Form 5498 Sa 2023-2026

What is the Form 5498 SA

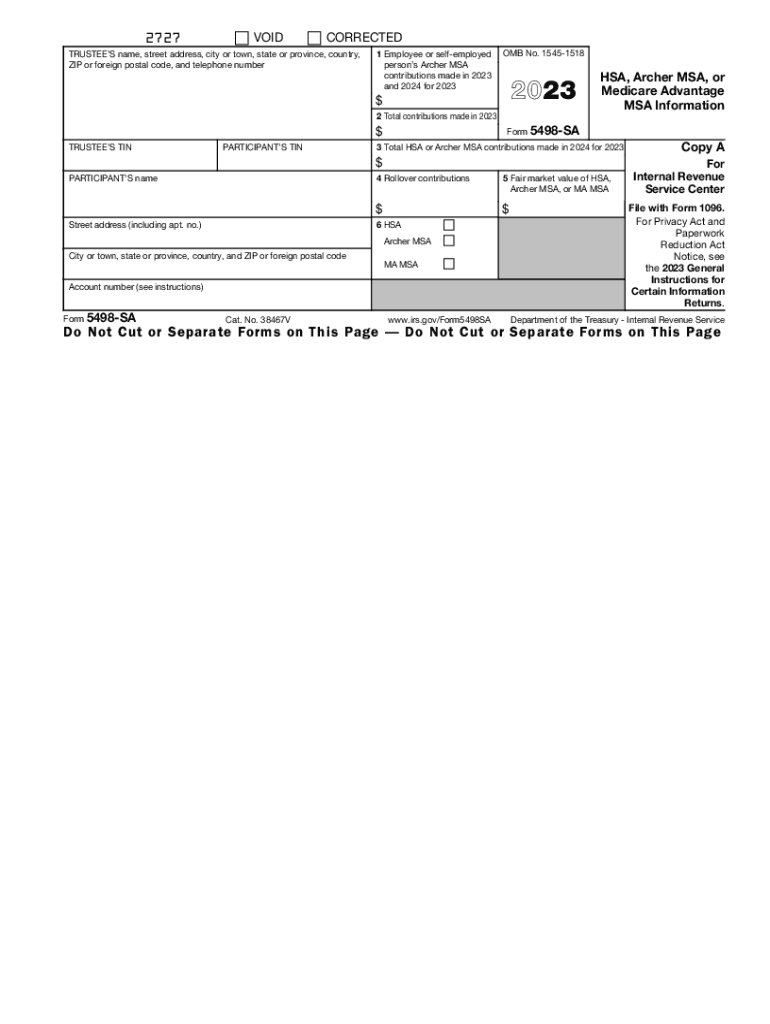

The Form 5498 SA is an important tax document used to report contributions to Health Savings Accounts (HSAs) and other related accounts. It is primarily utilized by individuals who have made contributions to their HSAs during the tax year. This form provides the IRS with essential information regarding the amounts contributed, the fair market value of the account, and any rollovers or transfers that may have occurred. Understanding this form is crucial for ensuring compliance with tax regulations and for accurately reporting HSA contributions on individual tax returns.

How to use the Form 5498 SA

Using the Form 5498 SA involves several key steps. First, individuals who have contributed to an HSA will receive this form from their HSA custodian or trustee by May 31 of the following year. It is important to review the information on the form for accuracy, including contribution amounts and account details. Taxpayers should use the information provided on the 5498 SA to complete their tax returns, particularly when filling out Form 8889, which is used to report HSA contributions and distributions. This ensures that the contributions are correctly reflected and any tax benefits are claimed.

Steps to complete the Form 5498 SA

Completing the Form 5498 SA involves several straightforward steps:

- Gather necessary information, including your HSA account details and contribution records.

- Review the form for accuracy once received from your HSA custodian.

- Ensure that all contributions, including any rollovers or transfers, are accurately reported.

- Use the information to complete Form 8889 when filing your tax return.

- Keep a copy of the Form 5498 SA for your records, as it may be needed for future reference.

Legal use of the Form 5498 SA

The legal use of the Form 5498 SA is essential for compliance with IRS regulations regarding HSAs. This form must be accurately completed and submitted to report contributions made to HSAs. Failure to report contributions accurately can lead to penalties or disqualification of the tax benefits associated with HSAs. It is also important for taxpayers to retain this form for their records, as it serves as proof of contributions in case of an audit or review by the IRS.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Form 5498 SA is crucial for compliance. The form is typically due to be sent to the IRS by May 31 of the year following the tax year in which contributions were made. Taxpayers should ensure that they receive this form in a timely manner from their HSA custodian, as it is necessary for accurate tax reporting. Additionally, individuals should be aware of their own tax filing deadlines to ensure that they incorporate the information from the Form 5498 SA into their tax returns promptly.

Who Issues the Form

The Form 5498 SA is issued by the HSA custodian or trustee. This entity is responsible for managing the Health Savings Account and must provide the form to account holders by the required deadline. It is important for individuals to ensure that their HSA custodian has accurate contact information to receive this form without delay. If a taxpayer does not receive their Form 5498 SA, they should reach out to their HSA custodian to obtain a copy.

Quick guide on how to complete form 5498 sa

Effortlessly Prepare Form 5498 Sa on Any Device

The management of online documents has become increasingly favored by companies and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can easily locate the right form and securely keep it online. airSlate SignNow provides you with all the necessary tools to create, alter, and electronically sign your documents swiftly without delays. Manage Form 5498 Sa on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven workflow today.

How to Alter and Electronically Sign Form 5498 Sa with Ease

- Obtain Form 5498 Sa and select Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive details with the tools provided by airSlate SignNow specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form navigation, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form 5498 Sa and ensure superior communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 5498 sa

Create this form in 5 minutes!

How to create an eSignature for the form 5498 sa

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 5498 sa form, and how does airSlate SignNow assist in managing it?

The 5498 sa form is a tax document used to report contributions to your traditional IRA or Roth IRA. With airSlate SignNow, you can effortlessly eSign and share your 5498 sa forms digitally, ensuring compliance and security in the documentation process. Our platform simplifies the management of these forms, allowing you to focus on your financial goals.

-

How can airSlate SignNow help reduce costs associated with 5498 sa submission?

airSlate SignNow offers a cost-effective solution for sending and eSigning 5498 sa forms without the need for paper or postage. By utilizing our digital signature technology, you can eliminate unnecessary expenses while ensuring timely submissions to the IRS. This not only saves money but also enhances your workflow efficiency.

-

Are there any features in airSlate SignNow that specifically benefit the handling of 5498 sa forms?

Yes, airSlate SignNow provides features tailored for 5498 sa forms, such as templates for easy reuse, customizable fields, and integration with popular accounting software. These features streamline the document creation process and help you stay organized, reducing the likelihood of errors. You can also track the status of your 5498 sa forms efficiently within our platform.

-

What integrations does airSlate SignNow offer for managing 5498 sa forms?

airSlate SignNow seamlessly integrates with various accounting and financial software, enabling effortless management of your 5498 sa forms. Popular integrations include QuickBooks and Xero, which help centralize your documents and streamline your processes. This integration ensures that your 5498 sa forms are readily accessible and update in real-time.

-

Is airSlate SignNow secure for submitting sensitive 5498 sa forms?

Absolutely! airSlate SignNow offers industry-leading security measures, including encrypted data transmission and secure storage, to protect your sensitive 5498 sa forms. Our platform is compliant with various regulations, including GDPR and HIPAA, ensuring that your data remains confidential and safe from unauthorized access.

-

Can I use airSlate SignNow on mobile devices for signing 5498 sa forms?

Yes, airSlate SignNow is mobile-friendly, allowing you to eSign your 5498 sa forms from any mobile device. Our user-friendly app provides a seamless experience, making it convenient to manage your documents while on the go. This feature ensures that you can handle your financial needs anytime, anywhere.

-

What customer support options are available for 5498 sa form assistance with airSlate SignNow?

airSlate SignNow offers multiple customer support options, including live chat, email support, and a comprehensive knowledge base to assist you with your 5498 sa forms. Our dedicated support team is available to help resolve any queries or issues you may encounter. We strive to ensure that your experience with our software is smooth and effective.

Get more for Form 5498 Sa

- Permissive membership calstrs form

- Instructions california wage theft prevention act wtpa form

- Centrally stored medication and destruction record form

- Dcradcbbl ez online form

- Claims attachment cover sheet indianamedicaid com form

- Lc 142 instructions form

- Sc1040tc tax credits sc department of revenue form

- 24 irs form 2678 employer appointment of agent

Find out other Form 5498 Sa

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online