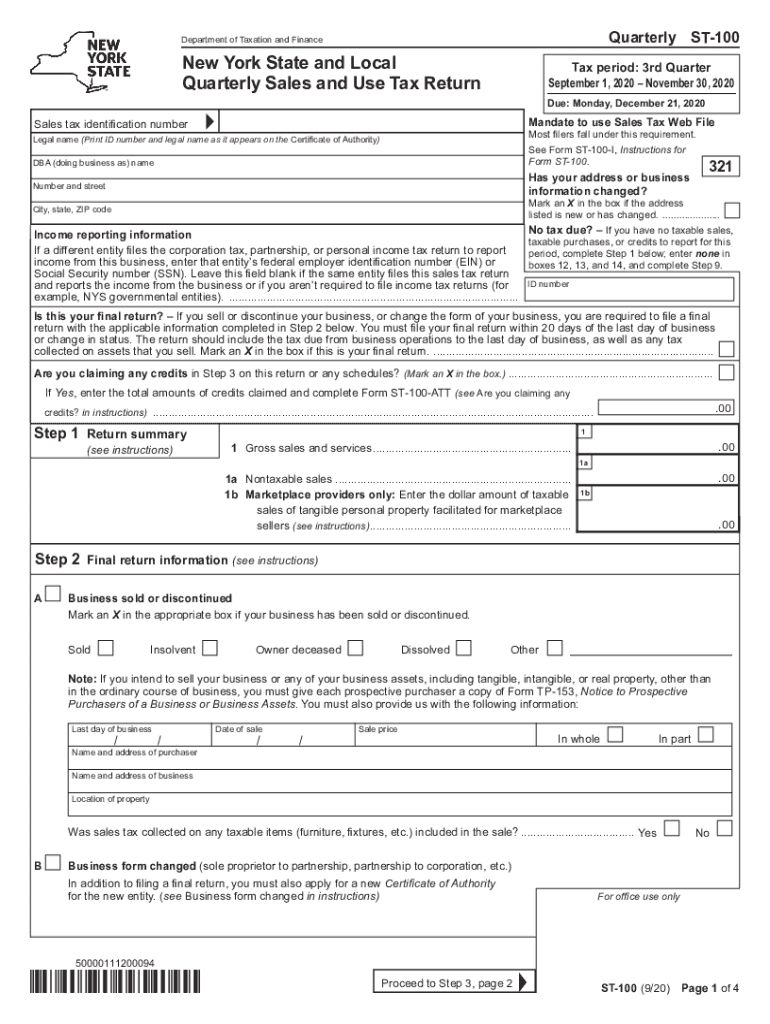

Form ST 100 New York State and Local Quarterly Sales and Use Tax Return Revised 920 2020

Understanding the ST 100 Form for New York State and Local Quarterly Sales and Use Tax

The ST 100 form is essential for businesses operating in New York State, as it serves as the Quarterly Sales and Use Tax Return. This form is used to report sales tax collected from customers and to remit the appropriate amount to the New York State Department of Taxation and Finance. It is crucial for compliance with state tax laws and helps ensure that businesses fulfill their tax obligations accurately and on time.

Steps to Complete the ST 100 Form

Completing the ST 100 form involves several key steps:

- Gather all necessary sales records for the reporting period.

- Calculate the total sales and the sales tax collected.

- Fill out the form accurately, ensuring all figures are correct.

- Review the completed form for any errors or omissions.

- Submit the form by the due date, either electronically or by mail.

Each step is vital to ensure that the form is completed correctly, minimizing the risk of penalties for inaccuracies or late submissions.

Obtaining the ST 100 Form

The ST 100 form can be obtained from the New York State Department of Taxation and Finance website. It is available in a printable PDF format, allowing for easy access and completion. Businesses can also request physical copies through their local tax office if needed.

Legal Use of the ST 100 Form

The ST 100 form must be completed and submitted in accordance with New York State tax laws. It serves as a legal document that verifies the sales tax collected by businesses. Proper use of this form ensures compliance with state regulations, helping to avoid potential legal issues or penalties.

Filing Deadlines for the ST 100 Form

Filing deadlines for the ST 100 form are typically set on a quarterly basis. Businesses must submit their returns by the last day of the month following the end of the quarter. For example, for sales made from January to March, the form is due by April 30. It is essential to adhere to these deadlines to avoid late fees and maintain good standing with tax authorities.

Penalties for Non-Compliance with the ST 100 Form

Failure to file the ST 100 form on time or inaccuracies in the reported figures may result in penalties. These can include fines, interest on unpaid taxes, and potential audits. Understanding the importance of timely and accurate submissions can help businesses avoid these consequences and ensure compliance with state tax laws.

Quick guide on how to complete form st 100 new york state and local quarterly sales and use tax return revised 920

Effortlessly prepare Form ST 100 New York State And Local Quarterly Sales And Use Tax Return Revised 920 on any device

Digital document management has become increasingly popular among companies and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, as you can easily locate the correct form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly and without delays. Manage Form ST 100 New York State And Local Quarterly Sales And Use Tax Return Revised 920 on any device using airSlate SignNow's Android or iOS applications and streamline any document-centric operation today.

The simplest way to modify and electronically sign Form ST 100 New York State And Local Quarterly Sales And Use Tax Return Revised 920 without hassle

- Locate Form ST 100 New York State And Local Quarterly Sales And Use Tax Return Revised 920 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or inaccuracies that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Edit and electronically sign Form ST 100 New York State And Local Quarterly Sales And Use Tax Return Revised 920 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form st 100 new york state and local quarterly sales and use tax return revised 920

Create this form in 5 minutes!

How to create an eSignature for the form st 100 new york state and local quarterly sales and use tax return revised 920

The way to make an electronic signature for a PDF online

The way to make an electronic signature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The best way to generate an electronic signature from your smartphone

The way to generate an eSignature for a PDF on iOS

The best way to generate an electronic signature for a PDF file on Android

People also ask

-

What is the ST 100 form 2018?

The ST 100 form 2018 is a sales tax return form used by businesses in certain states to report and remit sales taxes. Completing the ST 100 form 2018 accurately ensures compliance with state regulations and helps avoid potential penalties. Businesses can benefit from using electronic solutions like airSlate SignNow to easily fill out and eSign the ST 100 form 2018.

-

How can airSlate SignNow help with the ST 100 form 2018?

airSlate SignNow streamlines the process of completing the ST 100 form 2018 by allowing users to fill out the form electronically and eSign it securely. This reduces paperwork and facilitates fast submission, ensuring that reports are sent on time. Additionally, it helps maintain accurate records for auditing purposes.

-

Is there a cost associated with using airSlate SignNow for the ST 100 form 2018?

Yes, airSlate SignNow offers competitively priced plans that cater to different business needs. While pricing may vary based on the features required, the platform is designed to be cost-effective, making it an ideal choice for businesses looking to manage their ST 100 form 2018 submissions efficiently.

-

What features does airSlate SignNow offer for managing the ST 100 form 2018?

airSlate SignNow provides a variety of features for managing the ST 100 form 2018, including customizable templates, secure eSigning, and automated workflows. These features not only save time but also enhance accuracy while filling out tax forms like the ST 100 form 2018. Users can also track changes and manage document history seamlessly.

-

Can airSlate SignNow integrate with other software for the ST 100 form 2018 process?

Absolutely! airSlate SignNow integrates with various accounting and tax software to simplify the handling of the ST 100 form 2018. This allows for better data management and the seamless import/export of tax-related information, enhancing overall efficiency before filing.

-

What are the benefits of using airSlate SignNow for the ST 100 form 2018?

Using airSlate SignNow for the ST 100 form 2018 helps businesses save time and reduce errors. The platform provides easy access to electronic forms, secure eSigning, and efficient document management. As a result, users can focus on running their businesses while ensuring that their tax filings remain compliant.

-

Is airSlate SignNow secure for handling the ST 100 form 2018?

Yes, airSlate SignNow prioritizes security for all documents, including the ST 100 form 2018. With encryption methods and secure access controls in place, businesses can trust that their sensitive tax information is protected against unauthorized access and bsignNowes.

Get more for Form ST 100 New York State And Local Quarterly Sales And Use Tax Return Revised 920

- Marital settlement agreement form

- Settlement agreement form 497336342

- Hardship license 497336343 form

- United states infants rights of inheritance and the guide pdf form

- Assignment of note and deed of trust as security for debt of third party form

- Easement form

- Restriction easement form

- Easement deed form 497336348

Find out other Form ST 100 New York State And Local Quarterly Sales And Use Tax Return Revised 920

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe