Irs Notice 703 Fill and Sign Printable Template Online 2021

What is the IRS Notice 703?

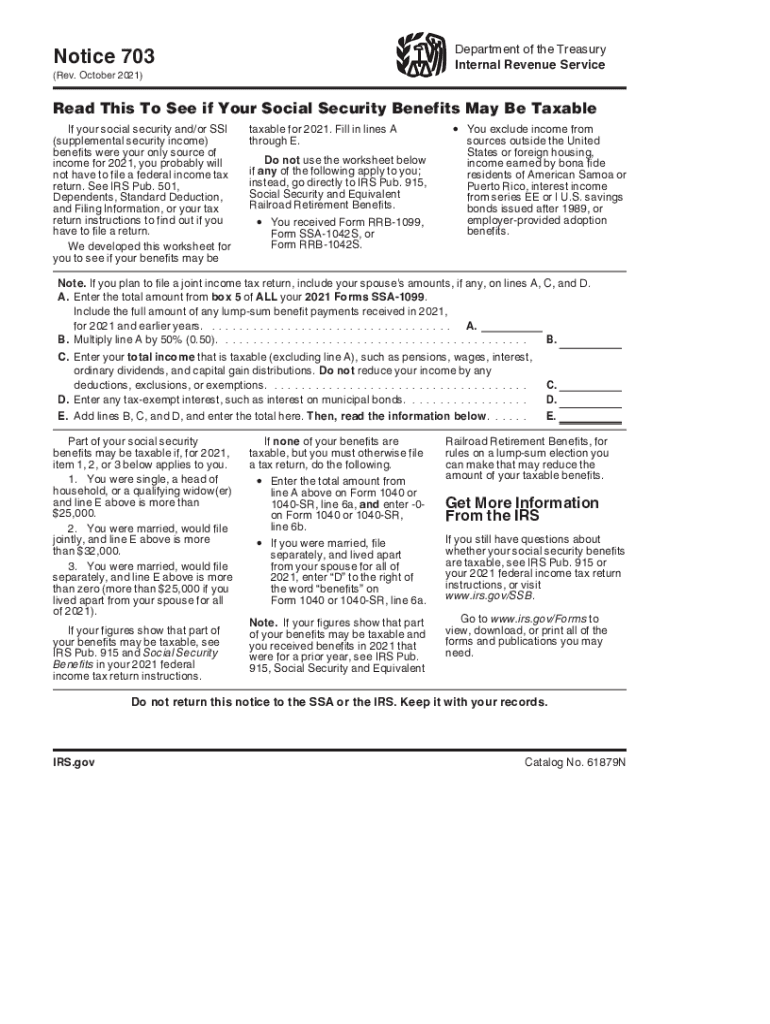

The IRS Notice 703 is a communication from the Internal Revenue Service that provides important information regarding tax matters. This notice may relate to issues such as unpaid taxes, discrepancies in reported income, or other tax-related concerns. Understanding the specifics of this notice is crucial for taxpayers to ensure compliance and address any potential issues promptly.

Steps to complete the IRS Notice 703

Completing the IRS Notice 703 involves several key steps to ensure accuracy and compliance. First, carefully read the notice to understand the information being requested. Next, gather all necessary documentation, such as tax returns and supporting records. Fill out the required sections of the notice, ensuring that all information is accurate and complete. Finally, review your completed notice before submission to avoid errors that could lead to further complications.

Legal use of the IRS Notice 703

The IRS Notice 703 serves a legal purpose in the context of tax compliance. When completed and submitted correctly, it can be used as an official record of communication between the taxpayer and the IRS. This notice may be referenced in future correspondence or legal matters, making it essential to adhere to the guidelines set forth by the IRS to ensure its validity.

How to obtain the IRS Notice 703

Obtaining the IRS Notice 703 can be done through various methods. Taxpayers may receive this notice directly from the IRS via mail if there are issues related to their tax filings. Additionally, it may be available for download from the IRS website or through tax preparation software that provides access to IRS forms and notices. Ensuring you have the correct version of the notice is important for accurate completion.

Filing Deadlines / Important Dates

Filing deadlines associated with the IRS Notice 703 can vary based on the specifics of the notice and the taxpayer's situation. It is essential to pay attention to the dates indicated on the notice itself. Missing these deadlines can result in penalties or further complications with the IRS. Keeping a calendar of important tax dates can help ensure compliance.

