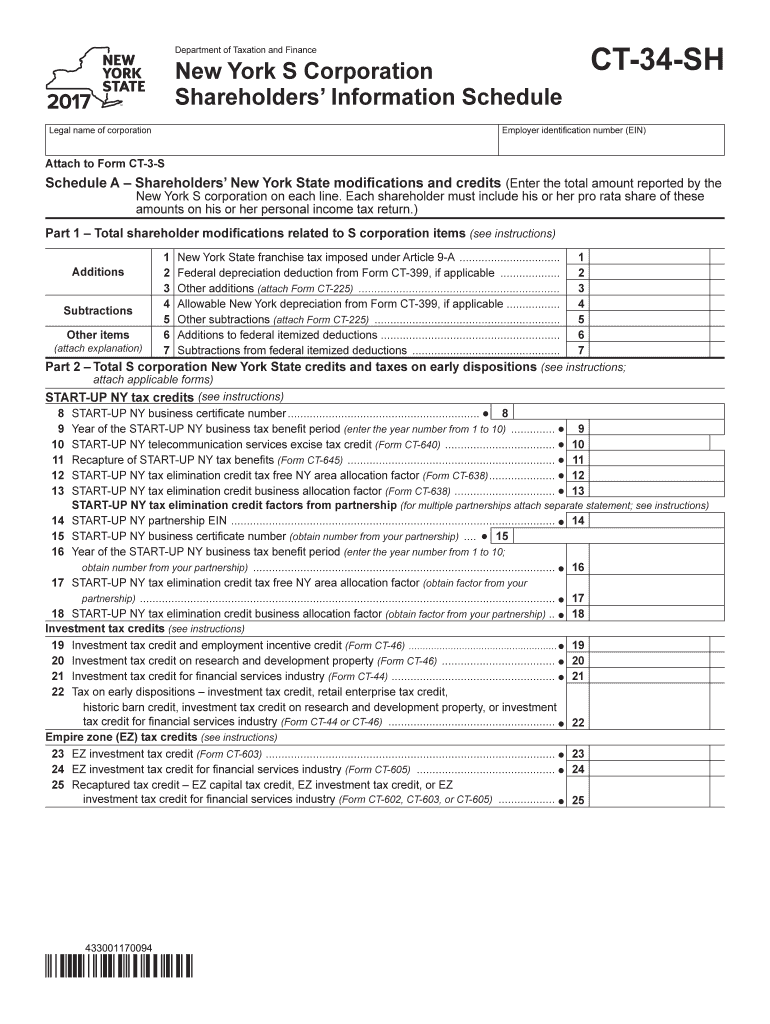

Form CT 34 SHNew York S Corporation Shareholders' Information Schedulect34sh 2017

What is the Form CT 34 SH New York S Corporation Shareholders' Information Schedule

The Form CT 34 SH is a crucial document for S corporations operating in New York. It serves as the Shareholders' Information Schedule, which provides essential details about the shareholders of an S corporation. This form is utilized to report the shareholders' information to the New York State Department of Taxation and Finance, ensuring compliance with state tax regulations. Accurate completion of this form is vital for maintaining the S corporation's tax status and for the shareholders' tax obligations.

How to use the Form CT 34 SH New York S Corporation Shareholders' Information Schedule

Using the Form CT 34 SH involves several steps to ensure accurate reporting of shareholder information. First, gather all necessary details about the shareholders, including names, addresses, and ownership percentages. Next, complete the form by entering this information in the designated fields. It is important to review the completed form for accuracy before submission. Once finalized, the form can be submitted electronically or via mail, depending on the preferred filing method.

Steps to complete the Form CT 34 SH New York S Corporation Shareholders' Information Schedule

Completing the Form CT 34 SH requires careful attention to detail. Follow these steps:

- Gather shareholder information, including full names, addresses, and ownership percentages.

- Access the form online or obtain a physical copy from the appropriate state agency.

- Fill in the required fields accurately, ensuring all information is current and correct.

- Review the form thoroughly to avoid errors that could lead to compliance issues.

- Submit the form electronically through the designated state portal or mail it to the appropriate address.

Legal use of the Form CT 34 SH New York S Corporation Shareholders' Information Schedule

The legal use of the Form CT 34 SH is governed by New York state tax laws. This form must be filed accurately and timely to comply with state regulations regarding S corporations. Failure to submit the form can result in penalties or jeopardize the S corporation's tax status. It is essential for shareholders and corporate officers to understand the legal implications of the information provided on this form.

Filing Deadlines / Important Dates

Filing deadlines for the Form CT 34 SH are critical for compliance. Typically, this form must be submitted along with the New York State corporate tax return. It is advisable to check the specific due dates each tax year, as they may vary. Timely submission helps avoid penalties and ensures that the corporation maintains its S status.

Form Submission Methods (Online / Mail / In-Person)

The Form CT 34 SH can be submitted through various methods, offering flexibility for businesses. Options include:

- Online submission via the New York State Department of Taxation and Finance website, which is often the quickest method.

- Mailing a physical copy of the completed form to the appropriate tax office.

- In-person submission at designated state tax offices, if required.

Choosing the right submission method can streamline the filing process and ensure timely compliance.

Quick guide on how to complete form ct 34 sh2016new york s corporation shareholders information schedulect34sh

Your assistance manual on how to prepare your Form CT 34 SHNew York S Corporation Shareholders' Information Schedulect34sh

If you’re wondering how to finalize and submit your Form CT 34 SHNew York S Corporation Shareholders' Information Schedulect34sh, here are several brief guidelines on how to make tax processing smoother.

