Form CT 34 SH New York S Corporation Shareholders' Information Schedule Tax Year 2020

What is the Form CT 34 SH New York S Corporation Shareholders' Information Schedule Tax Year

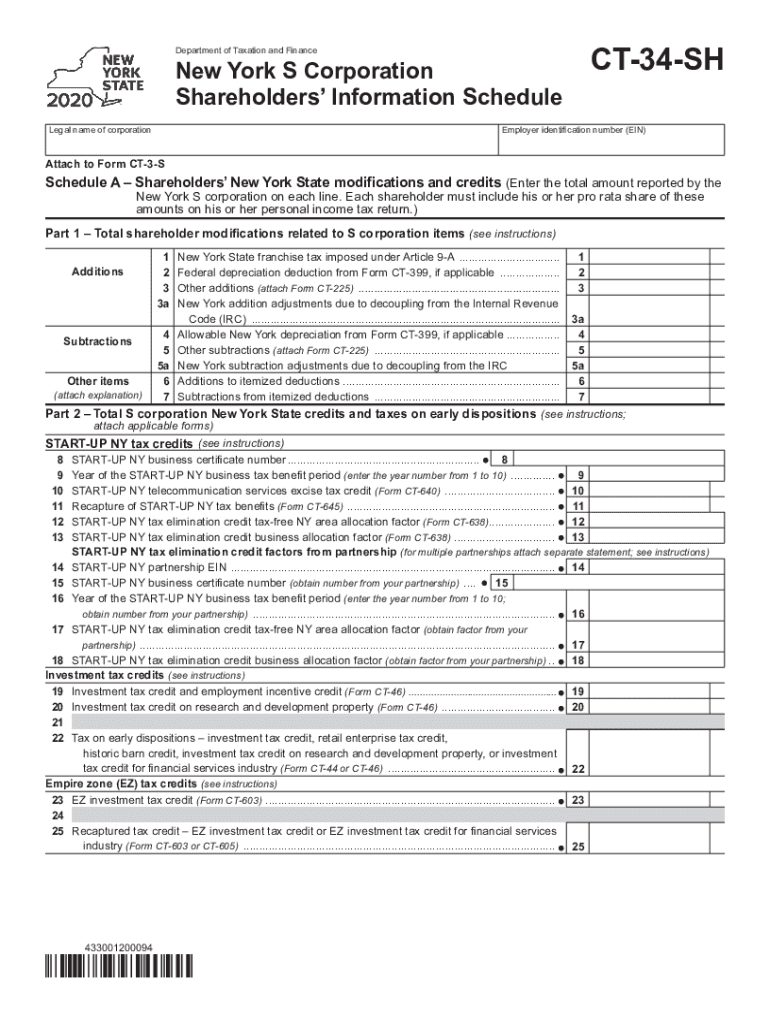

The Form CT 34 SH is a crucial document for S corporations operating in New York. It serves as the Shareholders' Information Schedule, which provides essential details about the shareholders of the corporation for a specific tax year. This form is used to report the allocation of income, deductions, and credits to each shareholder, ensuring compliance with state tax regulations. By accurately completing this form, S corporations can facilitate the correct taxation of their shareholders and maintain transparency in their financial reporting.

Steps to complete the Form CT 34 SH New York S Corporation Shareholders' Information Schedule Tax Year

Completing the Form CT 34 SH involves several key steps to ensure accuracy and compliance. Begin by gathering necessary information about the corporation and its shareholders, including names, addresses, and taxpayer identification numbers. Next, report the total income, deductions, and credits for the tax year, allocating these amounts to each shareholder based on their ownership percentage. It is essential to double-check all entries for accuracy before submitting the form. Finally, ensure that all shareholders receive a copy of the completed form for their records.

Legal use of the Form CT 34 SH New York S Corporation Shareholders' Information Schedule Tax Year

The Form CT 34 SH is legally binding when completed and submitted according to New York state tax laws. It must be filed alongside the corporation's tax return to provide a comprehensive view of the financial activities related to shareholders. The information contained in this form is critical for both the corporation and its shareholders, as it impacts their individual tax liabilities. Failure to accurately complete and file this form can result in penalties and complications with the New York State Department of Taxation and Finance.

Filing Deadlines / Important Dates

It is vital to be aware of the filing deadlines associated with the Form CT 34 SH. Generally, the form must be submitted by the due date of the S corporation's tax return. For most S corporations, this date falls on the fifteenth day of the third month following the end of the tax year. For example, if the tax year ends on December 31, the form is due by March 15 of the following year. Staying informed about these deadlines helps avoid late fees and ensures compliance with state regulations.