Examples of using the IRS Notice 703

Examples of situations where the IRS Notice 703 may be utilized include responding to an inquiry about unreported income or addressing discrepancies in tax filings. Taxpayers may also use this notice to clarify their tax status or resolve issues that could lead to penalties. Understanding these examples can help taxpayers recognize the importance of timely and accurate responses to the IRS.

Quick guide on how to complete irs notice 703 fill and sign printable template online

Effortlessly Prepare Irs Notice 703 Fill And Sign Printable Template Online on Any Device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed materials, allowing you to easily locate the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Manage Irs Notice 703 Fill And Sign Printable Template Online on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Easiest Way to Modify and Electronically Sign Irs Notice 703 Fill And Sign Printable Template Online

- Obtain Irs Notice 703 Fill And Sign Printable Template Online and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your updates.

- Select your preferred method of sending your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and electronically sign Irs Notice 703 Fill And Sign Printable Template Online and guarantee effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs notice 703 fill and sign printable template online

Create this form in 5 minutes!

How to create an eSignature for the irs notice 703 fill and sign printable template online

How to generate an electronic signature for your PDF file online

How to generate an electronic signature for your PDF file in Google Chrome

The way to make an e-signature for signing PDFs in Gmail

The best way to generate an electronic signature from your mobile device

How to make an electronic signature for a PDF file on iOS

The best way to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is the IRS Notice 703 and how does it affect my tax situation?

IRS Notice 703 is a communication from the IRS that notifies taxpayers about potential issues or actions required regarding their tax filings. Understanding this notice is crucial, as it may signal necessary corrective actions to avoid penalties. Responding promptly to IRS Notice 703 can help you resolve any issues with your tax returns effectively.

-

How can airSlate SignNow help me respond to IRS Notice 703?

airSlate SignNow provides a seamless platform for eSigning and sending essential documents, which is vital when responding to IRS Notice 703. You can quickly prepare the necessary paperwork, eSign it, and send it directly without any hassle. This helps ensure a timely response to the IRS and reduces the risk of further complications.

-

What are the features of airSlate SignNow that assist with IRS Notice 703?

airSlate SignNow offers features such as secure cloud storage, customizable templates, and electronic signatures that are incredibly useful when dealing with IRS Notice 703. These features allow you to streamline your document handling processes, ensuring you meet IRS requirements efficiently. Plus, the user-friendly interface simplifies your interactions with tax documents.

-

Is there a cost associated with using airSlate SignNow to handle IRS Notice 703?

Yes, airSlate SignNow offers flexible pricing plans that can suit your needs for managing documents related to IRS Notice 703. The service is designed to be cost-effective, meaning you can avoid hefty fees often associated with traditional legal services. Explore our pricing options to find a plan that fits your budget and document management needs.

-

Can airSlate SignNow integrate with my existing accounting software for IRS Notice 703?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, allowing you to handle IRS Notice 703 directly within your existing workflow. This integration helps streamline your processes, ensuring all documents related to your tax situation are organized and easily accessible. Connecting your accounts can facilitate straightforward communication regarding any IRS notices.

-

What benefits does airSlate SignNow provide when addressing IRS Notice 703?

Using airSlate SignNow offers multiple benefits when managing IRS Notice 703, including speed, efficiency, and security. The platform allows for rapid preparation and submission of documents, minimizing delays with the IRS. Plus, with secure eSigning, you can ensure that your submissions are protected and legally binding.

-

How secure is airSlate SignNow when dealing with sensitive documents like IRS Notice 703?

airSlate SignNow prioritizes security, ensuring that any documents related to IRS Notice 703 are encrypted and compliant with industry standards. Your sensitive information is safeguarded throughout the eSigning process, providing peace of mind. Regular audits and security updates further enhance the safety of your data.

Get more for Irs Notice 703 Fill And Sign Printable Template Online

- Notice of appearance 8th connecticut form

- Connecticut corporation form

- Connecticut corporation 497300931 form

- Connecticut pre incorporation agreement shareholders agreement and confidentiality agreement connecticut form

- Ct corporation business form

- Corporate records maintenance package for existing corporations connecticut form

- Connecticut llc form

- Ct llc search form

Find out other Irs Notice 703 Fill And Sign Printable Template Online

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile