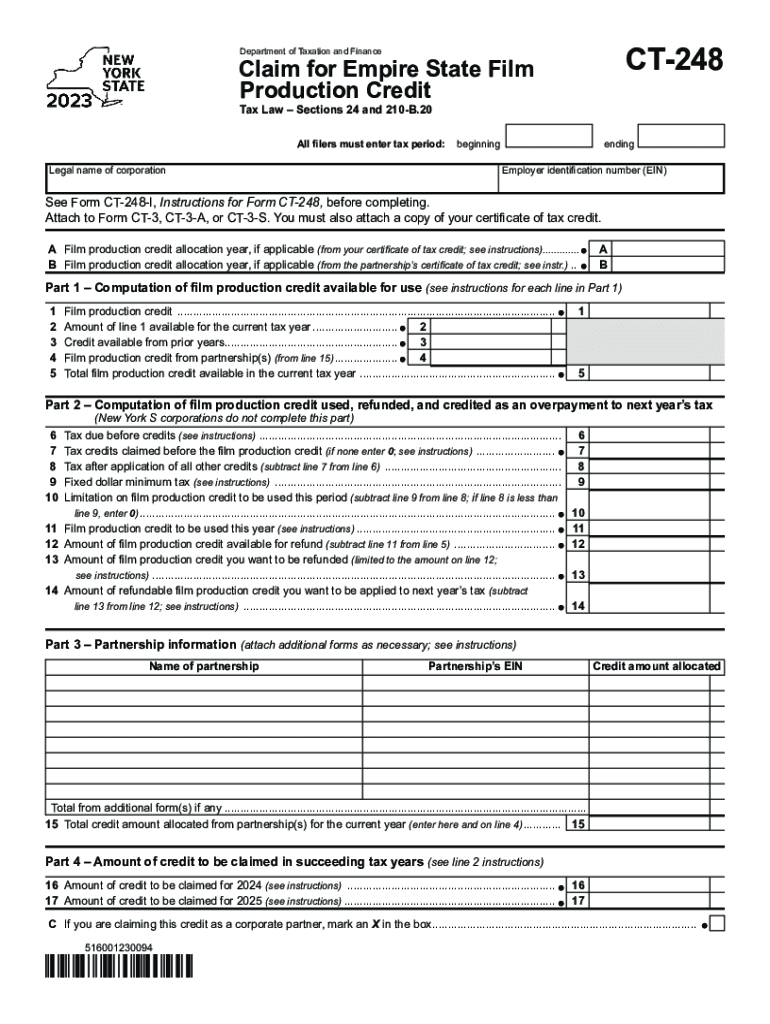

Ct 248 2023

What is the CT 248?

The CT 248 is a form used in the state of New York for claiming a credit for taxes paid to other jurisdictions. This form is essential for individuals and businesses that have paid taxes to another state and are seeking to offset those amounts against their New York State tax liability. The form allows taxpayers to ensure they are not taxed twice on the same income, promoting fair taxation practices.

How to use the CT 248

To effectively use the CT 248, taxpayers must first determine their eligibility for the credit. This involves reviewing the tax payments made to other states and ensuring they meet the requirements set forth by New York State. Once eligibility is confirmed, the taxpayer can complete the form by providing necessary details, including the amount of tax paid to other jurisdictions and relevant income information. The completed form is then submitted with the taxpayer's New York State tax return.

Steps to complete the CT 248

Completing the CT 248 involves several key steps:

- Gather documentation of taxes paid to other states.

- Fill out the personal information section, including your name, address, and Social Security number.

- Detail the tax payments made to other jurisdictions, including the amount and the state.

- Calculate the credit amount based on the information provided.

- Review the form for accuracy and completeness.

- Submit the CT 248 along with your New York State tax return.

Required Documents

When filing the CT 248, certain documents are necessary to support your claim. These include:

- Proof of tax payments made to other states, such as tax returns or payment receipts.

- Documentation of income earned in those jurisdictions.

- Any additional forms or schedules that may be required by New York State tax regulations.

Legal use of the CT 248

The CT 248 is legally recognized as a means for taxpayers to claim credits for taxes paid to other states. It is important to complete the form accurately and submit it within the designated filing period to avoid penalties. Misuse of the form or providing false information can lead to legal repercussions, including fines or audits by tax authorities.

Filing Deadlines / Important Dates

Taxpayers must be aware of specific deadlines when filing the CT 248. Typically, the form should be submitted along with the New York State tax return by the due date of the return. For most individuals, this is usually April fifteenth. However, if an extension is filed, the CT 248 must also be submitted by the extended deadline. It is crucial to stay informed about any changes to these dates each tax year.

Quick guide on how to complete ct 248

Effortlessly Prepare Ct 248 on Any Device

Digital document management has become increasingly popular among businesses and individuals. It presents an excellent eco-friendly solution to traditional printed and signed paperwork, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the resources you require to create, edit, and eSign your documents quickly and without delays. Manage Ct 248 on any device through airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Edit and eSign Ct 248 with Ease

- Find Ct 248 and click on Get Form to begin.

- Utilize the tools available to fill out your document.

- Emphasize signNow parts of your documents or obscure sensitive information with specialized tools that airSlate SignNow provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and select the Done button to save your changes.

- Decide how you wish to submit your form, whether by email, text message (SMS), invitation link, or by downloading it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Edit and eSign Ct 248 while ensuring outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct 248

Create this form in 5 minutes!

How to create an eSignature for the ct 248

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ct 248 in relation to airSlate SignNow?

CT 248 refers to a specific feature or integration within airSlate SignNow that enhances document management. By using ct 248, businesses can streamline their eSigning processes, making it easier to send and receive important documents digitally. This functionality is a part of our commitment to providing a seamless user experience.

-

How much does airSlate SignNow’s ct 248 feature cost?

The pricing for airSlate SignNow, including the ct 248 feature, varies based on the subscription plan chosen. We offer flexible pricing options designed for businesses of all sizes to ensure you get the best value. For exact pricing, please visit our website or contact our sales team.

-

What benefits does the ct 248 integration offer?

The ct 248 integration provides a range of benefits such as enhanced workflow automation and improved document tracking. With this feature, users can easily manage their eSigning processes, reducing time spent on paperwork. It helps businesses to boost efficiency and compliance.

-

Does airSlate SignNow’s ct 248 support third-party integrations?

Yes, the ct 248 feature is designed to support various third-party integrations, allowing you to connect with other tools you use daily. This flexibility enhances your workflow by ensuring that you can send and sign documents seamlessly across platforms. You can check our list of supported integrations for more details.

-

Is airSlate SignNow suitable for small businesses, especially with ct 248?

Absolutely! AirSlate SignNow is tailored to meet the needs of small businesses, and the ct 248 functionality makes managing document signing effortless. With its cost-effective solutions, businesses can leverage powerful eSigning capabilities without breaking the bank.

-

How does ct 248 improve document security in airSlate SignNow?

The ct 248 feature enhances security protocols in airSlate SignNow by employing advanced encryption methods. This ensures that all documents signed and sent through our platform are protected from unauthorized access. Businesses can confidently utilize our services knowing their sensitive data is secure.

-

Can I try the ct 248 feature before committing?

Yes, airSlate SignNow offers a trial period that allows you to explore the capabilities of the ct 248 feature. During the trial, you can test out all the functionalities and see how they fit with your business needs. This way, you can make an informed decision before fully committing.

Get more for Ct 248

Find out other Ct 248

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later