15 Printable Form 5498 Sa Templates Fillable Samples in 2020

What is the sample 5498 SA?

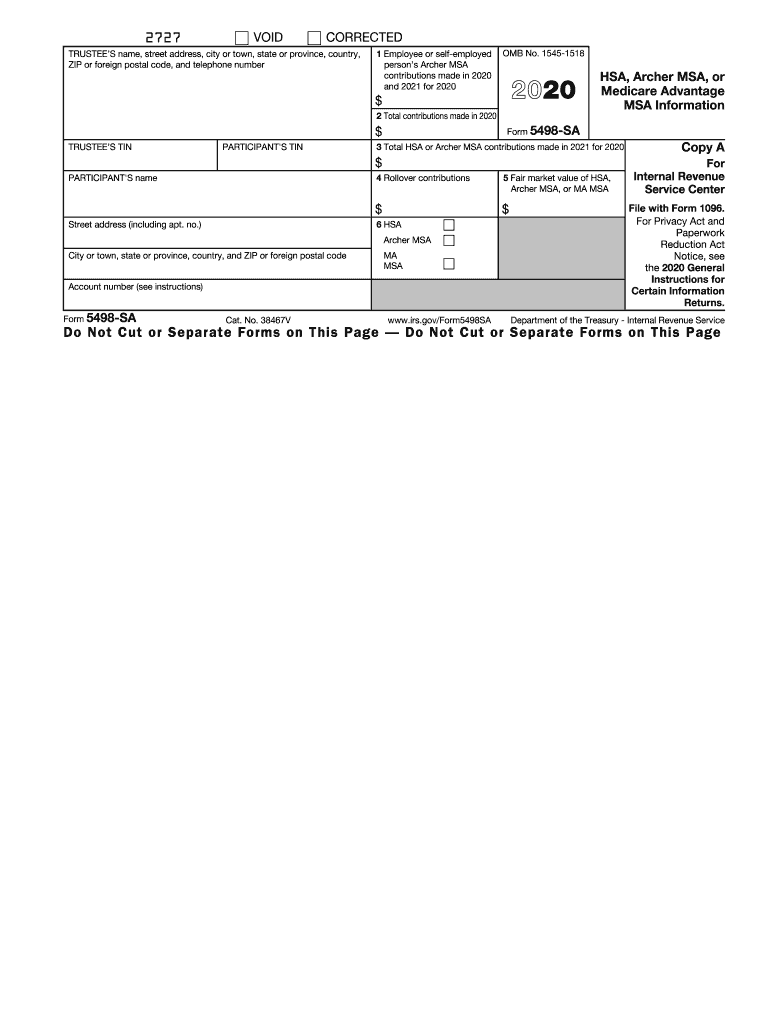

The sample 5498 SA is a tax form used in the United States to report contributions to Health Savings Accounts (HSAs). This form is essential for individuals who wish to claim tax deductions related to their HSA contributions. The IRS requires this form to be filed by trustees or custodians of HSAs to provide information about contributions made during the tax year. It includes details such as the account holder's name, address, and Social Security number, as well as the total contributions made to the HSA.

Steps to complete the sample 5498 SA

Completing the sample 5498 SA involves several key steps to ensure accuracy and compliance with IRS regulations. First, gather all necessary information, including personal details and contribution amounts. Next, enter your name, address, and Social Security number in the designated fields. Then, report the total contributions made to your HSA for the tax year. If applicable, include any rollover contributions from other accounts. Finally, review the form for any errors before submitting it to the IRS.

IRS Guidelines for the sample 5498 SA

The IRS provides specific guidelines regarding the completion and submission of the sample 5498 SA. According to IRS regulations, the form must be filed by the trustee or custodian of the HSA by May 31 of the year following the tax year in which contributions were made. It is important to ensure that the information reported is accurate and matches the records of the account holder. Failure to comply with IRS guidelines may result in penalties or issues with tax deductions.

Filing Deadlines for the sample 5498 SA

Filing deadlines for the sample 5498 SA are crucial for maintaining compliance with IRS regulations. The form must be submitted by May 31 of the year following the tax year in which contributions were made. For example, for contributions made in 2022, the form should be filed by May 31, 2023. It is important to keep track of these deadlines to avoid potential penalties and ensure that contributions are properly reported for tax purposes.

Legal use of the sample 5498 SA

The sample 5498 SA serves a legal purpose in documenting contributions to Health Savings Accounts. This form is recognized by the IRS as an official record of HSA contributions, which can be used to support tax deductions claimed by the account holder. Proper completion and submission of the form are essential for maintaining compliance with tax laws and ensuring that individuals can benefit from the tax advantages associated with HSAs.

Key elements of the sample 5498 SA

Several key elements are essential to the sample 5498 SA. These include the account holder's personal information, such as name and Social Security number, as well as the total contributions made to the HSA during the tax year. Additionally, the form may include information on rollover contributions and the fair market value of the account at the end of the year. Understanding these elements is crucial for accurate reporting and compliance with IRS regulations.

Quick guide on how to complete 15 printable form 5498 sa templates fillable samples in

Effortlessly Create 15 Printable Form 5498 sa Templates Fillable Samples In on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed papers, enabling you to obtain the proper format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without interruptions. Manage 15 Printable Form 5498 sa Templates Fillable Samples In on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The Easiest Way to Modify and Electronically Sign 15 Printable Form 5498 sa Templates Fillable Samples In with Minimal Effort

- Obtain 15 Printable Form 5498 sa Templates Fillable Samples In and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive details with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method of sharing your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Modify and electronically sign 15 Printable Form 5498 sa Templates Fillable Samples In to ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 15 printable form 5498 sa templates fillable samples in

Create this form in 5 minutes!

How to create an eSignature for the 15 printable form 5498 sa templates fillable samples in

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The best way to create an eSignature right from your smartphone

How to create an eSignature for a PDF on iOS

The best way to create an eSignature for a PDF on Android

People also ask

-

What is a sample 5498 sa and how is it used?

A sample 5498 sa is a tax form used to report contributions to an IRA account. It is typically issued by financial institutions to account holders to help them keep track of their contributions and deductions. Understanding how to properly fill out this sample can help ensure compliance with IRS requirements.

-

How can airSlate SignNow assist with completing a sample 5498 sa?

AirSlate SignNow provides tools for electronically signing and sending documents, making the process of completing a sample 5498 sa straightforward. Users can easily upload the form, fill it in online, and securely eSign it, ensuring it is processed quickly and efficiently.

-

Is airSlate SignNow cost-effective for managing forms like the sample 5498 sa?

Yes, airSlate SignNow offers a cost-effective solution for managing tax forms, including the sample 5498 sa. With flexible pricing plans tailored to different business sizes, you can optimize your document management without straining your budget, all while ensuring compliance and security.

-

What features does airSlate SignNow offer for handling a sample 5498 sa?

AirSlate SignNow includes various features such as document templates, unlimited eSignatures, and real-time tracking. These features streamline the completion and submission of documents like the sample 5498 sa, making the process more efficient and manageable.

-

Can I integrate airSlate SignNow with other software for managing the sample 5498 sa?

Absolutely! AirSlate SignNow integrates seamlessly with popular applications like Google Drive, Salesforce, and others. This means you can easily manage your documents and workflows related to the sample 5498 sa without switching between platforms.

-

How secure is the process of signing a sample 5498 sa with airSlate SignNow?

AirSlate SignNow prioritizes security, employing advanced encryption protocols and secure storage solutions. This ensures that documents like the sample 5498 sa are protected during transmission and storage, safeguarding sensitive financial information.

-

What are the benefits of using airSlate SignNow for the sample 5498 sa?

Using airSlate SignNow for the sample 5498 sa simplifies the document preparation process, saving time and reducing errors. Additionally, the platform allows for collaborative editing and easy sharing, enhancing team productivity while ensuring compliance.

Get more for 15 Printable Form 5498 sa Templates Fillable Samples In

- Request for waiver of dual compensation gsa form

- Fillable online request for waiver of dual pdffiller form

- Gsa 3698 employee requesting evacuation assistance form

- To office of congressional affairs form

- Gsa 3703 full time telework arrangement analysis tool form

- Telework ampamp flex schedules commuteorg form

- Official worksite for location based pay purposes opm form

- Project management and global sustainability pmi form

Find out other 15 Printable Form 5498 sa Templates Fillable Samples In

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online