Form Submission Methods (Online / Mail / In-Person)

The Form CT 34 SH can be submitted through various methods, providing flexibility for S corporations. Corporations may choose to file the form electronically through the New York State Department of Taxation and Finance's online portal, which offers a streamlined process. Alternatively, the form can be mailed to the appropriate tax office, ensuring that it is postmarked by the filing deadline. In-person submissions may also be possible at designated tax offices, allowing for immediate confirmation of receipt.

Key elements of the Form CT 34 SH New York S Corporation Shareholders' Information Schedule Tax Year

Several key elements must be included in the Form CT 34 SH to ensure it meets legal requirements. These elements include the corporation's name, address, and employer identification number (EIN), as well as detailed information about each shareholder. This includes their names, addresses, and ownership percentages. Additionally, the form should accurately reflect the allocation of income, deductions, and credits for each shareholder, ensuring compliance with tax regulations and facilitating proper tax reporting.

Quick guide on how to complete form ct 34 sh new york s corporation shareholders information schedule tax year 2020

Complete Form CT 34 SH New York S Corporation Shareholders' Information Schedule Tax Year effortlessly on any device

Online document management has gained signNow traction among organizations and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to locate the required form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your paperwork swiftly without delays. Handle Form CT 34 SH New York S Corporation Shareholders' Information Schedule Tax Year on any device with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to alter and electronically sign Form CT 34 SH New York S Corporation Shareholders' Information Schedule Tax Year without hassle

- Find Form CT 34 SH New York S Corporation Shareholders' Information Schedule Tax Year and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize crucial sections of your documents or redacted sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, exhausting form searches, or mistakes that necessitate the printing of new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choosing. Modify and electronically sign Form CT 34 SH New York S Corporation Shareholders' Information Schedule Tax Year to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 34 sh new york s corporation shareholders information schedule tax year 2020

Create this form in 5 minutes!

How to create an eSignature for the form ct 34 sh new york s corporation shareholders information schedule tax year 2020

The best way to create an eSignature for your PDF document in the online mode

The best way to create an eSignature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The way to make an eSignature from your mobile device

The way to generate an electronic signature for a PDF document on iOS devices

The way to make an eSignature for a PDF file on Android devices

People also ask

-

What is the 34 sh. pricing model for airSlate SignNow?

The 34 sh. pricing model for airSlate SignNow is designed to provide flexibility and value for businesses of all sizes. With various subscription plans, you can choose the option that best fits your organization's needs without compromising on essential features. This model ensures you get the most cost-effective solution for your electronic signing needs.

-

How do the features of airSlate SignNow compare for the 34 sh. plan?

The 34 sh. plan offers a robust set of features that enhance document management and eSignature capabilities. Users can enjoy unlimited document signing, customizable templates, and advanced security options, ensuring a seamless experience. This combination of features allows businesses to work efficiently while maintaining compliance.

-

What are the key benefits of using airSlate SignNow with the 34 sh. option?

Utilizing the 34 sh. option with airSlate SignNow provides businesses with a user-friendly interface and a highly efficient workflow. It accelerates the signing process, reduces paper usage, and enhances collaboration among teams. Moreover, businesses can track document status in real-time, improving overall productivity.

-

Can I integrate airSlate SignNow with other software while using the 34 sh. plan?

Yes, the 34 sh. plan supports integrations with various popular software applications, including CRM and document management systems. These integrations facilitate a seamless workflow, enabling businesses to connect their existing tools with airSlate SignNow's capabilities. You can streamline processes and improve efficiency without any added complexity.

-

Is there a mobile app for airSlate SignNow available under the 34 sh. plan?

Absolutely, the 34 sh. plan includes access to the airSlate SignNow mobile app, which allows users to manage documents and eSign on-the-go. This feature is ideal for businesses that require flexibility and the ability to work from anywhere. The mobile app reflects the same user-friendly experience as the desktop version, ensuring consistency.

-

What customer support options are available for the 34 sh. plan?

Customers using the 34 sh. plan can benefit from dedicated customer support, including live chat, email support, and extensive online resources. Whether you're facing technical issues or need guidance on using specific features, our support team is ready to assist you. This commitment to customer care ensures a smooth experience.

-

Are there any restrictions or limitations with the 34 sh. subscription?

The 34 sh. subscription does have some limitations compared to advanced plans, such as the number of users and API calls. However, it still provides comprehensive features suitable for most small to medium-sized businesses. Users can always upgrade as their needs grow for additional capabilities.

Get more for Form CT 34 SH New York S Corporation Shareholders' Information Schedule Tax Year

- Cctv footage request form template

- Fill pdf in arabic form

- Egg carton fractions worksheets form

- Pnb pmjjby certificate download form

- Bathroom log form

- Getting affairs in order worksheet form

- Publication order form mail to oregon state marine board oregon

- Doping control form formulaire de contrle du dopag

Find out other Form CT 34 SH New York S Corporation Shareholders' Information Schedule Tax Year

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later