Form CT 248 Claim for Empire State Film Production Credit 2024-2026

What is the Form CT 248 Claim For Empire State Film Production Credit

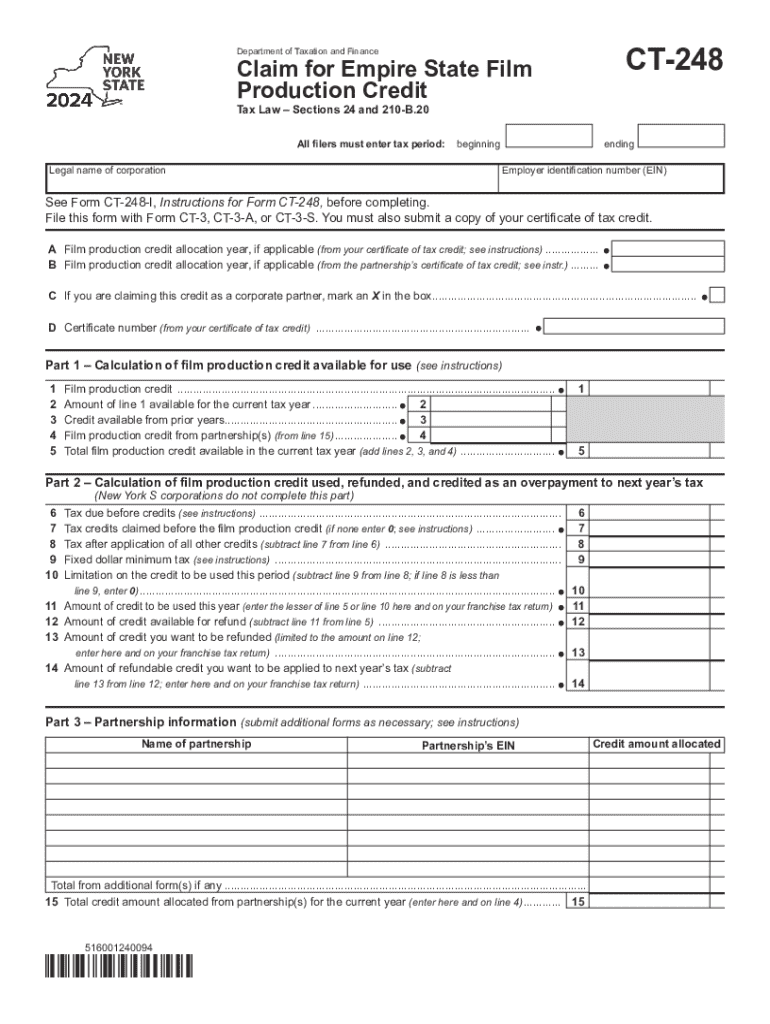

The Form CT 248 is a tax document used to claim the Empire State Film Production Credit in New York. This credit is designed to incentivize film and television production within the state, providing significant financial benefits to qualifying productions. By utilizing this form, production companies can receive a tax credit based on eligible production costs incurred while filming in New York. Understanding the purpose and benefits of this form is crucial for filmmakers looking to maximize their financial returns.

Steps to complete the Form CT 248 Claim For Empire State Film Production Credit

Completing the Form CT 248 involves several key steps to ensure accuracy and compliance with state regulations. First, gather all necessary documentation related to production expenses, including receipts and payroll records. Next, fill out the form with detailed information about the production, including the project title, production company details, and the total amount of eligible expenses. It is essential to accurately report all costs to avoid delays in processing. After completing the form, review it thoroughly for any errors before submission.

Eligibility Criteria

To qualify for the Empire State Film Production Credit, productions must meet specific eligibility criteria. These include the requirement that a minimum of 75% of the total production costs must be incurred within New York State. Additionally, the production must be a feature film, television series, or a television pilot. Productions that are primarily for commercial purposes or that do not meet the minimum budget threshold are typically ineligible. Understanding these criteria is vital for filmmakers to determine if they can benefit from the tax credit.

Required Documents

When submitting the Form CT 248, several supporting documents are required to substantiate the claimed expenses. These documents include detailed production budgets, payroll records for cast and crew, and invoices for services rendered. Additionally, proof of payments made to New York-based vendors and contractors is necessary. Collecting and organizing these documents before starting the application process can streamline submission and help ensure compliance with state requirements.

Filing Deadlines / Important Dates

Filing deadlines for the Form CT 248 are critical for producers to keep in mind. Typically, the form must be submitted within a certain timeframe following the completion of the production. It is advisable to check the New York State Department of Taxation and Finance website for the most current deadlines, as they can vary by year and production type. Missing these deadlines can result in the forfeiture of the tax credit, making timely submission essential.

Form Submission Methods

The Form CT 248 can be submitted through various methods to accommodate different preferences. Producers have the option to file the form electronically, which is often the fastest method for processing. Alternatively, the form can be mailed to the appropriate state office. In-person submissions may also be possible, depending on the current regulations and office policies. Understanding these options helps ensure that producers choose the most efficient method for their needs.

Create this form in 5 minutes or less

Find and fill out the correct form ct 248 claim for empire state film production credit

Create this form in 5 minutes!

How to create an eSignature for the form ct 248 claim for empire state film production credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is allocation ct claiming and how does it work with airSlate SignNow?

Allocation ct claiming refers to the process of managing and claiming allocations in Connecticut. With airSlate SignNow, businesses can streamline this process by electronically signing and sending necessary documents, ensuring compliance and efficiency.

-

How can airSlate SignNow help with the allocation ct claiming process?

airSlate SignNow simplifies allocation ct claiming by providing a user-friendly platform for document management. Users can easily create, send, and eSign documents related to their claims, reducing paperwork and speeding up the overall process.

-

What are the pricing options for airSlate SignNow for allocation ct claiming?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses involved in allocation ct claiming. Whether you are a small business or a large enterprise, you can choose a plan that fits your budget while enjoying all the essential features.

-

Are there any specific features in airSlate SignNow that support allocation ct claiming?

Yes, airSlate SignNow includes features specifically designed to support allocation ct claiming, such as customizable templates, automated workflows, and secure eSigning. These features help ensure that all necessary documents are completed accurately and efficiently.

-

What benefits does airSlate SignNow provide for businesses handling allocation ct claiming?

By using airSlate SignNow for allocation ct claiming, businesses can save time and reduce errors associated with manual document handling. The platform enhances collaboration and ensures that all stakeholders can access and sign documents from anywhere, improving overall productivity.

-

Can airSlate SignNow integrate with other tools for allocation ct claiming?

Absolutely! airSlate SignNow offers integrations with various tools and platforms that can enhance your allocation ct claiming process. This allows for seamless data transfer and improved workflow efficiency, making it easier to manage your claims.

-

Is airSlate SignNow secure for handling sensitive allocation ct claiming documents?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling sensitive allocation ct claiming documents. The platform employs advanced encryption and security protocols to protect your data and ensure that your documents are secure.

Get more for Form CT 248 Claim For Empire State Film Production Credit

Find out other Form CT 248 Claim For Empire State Film Production Credit

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word