Initially, you just need to create your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is a highly user-friendly and robust document platform that enables you to edit, draft, and finalize your tax forms effortlessly. Utilizing its editor, you can alternate between text, checkboxes, and eSignatures, and revisit to modify information as necessary. Streamline your tax organization with advanced PDF editing, eSigning, and convenient sharing options.

Follow the instructions below to complete your Form CT 34 SHNew York S Corporation Shareholders' Information Schedulect34sh in just minutes:

- Establish your account and start working on PDFs in a few minutes.

- Utilize our directory to obtain any IRS tax form; browse through different versions and schedules.

- Click Get form to access your Form CT 34 SHNew York S Corporation Shareholders' Information Schedulect34sh in our editor.

- Complete the necessary fillable fields with your information (text, numbers, checkmarks).

- Use the Sign Tool to add your legally-recognized eSignature (if required).

- Examine your document and correct any mistakes.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Keep in mind that filing on paper can lead to return errors and delay refunds. Certainly, before e-filing your taxes, verify the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct form ct 34 sh2016new york s corporation shareholders information schedulect34sh

Create this form in 5 minutes!

How to create an eSignature for the form ct 34 sh2016new york s corporation shareholders information schedulect34sh

How to generate an electronic signature for your Form Ct 34 Sh2016new York S Corporation Shareholders Information Schedulect34sh in the online mode

How to generate an eSignature for your Form Ct 34 Sh2016new York S Corporation Shareholders Information Schedulect34sh in Chrome

How to generate an electronic signature for putting it on the Form Ct 34 Sh2016new York S Corporation Shareholders Information Schedulect34sh in Gmail

How to make an eSignature for the Form Ct 34 Sh2016new York S Corporation Shareholders Information Schedulect34sh straight from your mobile device

How to generate an eSignature for the Form Ct 34 Sh2016new York S Corporation Shareholders Information Schedulect34sh on iOS devices

How to generate an eSignature for the Form Ct 34 Sh2016new York S Corporation Shareholders Information Schedulect34sh on Android devices

People also ask

-

What is Form CT 34 SHNew York S Corporation Shareholders' Information Schedule?

Form CT 34 SH is a crucial document that New York S Corporations must file to provide information about their shareholders. It outlines details such as shareholder identities, their ownership percentages, and the overall structure of the corporation. Ensuring compliance with Form CT 34 SH is essential for maintaining the tax status of the S Corporation.

-

How does airSlate SignNow help with the completion of Form CT 34 SHNew York S Corporation Shareholders' Information Schedule?

airSlate SignNow streamlines the process of completing Form CT 34 SH by offering customizable templates and an easy-to-use interface. Users can fill out their shareholder information digitally and send the document for eSignature. This speeds up the entire filing process, ensuring that your Form CT 34 SH is completed accurately and submitted on time.

-

Is there a cost associated with using airSlate SignNow for Form CT 34 SHNew York S Corporation Shareholders' Information Schedule?

Yes, airSlate SignNow provides various subscription plans, allowing you to choose one that fits your budget and business needs. While the basic plan offers essential functionalities, a more advanced plan may provide additional features beneficial for managing forms like Form CT 34 SH. Cost-effectiveness is a major benefit, making it accessible for businesses of all sizes.

-

What features does airSlate SignNow offer for eSigning Form CT 34 SHNew York S Corporation Shareholders' Information Schedule?

AirSlate SignNow includes features such as customizable document templates, robust eSignature capabilities, and secure storage to ensure your Form CT 34 SH is handled efficiently. The platform allows multiple users to sign and provides real-time tracking of the document's status. This enhances collaboration and ensures everyone is aligned during the filing process.

-

Can I integrate airSlate SignNow with other software for managing Form CT 34 SHNew York S Corporation Shareholders' Information Schedule?

Absolutely! airSlate SignNow offers seamless integrations with popular CRM and document management systems to streamline your workflow. By integrating with software like Google Drive and Salesforce, you can easily access and manage your Form CT 34 SH alongside other important documents. This integration helps in maintaining organized records for your business.

-

What are the benefits of using airSlate SignNow for filing Form CT 34 SHNew York S Corporation Shareholders' Information Schedule?

Using airSlate SignNow for Form CT 34 SH provides several benefits, such as enhanced efficiency, reduced paperwork, and compliance assurance. The platform's user-friendly interface makes the filling and signing process straightforward, while built-in security features protect sensitive shareholder information. By leveraging this tool, businesses can focus more on growth and less on administrative tasks.

-

How secure is the information submitted through airSlate SignNow for Form CT 34 SHNew York S Corporation Shareholders' Information Schedule?

Security is a top priority for airSlate SignNow. The platform employs end-to-end encryption and complies with industry standards to safeguard all information submitted, including Form CT 34 SH. Users can have peace of mind knowing that their sensitive corporate data is protected while utilizing the platform for document management.

Get more for Form CT 34 SHNew York S Corporation Shareholders' Information Schedulect34sh

- Juans mother gave him a recipe for trail mix form

- Lifewise credentialing application for doctors form

- Service card form

- Cancellation and release of purchase and sale contract mcba form

- Da form 5019 30551212

- Prnt sc au1122 form

- Using the ipst forms to support the problem solving

- Commercial property maintenance program form

Find out other Form CT 34 SHNew York S Corporation Shareholders' Information Schedulect34sh

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online