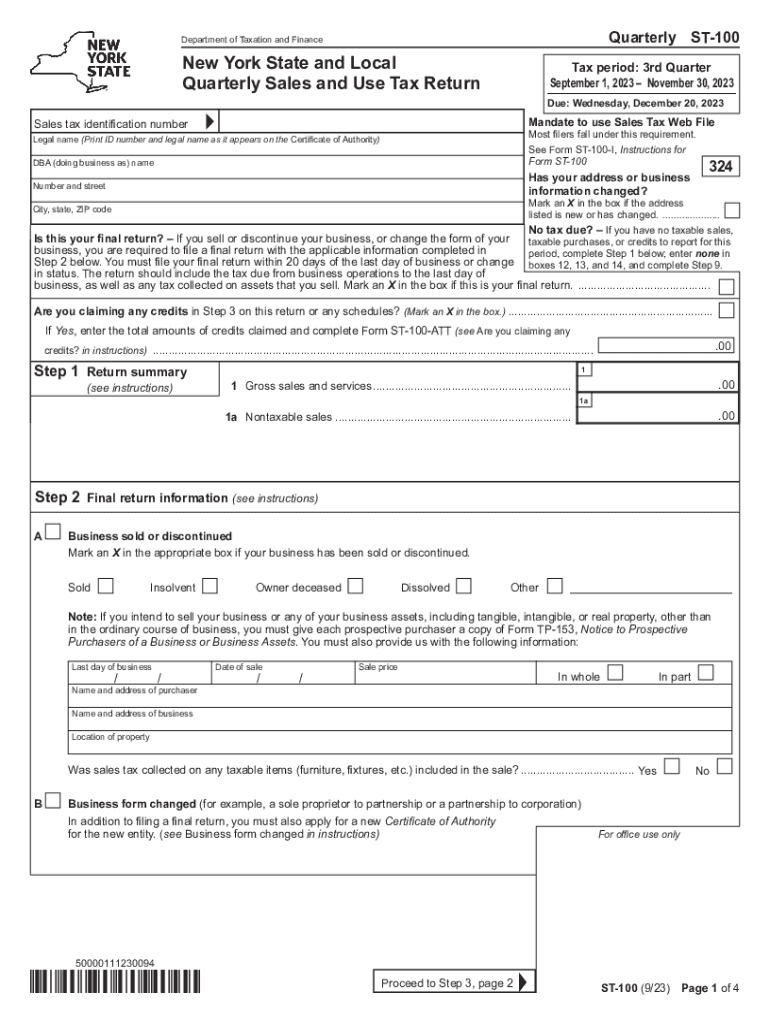

The ST-100 form is a New York State sales tax return used by businesses to report and pay sales tax collected during a specific period. This form is essential for businesses operating in New York that are registered to collect sales tax. It provides the New York State Department of Taxation and Finance with necessary information about taxable sales, exempt sales, and the amount of sales tax owed. The ST-100 is typically filed quarterly, aligning with the state's sales tax reporting schedule.

Steps to Complete the ST-100 Form

Filling out the ST-100 form involves several key steps:

- Gather all sales records for the reporting period, including total sales, exempt sales, and any sales tax collected.

- Fill in the business information, including the legal name, address, and sales tax identification number.

- Report the total sales and exempt sales in the designated sections of the form.

- Calculate the total sales tax due based on the applicable sales tax rate.

- Review the completed form for accuracy before submission.

Legal Use of the ST-100 Form

The ST-100 form must be used in accordance with New York State tax laws. Businesses are legally required to file this form if they collect sales tax. Accurate reporting is crucial, as failure to comply with sales tax regulations can lead to penalties and interest on unpaid taxes. Understanding the legal obligations associated with the ST-100 ensures that businesses remain compliant and avoid potential legal issues.

Form Submission Methods

The ST-100 form can be submitted through various methods to accommodate different business needs:

- Online: Businesses can file the ST-100 electronically through the New York State Department of Taxation and Finance website, which offers a streamlined process.

- Mail: The completed form can also be printed and mailed to the appropriate address provided by the state.

- In-Person: Some businesses may choose to deliver the form in person at designated state offices.

Key Elements of the ST-100 Form

Understanding the key elements of the ST-100 form is vital for accurate completion. The form includes sections for reporting:

- Total taxable sales

- Total exempt sales

- Sales tax collected

- Any adjustments from previous periods

- Final sales tax due

Each section must be filled out carefully to ensure that the total tax owed is calculated correctly.

Filing Deadlines / Important Dates

Timely filing of the ST-100 form is crucial to avoid penalties. The filing deadlines are typically set quarterly:

- For the first quarter (January to March), the deadline is usually April 20.

- For the second quarter (April to June), the deadline is typically July 20.

- For the third quarter (July to September), the deadline is usually October 20.

- For the fourth quarter (October to December), the deadline is typically January 20 of the following year.

It is important for businesses to mark these dates on their calendars to ensure compliance.

Quick guide on how to complete st 100 online

Complete St 100 Online effortlessly on any device

Digital document management has become increasingly favored by companies and individuals. It serves as an excellent environmentally friendly alternative to traditional printed and signed papers, allowing you to locate the correct form and securely archive it online. airSlate SignNow supplies you with all the resources necessary to create, modify, and eSign your documents promptly without delays. Handle St 100 Online across any platform using airSlate SignNow Android or iOS applications and enhance any document-centered operation today.

The simplest method to alter and eSign St 100 Online with ease

- Locate St 100 Online and click Get Form to commence.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign feature, which requires only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to retain your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, cumbersome form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your requirements in document management in just a few clicks from any device of your preference. Modify and eSign St 100 Online and ensure outstanding communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct st 100 online

Create this form in 5 minutes!

How to create an eSignature for the st 100 online

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is New York State sales tax, and how does it affect my business?

New York State sales tax is a tax imposed on the sale of goods and services within New York. If your business operates in New York, it's essential to understand how this tax affects your pricing and compliance obligations. Utilizing tools like airSlate SignNow can help streamline documentation processes related to tax compliance.

-

How can airSlate SignNow assist with New York State sales tax compliance?

AirSlate SignNow provides a platform to eSign and manage documents necessary for your sales tax compliance in New York. By digitizing your contracts and invoices, you can ensure that all documents adhere to state tax regulations. This reduces errors and saves time during tax season.

-

What features does airSlate SignNow offer to help manage New York State sales tax documentation?

AirSlate SignNow offers features such as customizable templates, automated reminders, and secure document storage for all sales tax-related documents. These features simplify the handling of invoices and tax forms so you can stay organized and compliant with New York State sales tax regulations.

-

Is airSlate SignNow affordable for businesses dealing with New York State sales tax?

Yes, airSlate SignNow offers competitive pricing plans designed to suit various business needs. By using our platform, you can save on costs associated with paper documentation and streamline your workflow related to New York State sales tax compliance, ultimately providing a cost-effective solution.

-

Can airSlate SignNow integrate with accounting software to manage New York State sales tax?

Absolutely! AirSlate SignNow integrates seamlessly with popular accounting software, allowing you to automate your sales tax calculations and filings in New York. This integration ensures that your financial records remain accurate and up-to-date, simplifying your accounting processes.

-

What benefits can I expect from using airSlate SignNow for New York State sales tax?

By using airSlate SignNow, you can enhance your efficiency in handling New York State sales tax documentation. The platform reduces manual paperwork and errors, increases your team's productivity, and ensures compliance, ultimately saving you time and money.

-

How user-friendly is airSlate SignNow for managing New York State sales tax?

AirSlate SignNow is designed with user-friendliness in mind, making it easy for businesses of all sizes to manage their New York State sales tax documentation. The intuitive interface allows you to quickly navigate through features, ensuring a smooth experience in eSigning and managing your documents.

Get more for St 100 Online

- Preadmission screening and resident review pasrr for persons with intellectual disabilitydevelopmental disabilities and related form

- State of hawaii department of human services med quest med quest form

- Cms 416 fy2005 hawaiixls med quest form

- Med quest 6964414 form

- Membership appldoc form

- Action for children address 2008 form

- Wic referral form illinois 2000

- Provider information change request form blue cross blue

Find out other St 100 Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast