5498 Sa Form 2016

What is the 5498 SA Form

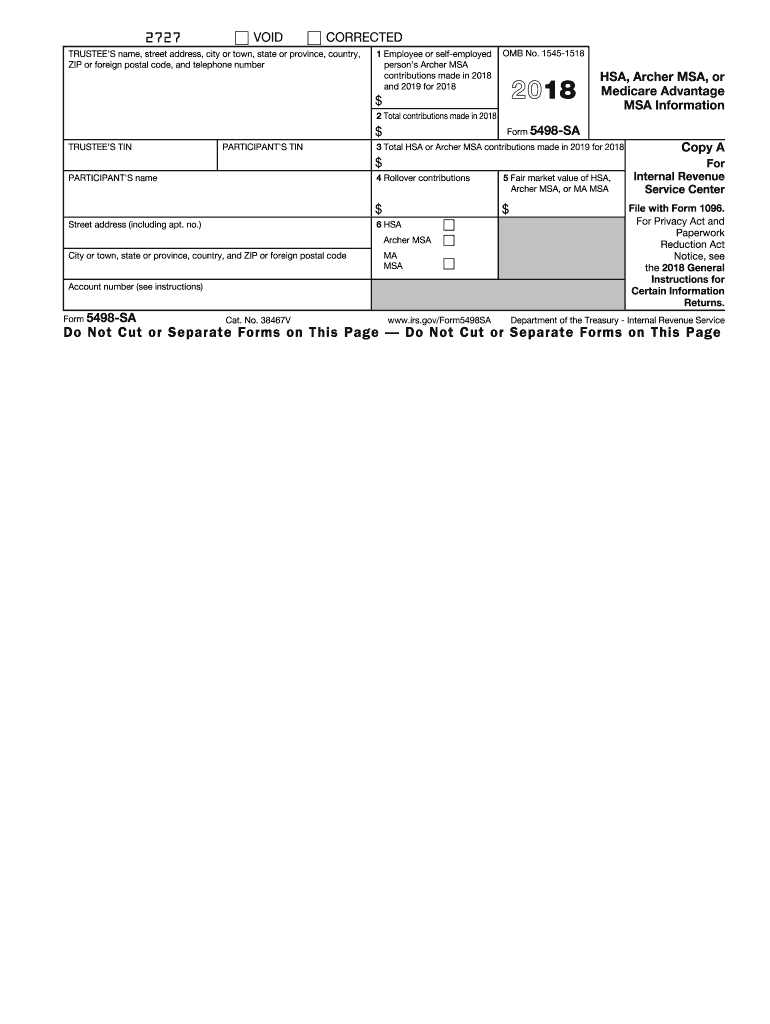

The 5498 SA Form is a tax document used in the United States to report contributions to Health Savings Accounts (HSAs). This form is essential for individuals who have made contributions to their HSAs during the tax year. It provides the IRS with necessary information regarding the total contributions, rollovers, and any other relevant details about the account. Understanding the purpose of the 5498 SA Form is crucial for accurate tax reporting and compliance.

How to use the 5498 SA Form

Using the 5498 SA Form involves several key steps. First, ensure that you have received the form from your HSA trustee or custodian. This form will typically be mailed to you by the end of May following the tax year. Once you have the form, review the information for accuracy, including your personal details and the contribution amounts. Use this information when preparing your tax return to report your HSA contributions accurately. It is important to retain a copy of the form for your records, as it may be needed for future reference or audits.

Steps to complete the 5498 SA Form

Completing the 5498 SA Form requires attention to detail. Follow these steps to ensure accuracy:

- Gather necessary documents, including your HSA account statements and contribution records.

- Review the form sections, which include your personal information, account details, and contribution amounts.

- Enter the total contributions made to your HSA for the tax year.

- Check for any rollovers or transfers that may need to be reported.

- Sign and date the form if required, and keep a copy for your records.

Legal use of the 5498 SA Form

The 5498 SA Form serves a legal purpose in the context of tax reporting. It is required by the IRS to ensure that individuals report their HSA contributions accurately. Failure to report contributions can lead to penalties or issues with tax compliance. The form must be completed in accordance with IRS guidelines, and it is essential to keep it on file as proof of contributions for tax purposes. Understanding the legal implications of this form can help individuals avoid complications during tax season.

Filing Deadlines / Important Dates

Filing deadlines for the 5498 SA Form are crucial for compliance. The form must be filed by the HSA trustee or custodian by May 31 of the year following the tax year for which contributions are reported. Taxpayers should be aware that they do not need to submit the 5498 SA Form with their tax return, but they should retain it for their records. It is advisable to review any changes in IRS deadlines to ensure timely compliance.

IRS Guidelines

The IRS provides specific guidelines for the 5498 SA Form to ensure proper reporting of HSA contributions. These guidelines include instructions on what information must be reported, how to handle rollovers, and the importance of accurate record-keeping. Taxpayers should refer to the IRS website or official publications for the most current information regarding the form. Following these guidelines can help prevent errors and ensure compliance with tax laws.

Quick guide on how to complete 2016 5498 sa form

Effortlessly prepare 5498 Sa Form on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed paperwork, as you can access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without interruptions. Handle 5498 Sa Form on any platform using the airSlate SignNow Android or iOS applications and simplify any document-centric process today.

The simplest way to modify and electronically sign 5498 Sa Form with ease

- Obtain 5498 Sa Form and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate issues with lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign 5498 Sa Form and guarantee exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 5498 sa form

Create this form in 5 minutes!

How to create an eSignature for the 2016 5498 sa form

The way to create an electronic signature for your PDF online

The way to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The best way to make an eSignature straight from your smartphone

The best way to create an electronic signature for a PDF on iOS

The best way to make an eSignature for a PDF document on Android

People also ask

-

What is the 5498 Sa Form?

The 5498 Sa Form is a tax document used by financial institutions to report contributions to individual retirement accounts (IRAs). It provides essential information for taxpayers regarding their retirement savings. Understanding the 5498 Sa Form is crucial for ensuring accurate tax reporting.

-

How can airSlate SignNow help with the 5498 Sa Form?

airSlate SignNow simplifies the process of signing and sending the 5498 Sa Form electronically. With our platform, users can easily upload, eSign, and share the form securely. This streamlines the documentation process and ensures compliance with IRS requirements.

-

Is there a cost associated with using airSlate SignNow for the 5498 Sa Form?

airSlate SignNow offers a range of pricing plans to suit different business needs when dealing with the 5498 Sa Form and other documents. Our services are designed to be cost-effective, ensuring that you receive value for your investment. You can select a plan that fits your budget and requirements.

-

What features does airSlate SignNow provide for managing the 5498 Sa Form?

airSlate SignNow offers several features for the 5498 Sa Form, including easy document creation, customizable templates, and secure eSigning. Additionally, users can track document status and send reminders, enhancing the efficiency of handling important tax documents. These features ensure a seamless experience.

-

Can I integrate airSlate SignNow with other software when managing the 5498 Sa Form?

Yes, airSlate SignNow integrates with various applications and software, allowing you to manage the 5498 Sa Form effectively. You can connect tools like CRM systems, cloud storage, and productivity applications to streamline workflows. These integrations enhance usability and improve overall efficiency.

-

What are the benefits of using airSlate SignNow for the 5498 Sa Form?

Using airSlate SignNow for the 5498 Sa Form offers several benefits, including reduced processing time and improved accuracy. The digital platform minimizes the possibility of errors and ensures compliance with IRS regulations. Furthermore, our solution enhances the collaboration between businesses and clients.

-

Is the 5498 Sa Form secure when processed through airSlate SignNow?

Absolutely, the 5498 Sa Form is processed securely on the airSlate SignNow platform. We utilize advanced encryption and security measures to protect your sensitive financial information. Our commitment to privacy ensures that your documents remain confidential and secure throughout the signing process.

Get more for 5498 Sa Form

Find out other 5498 Sa Form

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation