Tax Form St 100 2017

What is the Tax Form St 100

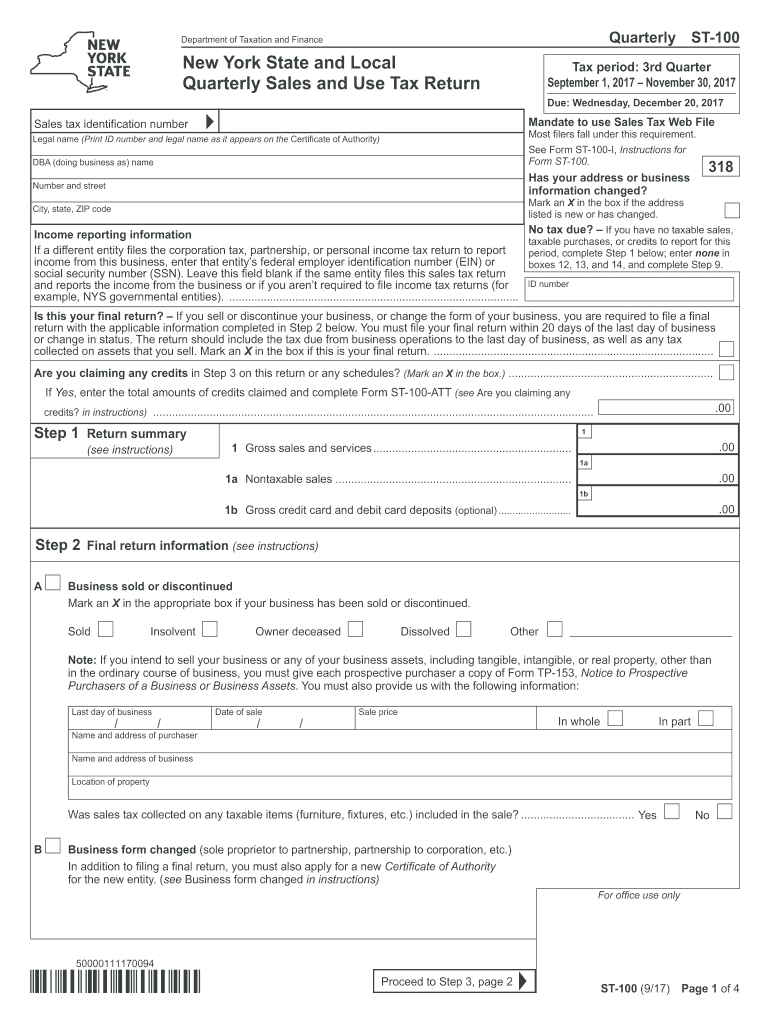

The Tax Form St 100 is a crucial document used for reporting sales and use tax in the state of New York. This form is specifically designed for businesses that are required to collect sales tax from customers and remit it to the state. It serves as a declaration of the total sales made and the amount of tax collected during a specified period. Understanding this form is essential for compliance with New York tax laws and regulations.

How to use the Tax Form St 100

To effectively use the Tax Form St 100, businesses must accurately report their total sales and the corresponding sales tax collected. The form is typically completed on a quarterly basis, aligning with the state's tax reporting schedule. Users should ensure that all sales figures are correctly calculated and that any exemptions or deductions are properly documented. Once completed, the form must be submitted to the New York State Department of Taxation and Finance by the specified deadline.

Steps to complete the Tax Form St 100

Completing the Tax Form St 100 involves several key steps:

- Gather all sales records and documentation for the reporting period.

- Calculate the total sales made, including taxable and non-taxable sales.

- Determine the total sales tax collected from customers.

- Fill out the form with the calculated figures, ensuring accuracy.

- Review the completed form for any errors or omissions.

- Submit the form electronically or by mail to the appropriate tax authority.

Legal use of the Tax Form St 100

The Tax Form St 100 must be used in accordance with New York state tax laws. Businesses are legally obligated to file this form if they engage in taxable sales. Failure to file accurately and on time can result in penalties, including fines and interest on unpaid taxes. It is important for businesses to maintain proper records to support the information reported on the form, as this can be subject to audit by the state.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Form St 100 are typically set on a quarterly basis. Businesses must submit their forms by the last day of the month following the end of each quarter. For example, the deadlines are generally as follows:

- First Quarter: April 30

- Second Quarter: July 31

- Third Quarter: October 31

- Fourth Quarter: January 31

It is essential for businesses to adhere to these deadlines to avoid penalties and ensure compliance with state regulations.

Who Issues the Form

The Tax Form St 100 is issued by the New York State Department of Taxation and Finance. This state agency is responsible for administering tax laws and ensuring that businesses comply with their tax obligations. The department provides resources and guidance for completing the form and offers support for businesses navigating the sales tax process.

Quick guide on how to complete tax form st 100 2017

Your assistance manual on preparing your Tax Form St 100

If you’re looking to understand how to finalize and submit your Tax Form St 100, here are some straightforward instructions to simplify your tax submission process.

To start, you simply need to create your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow offers a user-friendly and powerful document management solution that allows you to edit, draft, and finalize your income tax forms effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures, and revisit to revise details as necessary. Enhance your tax administration with advanced PDF editing, eSigning, and a simple sharing experience.

