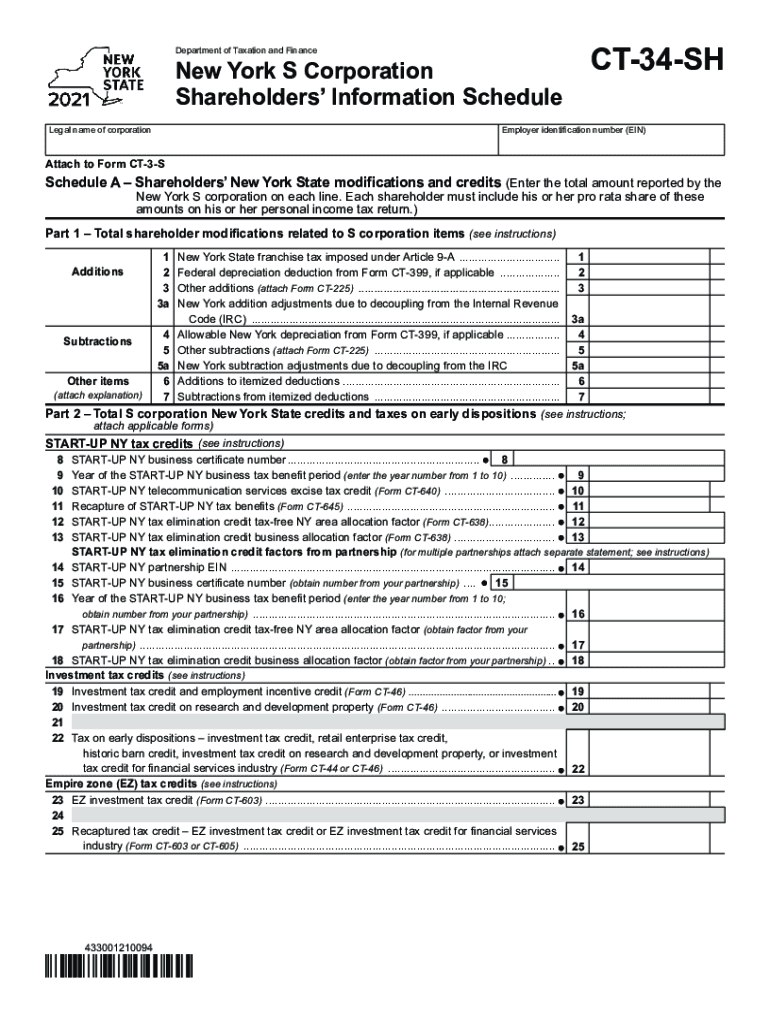

Department of Taxation and Finance New York S Corporation 2021

What is the Department of Taxation and Finance New York S Corporation?

The Department of Taxation and Finance in New York oversees the taxation of S Corporations, which are a type of business entity that elects to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes. This structure allows S Corporations to avoid double taxation on the corporate income. Understanding the role of this department is crucial for compliance and effective tax planning for businesses operating as S Corporations in New York.

Steps to Complete the Department of Taxation and Finance New York S Corporation

Completing the necessary forms for the New York S Corporation involves several key steps:

- Gather all required financial documents, including profit and loss statements and balance sheets.

- Complete the IT-225 form, which details the corporation's income and expenses.

- Ensure that all information is accurate and reflects the corporation's financial status.

- Submit the completed form to the Department of Taxation and Finance by the specified deadline.

- Keep a copy of the submitted form for your records and future reference.

Legal Use of the Department of Taxation and Finance New York S Corporation

The legal framework governing S Corporations in New York is defined by both state and federal laws. Compliance with these regulations ensures that the corporation can benefit from the tax advantages associated with S Corporation status. This includes adhering to filing requirements, maintaining proper records, and ensuring that the corporation operates within the legal guidelines established by the Department of Taxation and Finance.

Filing Deadlines / Important Dates

Filing deadlines for S Corporations in New York are critical to avoid penalties. Typically, the due date for filing the IT-225 form aligns with the federal tax return deadline. It is essential to stay informed about specific dates, as they may vary annually. Mark your calendar for the following important dates:

- Federal tax return due date: typically April 15.

- Extension request deadline: typically the same as the federal due date.

- Final submission deadline for extended returns: typically six months after the original due date.

Required Documents

To successfully complete the IT-225 form, several documents are necessary. These may include:

- Financial statements, including income statements and balance sheets.

- Previous year’s tax return for reference.

- Documentation of any business expenses and deductions.

- Shareholder information and ownership structure details.

Form Submission Methods (Online / Mail / In-Person)

Submitting the IT-225 form can be done through various methods, providing flexibility for businesses:

- Online Submission: Use the Department of Taxation and Finance's online portal for electronic filing.

- Mail Submission: Print and send the completed form to the designated address provided by the department.

- In-Person Submission: Visit a local office of the Department of Taxation and Finance to submit the form directly.

Quick guide on how to complete department of taxation and finance new york s corporation

Prepare Department Of Taxation And Finance New York S Corporation seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to conventional printed and signed paperwork, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Manage Department Of Taxation And Finance New York S Corporation on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

The easiest way to modify and eSign Department Of Taxation And Finance New York S Corporation effortlessly

- Obtain Department Of Taxation And Finance New York S Corporation and then click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize key sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to finalize your changes.

- Select your preferred method to deliver your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow caters to your document management needs with just a few clicks from any device you choose. Modify and eSign Department Of Taxation And Finance New York S Corporation to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct department of taxation and finance new york s corporation

Create this form in 5 minutes!

How to create an eSignature for the department of taxation and finance new york s corporation

The way to make an e-signature for your PDF document in the online mode

The way to make an e-signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your mobile device

The way to make an electronic signature for a PDF document on iOS devices

The way to make an electronic signature for a PDF document on Android devices

People also ask

-

What are the it 225 instructions for using airSlate SignNow?

The it 225 instructions for airSlate SignNow guide you through the process of electronically signing documents and managing workflows. This includes setting up your account, uploading documents, and inviting others to sign. Understanding these instructions ensures a smooth digital signing experience.

-

How much does airSlate SignNow cost and what are the it 225 instructions related to pricing?

AirSlate SignNow offers various pricing plans that are clearly outlined in the it 225 instructions. These instructions help you evaluate which plan suits your needs, whether it’s for individual use or a business. Pricing remains competitive, making it a cost-effective solution for eSignatures.

-

What key features does airSlate SignNow provide as per the it 225 instructions?

According to the it 225 instructions, airSlate SignNow provides features such as document sharing, eSigning, and mobile access. Additionally, it allows users to create templates, track document status, and automate workflows. These features enhance productivity and streamline the signing process.

-

What are the benefits of using airSlate SignNow based on the it 225 instructions?

The it 225 instructions highlight numerous benefits of using airSlate SignNow, including increased efficiency, time savings, and improved compliance. By digitizing the signing process, businesses can reduce paper waste and improve turnaround times. This ultimately leads to enhanced customer satisfaction.

-

Can airSlate SignNow integrate with other software as outlined in the it 225 instructions?

Yes, airSlate SignNow can easily integrate with various software applications, as described in the it 225 instructions. These integrations include popular platforms such as Google Drive, Salesforce, and Microsoft Office. Such compatibility enhances workflow efficiency and data management.

-

How do I access the it 225 instructions for troubleshooting airSlate SignNow?

To troubleshoot issues with airSlate SignNow, access the it 225 instructions available on the support page. These instructions provide guidance on common problems and their resolutions, helping users quickly get back on track. Additional resources, including FAQs and customer service, are also accessible.

-

Are there any security measures in place as mentioned in the it 225 instructions?

The it 225 instructions specify that airSlate SignNow employs advanced security measures such as encryption, two-factor authentication, and compliance with industry standards. These security features ensure that your documents are safe and secure during the signing process. Users can trust airSlate SignNow with their sensitive information.

Get more for Department Of Taxation And Finance New York S Corporation

Find out other Department Of Taxation And Finance New York S Corporation

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast