Ct34 Sh 2018

What is the Ct34 Sh

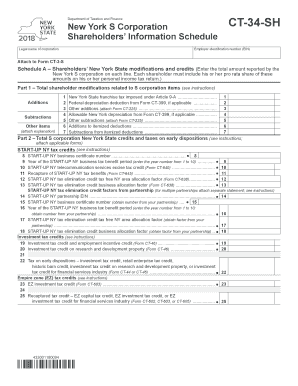

The Ct34 Sh is a specific form used in New York State for tax purposes. It is designed for businesses to report their income and calculate their tax liabilities. This form is essential for ensuring compliance with state tax regulations and is part of the broader tax filing process. Understanding the Ct34 Sh is crucial for businesses operating within New York, as it helps them accurately report their financial activities and fulfill their tax obligations.

Steps to complete the Ct34 Sh

Completing the Ct34 Sh involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and expense reports. Next, carefully fill out the form, providing accurate information in each section. Pay special attention to the calculations, ensuring they reflect your business's true financial status. After completing the form, review it thoroughly for any errors or omissions. Finally, submit the Ct34 Sh to the appropriate state tax authority by the specified deadline.

Legal use of the Ct34 Sh

The Ct34 Sh is legally recognized as a valid document for tax reporting in New York State. It must be filled out and submitted in accordance with state laws and regulations. Businesses are required to use this form to report their income accurately and to calculate their tax liabilities. Failure to comply with these requirements can result in penalties, making it essential for businesses to understand the legal implications of the Ct34 Sh.

Filing Deadlines / Important Dates

Filing deadlines for the Ct34 Sh are critical for businesses to adhere to in order to avoid penalties. Typically, the form must be submitted by the due date specified by the New York State Department of Taxation and Finance. This date may vary based on the business's fiscal year or specific tax circumstances. It is advisable for businesses to mark their calendars with these important dates to ensure timely filing.

Required Documents

To complete the Ct34 Sh, businesses need to prepare several key documents. These typically include financial statements, tax identification numbers, and any relevant supporting documentation that verifies income and expenses. Having these documents ready will streamline the process of filling out the form and ensure that all information provided is accurate and complete.

Who Issues the Form

The Ct34 Sh is issued by the New York State Department of Taxation and Finance. This agency is responsible for overseeing tax compliance and ensuring that businesses adhere to state tax laws. As the issuing authority, the Department provides guidelines and resources to assist businesses in properly completing and submitting the form.

Quick guide on how to complete ct 34 sh form 2018 2019

Your assistance manual on how to prepare your Ct34 Sh

If you're wondering how to generate and dispatch your Ct34 Sh, here are a few quick recommendations to make tax submission simpler.

To begin, you simply need to establish your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an intuitive and robust document solution that enables you to modify, create, and finalize your income tax forms effortlessly. With its editor, you can alternate between text, check boxes, and eSignatures and return to update responses as necessary. Streamline your tax handling with advanced PDF editing, eSigning, and easy sharing.

Follow the instructions below to finalize your Ct34 Sh in just a few moments:

- Set up your account and begin editing PDFs within minutes.

- Utilize our library to find any IRS tax form; browse through variations and schedules.

- Click Get form to access your Ct34 Sh in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Utilize the Sign Tool to apply your legally-binding eSignature (if necessary).

- Examine your document and rectify any mistakes.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes digitally with airSlate SignNow. Note that filing on paper can increase return mistakes and delay refunds. Be sure to consult the IRS website for submission regulations in your state before e-filing your taxes.

Create this form in 5 minutes or less

Find and fill out the correct ct 34 sh form 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Which ITR form should an NRI fill out for AY 2018–2019 if there are two rental incomes in India other than that from interests?

Choosing Correct Income Tax form is the important aspect of filling Income tax return.Lets us discuss it one by one.ITR -1 —— Mainly used for salary income , other source income, one house property income ( upto Rs. 50 Lakhs ) for Individual Resident Assessees only.ITR-2 —- For Salary Income , Other source income ( exceeding Rs. 50 lakhs) house property income from more than one house and Capital Gains / Loss Income for Individual Resident or Non- Resident Assessees and HUF Assessees only.ITR 3— Income from Business or profession Together with any other income such as Salary Income, Other sources, Capital Gains , House property ( Business/ Profession income is must for filling this form) . For individual and HUF Assessees OnlySo in case NRI Assessees having rental income from two house property , then ITR need to be filed in Form ITR 2.For Detail understanding please refer to my video link.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

Create this form in 5 minutes!

How to create an eSignature for the ct 34 sh form 2018 2019

How to create an eSignature for your Ct 34 Sh Form 2018 2019 in the online mode

How to make an eSignature for the Ct 34 Sh Form 2018 2019 in Google Chrome

How to create an electronic signature for putting it on the Ct 34 Sh Form 2018 2019 in Gmail

How to generate an electronic signature for the Ct 34 Sh Form 2018 2019 from your mobile device

How to create an eSignature for the Ct 34 Sh Form 2018 2019 on iOS

How to generate an eSignature for the Ct 34 Sh Form 2018 2019 on Android

People also ask

-

What is Ct34 Sh and how does it work?

Ct34 Sh is a powerful feature offered by airSlate SignNow that allows businesses to streamline their document signing process. It enables users to send, sign, and manage documents electronically, making it efficient and time-saving. With Ct34 Sh, you can easily track the status of your documents and ensure secure eSignatures.

-

What are the pricing options for Ct34 Sh?

airSlate SignNow offers flexible pricing plans for Ct34 Sh that cater to businesses of all sizes. You can choose from monthly or annual subscriptions, with options that provide various features based on your needs. Visit our pricing page to find the perfect plan for your business and start using Ct34 Sh today.

-

What features does Ct34 Sh offer?

Ct34 Sh comes packed with features designed to enhance your document management experience. Key features include customizable templates, real-time tracking, secure cloud storage, and mobile access. These functionalities ensure that your document signing process is not only efficient but also secure and accessible.

-

How can Ct34 Sh benefit my business?

Implementing Ct34 Sh can signNowly benefit your business by reducing turnaround time for document approvals. It enhances productivity by allowing team members to sign documents from anywhere, at any time. Additionally, Ct34 Sh helps in minimizing paper usage, reducing costs, and improving overall workflow.

-

Is Ct34 Sh compatible with other software?

Yes, Ct34 Sh integrates seamlessly with a variety of popular software applications. This includes CRM systems, cloud storage services, and productivity tools, allowing for a more streamlined workflow. By leveraging these integrations, you can enhance the capabilities of Ct34 Sh and improve your document management processes.

-

Can I use Ct34 Sh for international transactions?

Absolutely! Ct34 Sh is designed to support international transactions with its secure eSignature capabilities. You can send documents for signing to recipients worldwide, ensuring compliance with international eSignature laws. This makes Ct34 Sh an excellent choice for global businesses.

-

What security measures are in place for Ct34 Sh?

Security is a top priority with Ct34 Sh. airSlate SignNow employs advanced encryption methods and compliance with industry standards to protect your sensitive information. Additionally, you can track who signed your documents and when, providing an extra layer of security and accountability.

Get more for Ct34 Sh

- Corporate resolution general formdoc

- Metropolitan transportation authority certificate of insurance form

- Hydraulic jack inspection checklist 251426920 form

- A film application form

- Community service hours certification vol03 pdf marion county marion k12 fl form

- Please type or print clearly the bnamesb of bb bformsbfreshfromfl

- Permit volusia county florida form

- Bill of sale 777079638 form

Find out other Ct34 Sh

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure