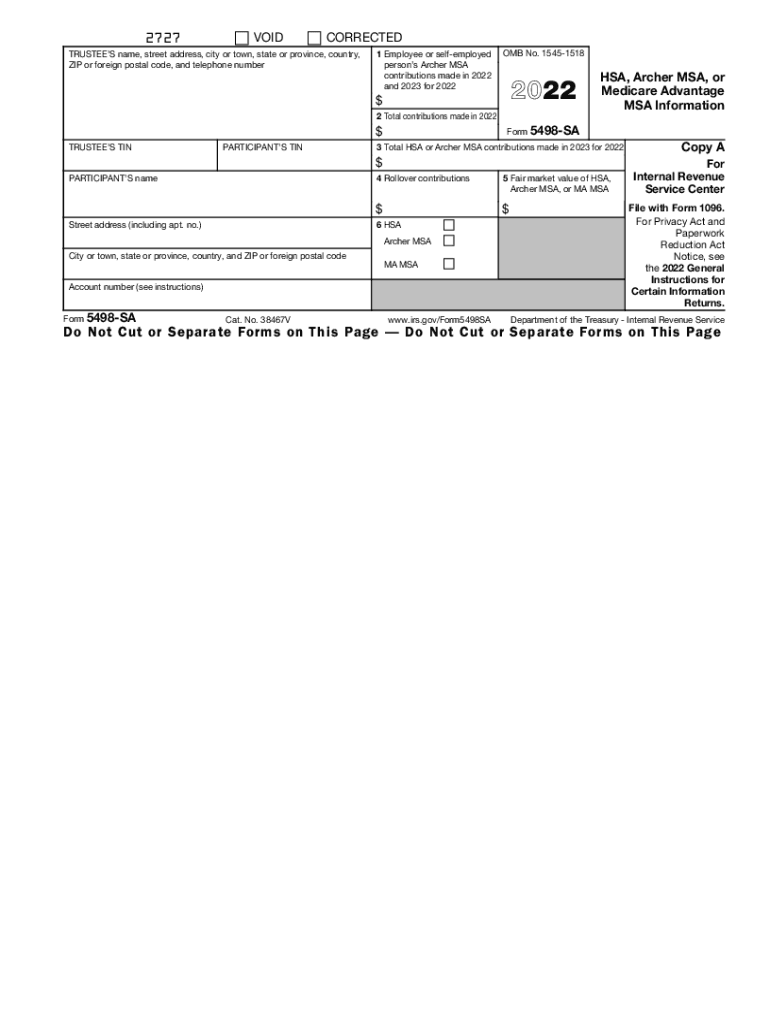

Form 5498 SA HSA, Archer MSA, or Medicare Advantage MSA Information 2022

What is the Form 5498 SA HSA, Archer MSA, Or Medicare Advantage MSA Information

The Form 5498 SA is a crucial document used to report contributions to Health Savings Accounts (HSAs), Archer Medical Savings Accounts (MSAs), and Medicare Advantage MSAs. This form is essential for individuals who wish to track their contributions and ensure compliance with IRS regulations. The information reported on this form includes the total contributions made during the tax year, which can affect tax deductions and overall tax liability. Understanding the specifics of the Form 5498 SA is vital for effective tax planning and compliance.

Steps to complete the Form 5498 SA HSA, Archer MSA, Or Medicare Advantage MSA Information

Completing the Form 5498 SA involves several key steps to ensure accuracy and compliance. First, gather all relevant information regarding your HSA, Archer MSA, or Medicare Advantage MSA contributions for the tax year. This includes details about the account holder, the account number, and the total contributions made. Next, accurately fill out each section of the form, ensuring that all figures are correct. It is also important to review the form for any errors before submission. Once completed, the form can be submitted electronically or via mail, depending on your preference and IRS guidelines.

How to obtain the Form 5498 SA HSA, Archer MSA, Or Medicare Advantage MSA Information

Obtaining the Form 5498 SA is a straightforward process. Individuals can acquire the form through the IRS website, where it is available for download. Financial institutions that manage HSAs, Archer MSAs, or Medicare Advantage MSAs are also required to provide this form to account holders. Typically, these institutions will send a copy of the completed form to you by mail or make it available through their online platforms. It is advisable to check with your financial institution to ensure you receive the correct version of the form.

Legal use of the Form 5498 SA HSA, Archer MSA, Or Medicare Advantage MSA Information

The legal use of the Form 5498 SA is significant for maintaining compliance with IRS regulations. This form serves as proof of contributions made to HSAs and MSAs, which can impact tax deductions. Ensuring that the form is filled out accurately and submitted on time is essential to avoid potential penalties. The IRS requires that the form be filed annually, and failure to do so may result in fines or additional scrutiny during tax audits. Understanding the legal implications of this form can help individuals manage their tax obligations effectively.

IRS Guidelines

The IRS provides specific guidelines regarding the use and submission of the Form 5498 SA. These guidelines outline the required information that must be reported, deadlines for submission, and the penalties for non-compliance. It is crucial for individuals to familiarize themselves with these guidelines to ensure that they are meeting all necessary requirements. The IRS also updates these guidelines periodically, so staying informed about any changes is essential for accurate reporting.

Filing Deadlines / Important Dates

Filing deadlines for the Form 5498 SA are important to keep in mind to avoid penalties. Generally, the form must be filed by May 31 of the year following the tax year in which contributions were made. This allows individuals to report their contributions accurately and take advantage of any potential tax benefits. It is advisable to mark this date on your calendar and plan accordingly to ensure timely submission.

Quick guide on how to complete 2022 form 5498 sa hsa archer msa or medicare advantage msa information

Complete Form 5498 SA HSA, Archer MSA, Or Medicare Advantage MSA Information effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Form 5498 SA HSA, Archer MSA, Or Medicare Advantage MSA Information on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Form 5498 SA HSA, Archer MSA, Or Medicare Advantage MSA Information without hassle

- Locate Form 5498 SA HSA, Archer MSA, Or Medicare Advantage MSA Information and then click Get Form to start.

- Utilize the tools we provide to fill in your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 5498 SA HSA, Archer MSA, Or Medicare Advantage MSA Information to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 form 5498 sa hsa archer msa or medicare advantage msa information

Create this form in 5 minutes!

People also ask

-

What is 5498 sa and why is it important?

The 5498 sa is a tax form used to report contributions to certain retirement accounts. It's important for taxpayers to understand its implications for their tax returns and financial planning.

-

How does airSlate SignNow handle the 5498 sa form?

With airSlate SignNow, you can easily create, send, and eSign the 5498 sa form, ensuring a seamless experience. Our platform simplifies the management of important documents, making compliance easier for users.

-

What features does airSlate SignNow offer for the 5498 sa form?

AirSlate SignNow provides features like electronic signatures, document templates, and real-time tracking specifically for the 5498 sa form. These tools streamline the signing process, allowing users to focus on what matters most.

-

Is airSlate SignNow a cost-effective solution for handling the 5498 sa?

Yes, airSlate SignNow is a cost-effective solution designed for businesses of all sizes. Our pricing plans are flexible, making it easy to manage the 5498 sa and other important documents without breaking the bank.

-

Can airSlate SignNow integrate with other software for 5498 sa management?

Absolutely, airSlate SignNow offers integrations with various software applications, enhancing the management of the 5498 sa. This seamless integration helps users streamline operations and access critical data in one place.

-

What are the benefits of using airSlate SignNow for the 5498 sa?

Using airSlate SignNow for the 5498 sa offers numerous benefits, including time savings, increased accuracy, and enhanced security. Our platform helps users reduce errors and ensure compliance during the document signing process.

-

How secure is airSlate SignNow for handling the 5498 sa form?

AirSlate SignNow takes security seriously, employing robust encryption and compliance measures for the 5498 sa form. This ensures that your sensitive information remains protected throughout the signing process.

Get more for Form 5498 SA HSA, Archer MSA, Or Medicare Advantage MSA Information

- Tenant consent to background and reference check nevada form

- Residential lease or rental agreement for month to month nevada form

- Residential rental lease agreement nevada form

- Tenant welcome letter nevada form

- Warning of default on commercial lease nevada form

- Warning of default on residential lease nevada form

- Landlord tenant closing statement to reconcile security deposit nevada form

- Nevada name form

Find out other Form 5498 SA HSA, Archer MSA, Or Medicare Advantage MSA Information

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template