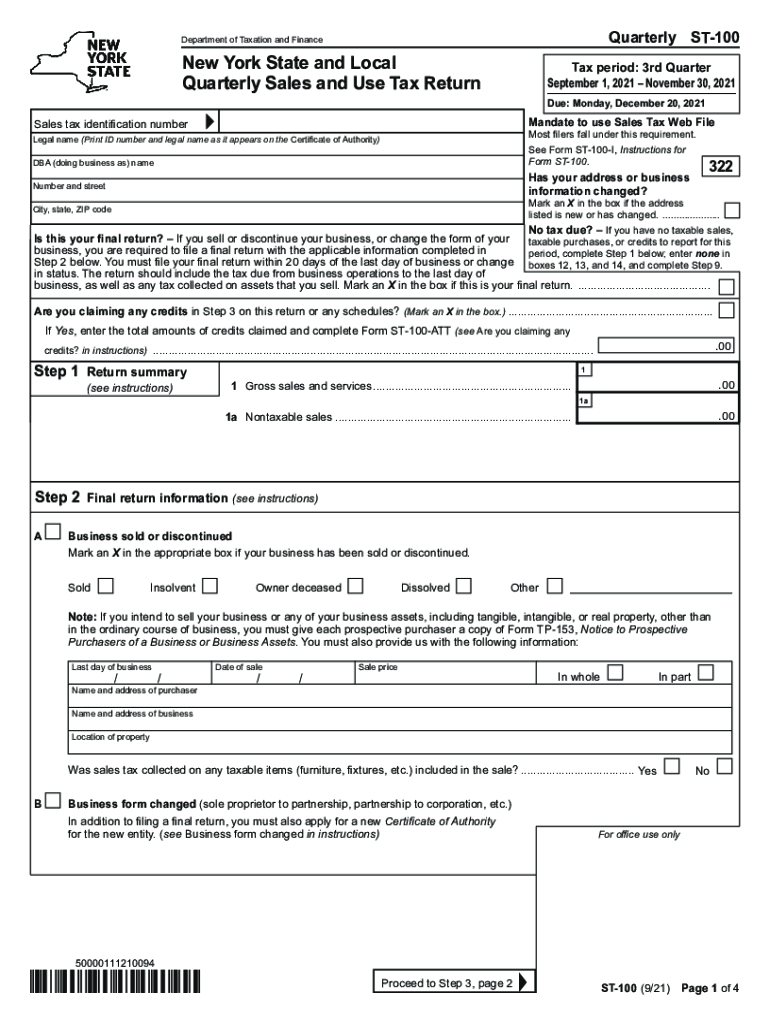

Form ST 100 New York State and Local Quarterly Sales and Use Tax Return Revised 921 2021

What is the ST 100 Form?

The ST 100 form, officially known as the New York State and Local Quarterly Sales and Use Tax Return, is a crucial document for businesses operating in New York. This form is used to report sales and use tax collected from customers during a specific quarter. It is essential for ensuring compliance with New York state tax laws and helps businesses accurately calculate their tax obligations. The ST 100 form is revised periodically, with the most recent version being revised in September 2021.

How to Use the ST 100 Form

Using the ST 100 form involves several steps to ensure accurate reporting of sales and use tax. First, businesses must gather all relevant sales data for the quarter, including total sales, taxable sales, and any exempt sales. Next, the form requires the calculation of the total sales tax due based on the applicable tax rates. After completing the calculations, businesses can submit the form either electronically or via mail. It is important to keep a copy of the submitted form for record-keeping purposes.

Steps to Complete the ST 100 Form

Completing the ST 100 form involves a systematic approach:

- Gather all sales records for the reporting period, including receipts and invoices.

- Calculate total sales and determine which sales are taxable.

- Apply the appropriate sales tax rates to the taxable sales to determine the total tax due.

- Fill out the ST 100 form, ensuring all sections are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the form by the due date, either online or by mail.

Legal Use of the ST 100 Form

The ST 100 form is legally binding when completed and submitted according to New York state regulations. It is essential for businesses to ensure that all information provided is accurate and truthful, as discrepancies can lead to penalties or audits. The form must be filed quarterly, and failure to do so can result in legal repercussions, including fines and interest on unpaid taxes.

Filing Deadlines for the ST 100 Form

Filing deadlines for the ST 100 form are crucial for compliance. The form is due on the 20th day of the month following the end of each quarter. For example, the due date for the first quarter (January to March) is April 20, while the second quarter (April to June) is July 20. It is important for businesses to be aware of these deadlines to avoid late fees and penalties.

Penalties for Non-Compliance

Failure to file the ST 100 form on time or inaccuracies in reporting can result in significant penalties. Businesses may face late filing fees, interest on unpaid taxes, and potential audits by the New York State Department of Taxation and Finance. To mitigate these risks, it is advisable for businesses to maintain accurate records and file the form promptly.

Quick guide on how to complete form st 100 new york state and local quarterly sales and use tax return revised 921

Complete Form ST 100 New York State And Local Quarterly Sales And Use Tax Return Revised 921 effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, enabling you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without interruptions. Manage Form ST 100 New York State And Local Quarterly Sales And Use Tax Return Revised 921 on any platform using airSlate SignNow's Android or iOS applications and simplify any document-based procedure today.

How to modify and eSign Form ST 100 New York State And Local Quarterly Sales And Use Tax Return Revised 921 with ease

- Locate Form ST 100 New York State And Local Quarterly Sales And Use Tax Return Revised 921 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes moments and carries the same legal authority as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Form ST 100 New York State And Local Quarterly Sales And Use Tax Return Revised 921 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form st 100 new york state and local quarterly sales and use tax return revised 921

Create this form in 5 minutes!

How to create an eSignature for the form st 100 new york state and local quarterly sales and use tax return revised 921

How to generate an e-signature for a PDF document in the online mode

How to generate an e-signature for a PDF document in Chrome

How to generate an e-signature for putting it on PDFs in Gmail

The way to make an e-signature from your mobile device

The best way to create an e-signature for a PDF document on iOS devices

The way to make an e-signature for a PDF file on Android devices

People also ask

-

What is the st 100 form, and why do I need it?

The st 100 form is a critical document used for sales tax reporting and compliance in many jurisdictions. Understanding this form is essential for businesses to accurately report their sales tax obligations and avoid potential penalties. Using airSlate SignNow, you can easily eSign and send your st 100 form, ensuring quick compliance with local regulations.

-

How does airSlate SignNow facilitate the completion of the st 100 form?

airSlate SignNow provides a user-friendly interface that simplifies the process of filling out the st 100 form. With drag-and-drop features and pre-built templates, users can complete and eSign the form quickly, saving time and reducing the likelihood of errors. This efficiency is crucial for businesses aiming to stay compliant with tax regulations.

-

What are the pricing plans for using airSlate SignNow for the st 100 form?

airSlate SignNow offers a variety of pricing plans that cater to different business needs, starting from a basic plan for individuals to advanced plans for larger teams. Regardless of the plan you choose, all options provide the ability to send and eSign documents, including the st 100 form. By selecting the right plan, businesses can optimize their document management and compliance processes.

-

Can I integrate airSlate SignNow with other software for handling the st 100 form?

Yes, airSlate SignNow seamlessly integrates with various applications and software, enhancing your workflow when dealing with the st 100 form. Integrations with accounting software and CRM systems streamline data transfer, ensuring that all your necessary information is available in one place. This interoperability improves efficiency and helps maintain accurate records for tax reporting.

-

What are the key benefits of using airSlate SignNow for the st 100 form?

Using airSlate SignNow for the st 100 form offers numerous benefits, including increased efficiency, enhanced security, and improved compliance tracking. The platform allows users to eSign documents remotely, reducing the time spent on physical paperwork. Additionally, secure storage options help businesses keep their st 100 forms protected and easily accessible.

-

Is it easy to eSign the st 100 form with airSlate SignNow?

Absolutely! airSlate SignNow makes it incredibly easy to eSign the st 100 form with just a few clicks. The platform provides intuitive tools for electronic signatures, making the signing process smooth for all parties involved, whether they are in the office or working remotely.

-

What support options are available for users of the st 100 form on airSlate SignNow?

AirSlate SignNow offers robust customer support options, including a comprehensive knowledge base, live chat, and email assistance to help you with any inquiries related to the st 100 form. Whether you have questions about the signing process or need guidance on compliance issues, the support team is ready to assist you. This ensures that users can effectively navigate the platform while handling important documents.

Get more for Form ST 100 New York State And Local Quarterly Sales And Use Tax Return Revised 921

- Legal last will and testament form for single person with adult children arkansas

- Legal last will and testament for married person with minor children from prior marriage arkansas form

- Legal last will and testament form for married person with adult children from prior marriage arkansas

- Legal last will and testament form for divorced person not remarried with adult children arkansas

- Legal last will and testament form for divorced person not remarried with no children arkansas

- Legal last will and testament form for divorced person not remarried with minor children arkansas

- Legal last will and testament form for married person with adult children arkansas

- Legal last will and testament form for a married person with no children arkansas

Find out other Form ST 100 New York State And Local Quarterly Sales And Use Tax Return Revised 921

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form