Follow these steps to complete your Tax Form St 100 in just a few minutes:

- Create your account and start working with PDFs in no time.

- Utilize our directory to find any IRS tax form; browse through different versions and schedules.

- Press Get form to open your Tax Form St 100 in our editor.

- Complete the mandatory fillable sections with your data (text, numbers, check marks).

- Employ the Sign Tool to insert your legally-recognized eSignature (if necessary).

- Examine your document and correct any mistakes.

- Store modifications, print your copy, dispatch it to your intended recipient, and download it to your device.

Refer to this manual to electronically file your taxes with airSlate SignNow. Be aware that submitting on paper may lead to increased errors and delayed refunds. It is essential to verify the IRS website for submission guidelines specific to your state before e-filing your taxes.

Create this form in 5 minutes or less

Find and fill out the correct tax form st 100 2017

FAQs

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

How do I fill out tax form 4972?

Here are the line by line instructions Page on irs.gov, if you still are having problems, I suggest you contact a US tax professional to complete the form for you.

-

How do I fill out 2013 tax forms?

I hate when people ask a question, then rather than answer, someone jumps in and tells them they don't need to know--but today, I will be that guy, because this is serious.Why oh why do you think you can do this yourself?Two things to consider:People who get a masters degree in Accounting then go get a CPA then start doing taxes--only then do some of them start specializing in international accounting. I've taught Accounting at the college-level, have taken tax classes beyond that, and wouldn't touch your return.Tax professionals generally either charge by the form or by the hour. Meaning you can sit and do this for 12 hours, or you can pay a CPA by the hour to do it, or you can go to an H&R Block that has flat rates and will do everything but hit Send for free. So why spend 12 hours doing it incorrectly, destined to worry about the IRS putting you in jail, bankrupting you, or deporting you for the next decade when you can get it done professionally for $200-$300?No, just go get it done right.

Create this form in 5 minutes!

How to create an eSignature for the tax form st 100 2017

How to generate an eSignature for the Tax Form St 100 2017 in the online mode

How to make an electronic signature for your Tax Form St 100 2017 in Chrome

How to make an eSignature for putting it on the Tax Form St 100 2017 in Gmail

How to make an electronic signature for the Tax Form St 100 2017 from your mobile device

How to create an eSignature for the Tax Form St 100 2017 on iOS devices

How to make an eSignature for the Tax Form St 100 2017 on Android

People also ask

-

What is the Tax Form ST 100?

The Tax Form ST 100 is a sales tax return form used by businesses in New York State to report their sales tax liability. It is essential for compliance with state tax regulations and helps ensure accurate reporting and remittance of sales tax. By utilizing airSlate SignNow, businesses can easily eSign and submit their Tax Form ST 100 digitally, streamlining the filing process.

-

How does airSlate SignNow simplify the eSigning of the Tax Form ST 100?

airSlate SignNow allows users to eSign the Tax Form ST 100 quickly and securely, eliminating the need for printing, scanning, or mailing. With our intuitive platform, you can create templates for your forms, making it even easier to manage and send the Tax Form ST 100 for signature. This user-friendly approach saves time and reduces errors in the filing process.

-

Is there a cost associated with using airSlate SignNow for the Tax Form ST 100?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs, including the ability to eSign documents like the Tax Form ST 100. Our plans are designed to be cost-effective, ensuring that you get the best value for your investment in eSignature solutions. You can choose the plan that fits your volume of documents and specific features required.

-

Can I integrate airSlate SignNow with my existing accounting software for the Tax Form ST 100?

Absolutely! airSlate SignNow seamlessly integrates with various accounting software, making it easy to manage and eSign documents like the Tax Form ST 100. Our integrations allow for smooth workflows, enabling you to retrieve, fill out, and send your tax forms directly from your accounting platform.

-

What are the key benefits of using airSlate SignNow for the Tax Form ST 100?

Using airSlate SignNow for the Tax Form ST 100 offers numerous benefits, including enhanced efficiency, reduced paperwork, and improved compliance. Our platform ensures secure eSigning and easy tracking of your documents, minimizing the risk of lost forms or delays. Additionally, you can access your signed Tax Form ST 100 anytime, anywhere.

-

How secure is my information when signing the Tax Form ST 100 with airSlate SignNow?

Security is a top priority at airSlate SignNow. When you sign the Tax Form ST 100 using our platform, your data is protected by advanced encryption protocols and secure cloud storage. We comply with industry standards to ensure that all your personal and tax information remains confidential and safe.

-

Can I access my signed Tax Form ST 100 after submission?

Yes, once you eSign your Tax Form ST 100 using airSlate SignNow, you can easily access and download it whenever you need it. Our platform provides a comprehensive document management system, allowing you to keep track of all your signed forms and their statuses in one place.

Get more for Tax Form St 100

- Publicpartnerships com form

- Graphing in excel handout final the national center on student fcps form

- Letter of direction cd baby form

- Osbi submittal form

- Loan application form fill out and sign printable pdf templatesignnow

- Lender letter 05 new notice of transfer of mortgage loan ownership notice of transfer of mortgage loan ownership michigan form

- Www cityofalgonac org media building permit 52skm c360i22050209380 cityofalgonac org form

- Charter township of orion building department 2323 form

Find out other Tax Form St 100

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation