Form ST 100 New York State and Local Quarterly Sales and Use Tax Return Revised 922 2022

What is the Form ST 100 New York State And Local Quarterly Sales And Use Tax Return Revised 922

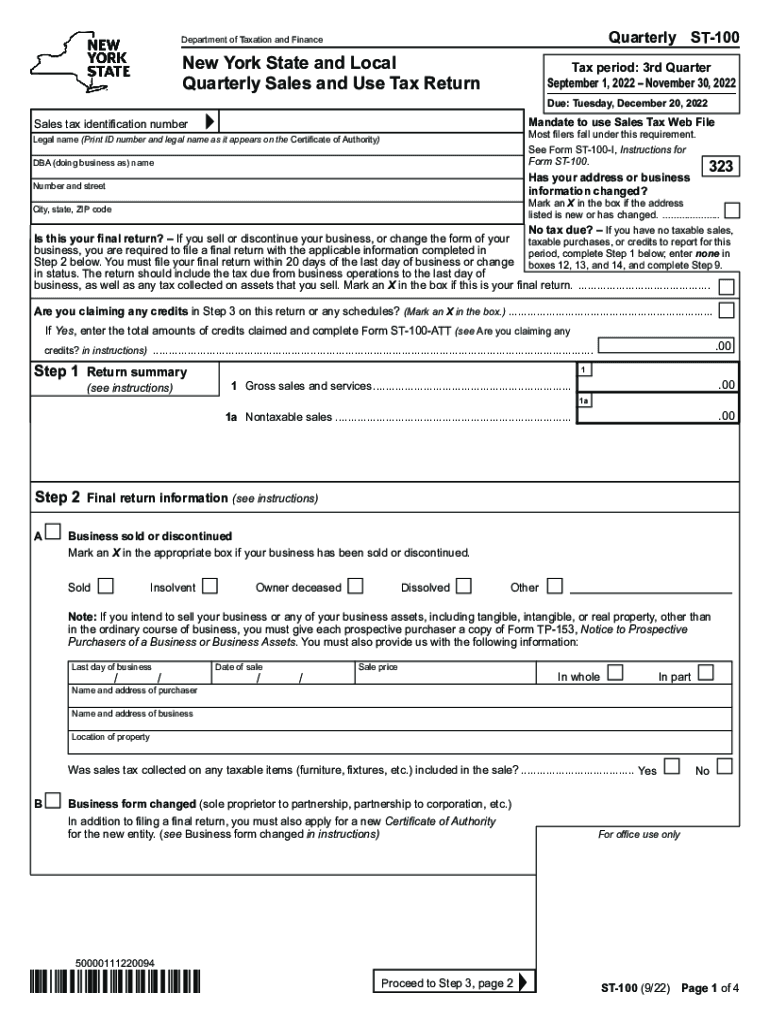

The ST 100 form is a crucial document for businesses operating in New York State, specifically designed for reporting state and local sales and use tax. This form must be completed quarterly, allowing businesses to accurately report their tax liabilities based on sales made during the reporting period. The ST 100 form includes sections for detailing taxable sales, exempt sales, and the total tax due. Understanding this form is essential for compliance with New York tax regulations, ensuring that businesses fulfill their legal obligations while avoiding potential penalties.

Steps to complete the Form ST 100 New York State And Local Quarterly Sales And Use Tax Return Revised 922

Completing the ST 100 form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial records, including sales invoices and receipts. Next, accurately calculate your total sales, distinguishing between taxable and exempt sales. Enter these figures into the appropriate sections of the form. After completing the calculations, review the form for any errors or omissions. Finally, submit the completed ST 100 form either online or via mail, adhering to the specified filing deadlines to avoid penalties.

Legal use of the Form ST 100 New York State And Local Quarterly Sales And Use Tax Return Revised 922

The legal use of the ST 100 form is governed by New York State tax laws. This form serves as an official declaration of sales and use tax collected by businesses, making it essential for compliance. Accurate completion of the ST 100 ensures that businesses report their tax obligations correctly, which is crucial for maintaining good standing with state tax authorities. Failure to use the form correctly can result in legal repercussions, including fines and audits.

Filing Deadlines / Important Dates

Filing deadlines for the ST 100 form are critical for businesses to avoid penalties. The form must be submitted quarterly, with specific due dates typically falling on the 20th of the month following the end of each quarter. For example, the due date for the first quarter (January to March) is April 20. It is essential for businesses to mark these deadlines on their calendars and ensure timely submission to maintain compliance with New York tax regulations.

Form Submission Methods (Online / Mail / In-Person)

The ST 100 form can be submitted through various methods, providing flexibility for businesses. Online submission is available through the New York State Department of Taxation and Finance website, allowing for quick processing and confirmation. Alternatively, businesses may choose to mail the completed form to the designated tax office address. In-person submission is also an option, though it is less common. Each method has its advantages, and businesses should select the one that best suits their needs.

Key elements of the Form ST 100 New York State And Local Quarterly Sales And Use Tax Return Revised 922

The ST 100 form includes several key elements that are vital for accurate reporting. These elements consist of sections for reporting total sales, exempt sales, and the calculation of tax due. Additionally, the form requires information about the business, including its name, address, and identification number. Each section must be filled out meticulously to ensure compliance and to facilitate the accurate assessment of tax liabilities. Understanding these key elements helps businesses navigate the form effectively.

Quick guide on how to complete form st 100 new york state and local quarterly sales and use tax return revised 922

Complete Form ST 100 New York State And Local Quarterly Sales And Use Tax Return Revised 922 effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, as you can acquire the correct form and securely archive it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle Form ST 100 New York State And Local Quarterly Sales And Use Tax Return Revised 922 on any platform using airSlate SignNow’s Android or iOS applications and simplify any document-related process today.

The easiest way to alter and eSign Form ST 100 New York State And Local Quarterly Sales And Use Tax Return Revised 922 without effort

- Obtain Form ST 100 New York State And Local Quarterly Sales And Use Tax Return Revised 922 and then click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive data with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form ST 100 New York State And Local Quarterly Sales And Use Tax Return Revised 922 and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form st 100 new york state and local quarterly sales and use tax return revised 922

Create this form in 5 minutes!

People also ask

-

What is the ST 100 form, and how can airSlate SignNow help with it?

The ST 100 form is a tax exempt certificate used in various business transactions. airSlate SignNow simplifies the process of completing and signing the ST 100 form by providing a user-friendly interface and electronic signature capabilities, ensuring compliance and efficiency.

-

Is there a cost associated with using airSlate SignNow for the ST 100 form?

Yes, airSlate SignNow offers various pricing plans tailored for businesses of all sizes. By choosing an appropriate plan, you can efficiently manage the ST 100 form and other documents without hidden fees, providing great value for your investment.

-

Can I store my completed ST 100 forms securely using airSlate SignNow?

Absolutely! airSlate SignNow provides secure cloud storage for all your completed documents, including the ST 100 form. You can access, manage, and retrieve your documents anytime, ensuring you maintain proper records.

-

What features does airSlate SignNow offer for managing the ST 100 form?

airSlate SignNow includes a range of features for managing the ST 100 form, such as customizable templates, real-time tracking, and automated workflows. These features enhance productivity and ensure that your documents are processed efficiently.

-

Can I use airSlate SignNow to integrate the ST 100 form with other applications?

Yes, airSlate SignNow integrates seamlessly with various third-party applications, allowing you to streamline your workflow with the ST 100 form. This capability helps improve efficiency and enhances collaboration across your team.

-

How does airSlate SignNow enhance compliance when using the ST 100 form?

airSlate SignNow enhances compliance for the ST 100 form by ensuring that electronic signatures meet legal requirements. The platform adheres to strict security protocols, providing peace of mind that your documents are valid and secure.

-

Is airSlate SignNow user-friendly for signing the ST 100 form?

Yes, airSlate SignNow is designed with user experience in mind, making it easy for anyone to sign the ST 100 form. Its intuitive interface and clear instructions help users complete the signing process quickly and efficiently.

Get more for Form ST 100 New York State And Local Quarterly Sales And Use Tax Return Revised 922

- New mexico dissolution 497320212 form

- New mexico dissolution 497320213 form

- Living trust for husband and wife with no children new mexico form

- New mexico living trust form

- Living trust for individual who is single divorced or widow or widower with children new mexico form

- Living trust for husband and wife with one child new mexico form

- Living trust for husband and wife with minor and or adult children new mexico form

- Nm trust form

Find out other Form ST 100 New York State And Local Quarterly Sales And Use Tax Return Revised 922

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF