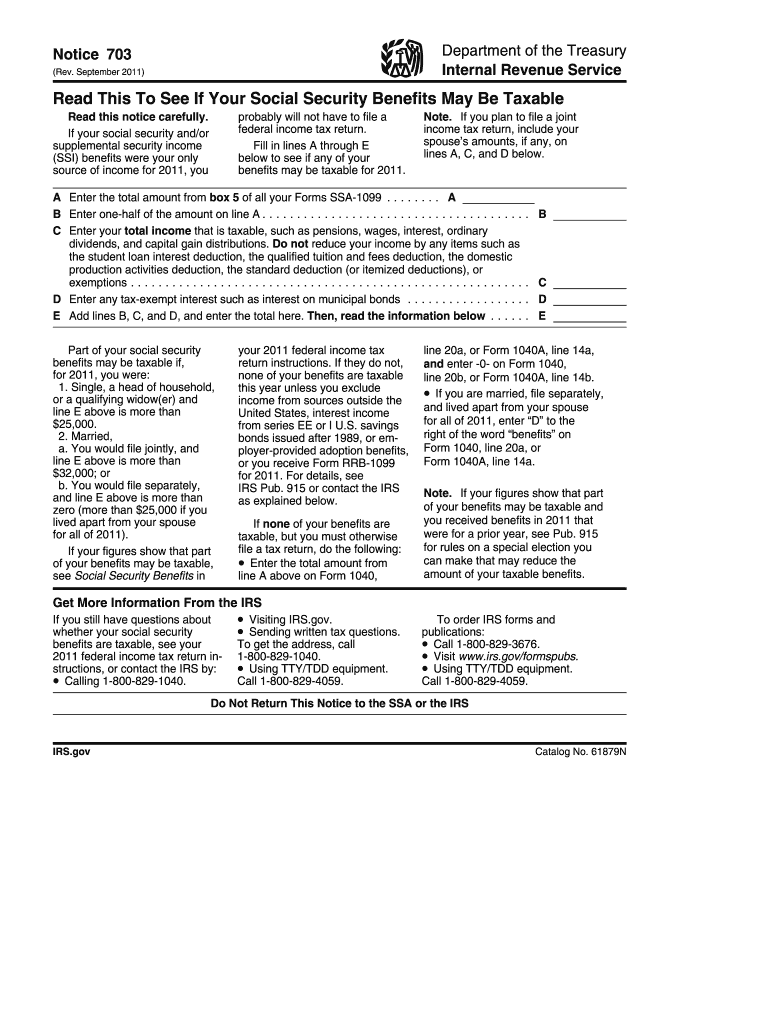

Irs Form 703 for 2011

What is the IRS Form 703 For

The IRS Form 703 is utilized for specific tax-related purposes, primarily focusing on the reporting of certain transactions or events that may affect a taxpayer's obligations. This form is particularly relevant for individuals and businesses that need to disclose information to the IRS regarding specific financial activities. Understanding the purpose of this form is crucial for ensuring compliance with tax regulations and avoiding potential penalties.

How to Use the IRS Form 703 For

Using the IRS Form 703 involves several steps to ensure accurate completion and submission. First, gather all necessary information related to the transactions or events that the form requires. This may include financial statements, transaction records, and other relevant documentation. Next, fill out the form carefully, ensuring that all fields are completed accurately. Once the form is filled out, review it for any errors before submitting it to the IRS. Proper use of this form helps maintain compliance and supports accurate tax reporting.

Steps to Complete the IRS Form 703 For

Completing the IRS Form 703 requires a systematic approach. Follow these steps:

- Gather necessary documentation, including financial records related to the transactions.

- Access the form through the IRS website or other official sources.

- Fill out the form, ensuring all required fields are completed accurately.

- Review the form for accuracy, checking for any mistakes or omissions.

- Submit the completed form to the IRS, either electronically or by mail, as per the guidelines.

Legal Use of the IRS Form 703 For

The legal use of the IRS Form 703 is essential for ensuring that all reported information is compliant with federal tax laws. The form must be filled out truthfully and accurately, as any discrepancies or false information can lead to penalties or legal consequences. It is important to understand the legal implications of the information reported on this form, as it can affect a taxpayer's standing with the IRS and may have financial repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 703 are critical to ensure compliance and avoid penalties. Generally, the form must be submitted by a specific date, which can vary based on the type of transaction or event being reported. It is important to stay informed about these deadlines and plan accordingly to ensure timely submission. Missing a deadline can result in fines or additional scrutiny from the IRS.

Form Submission Methods (Online / Mail / In-Person)

The IRS Form 703 can be submitted through various methods, depending on the preferences of the taxpayer and the requirements of the IRS. Options for submission include:

- Online submission through the IRS e-filing system, which is often the quickest method.

- Mailing a physical copy of the completed form to the appropriate IRS address.

- In-person submission at designated IRS offices, if applicable.

Choosing the right submission method can help ensure that the form is processed efficiently.

Key Elements of the IRS Form 703 For

The IRS Form 703 contains several key elements that must be understood for proper completion. These include:

- Personal information of the taxpayer, including name, address, and taxpayer identification number.

- Details of the transactions or events being reported, including dates, amounts, and descriptions.

- Signature and date, which validate the information provided on the form.

Familiarity with these elements is crucial for ensuring that the form is completed accurately and submitted correctly.

Quick guide on how to complete irs form 703 for 2011

Effortlessly Handle Irs Form 703 For on Any Device

Digital document management has become favored by both businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without any hold-ups. Manage Irs Form 703 For on any device using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The Easiest Way to Modify and eSign Irs Form 703 For Effortlessly

- Find Irs Form 703 For and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misfiled documents, cumbersome form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs within a few clicks from any device of your choosing. Modify and eSign Irs Form 703 For and ensure effective communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 703 for 2011

Create this form in 5 minutes!

How to create an eSignature for the irs form 703 for 2011

The way to create an electronic signature for a PDF online

The way to create an electronic signature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

How to make an eSignature right from your smartphone

The best way to create an eSignature for a PDF on iOS

How to make an eSignature for a PDF on Android

People also ask

-

What is IRS Form 703 for and how can I use it?

IRS Form 703 is used for reporting various tax-related information. With airSlate SignNow, you can easily eSign and send your completed IRS Form 703 for quick submission. Our platform simplifies the signing process, ensuring you meet all tax deadlines efficiently.

-

How does airSlate SignNow simplify the process of completing IRS Form 703 for businesses?

airSlate SignNow streamlines the completion of IRS Form 703 for businesses by providing an intuitive interface for document management. You can easily upload, fill out, and eSign the form, making compliance easier and faster. This efficient process helps reduce errors and saves valuable time.

-

What features does airSlate SignNow offer for managing IRS Form 703 for tax purposes?

airSlate SignNow offers features such as document templates, in-app signing, and secure cloud storage that enhance the management of IRS Form 703 for tax purposes. These features ensure your documents are organized, easily accessible, and securely stored. This makes it simple to retrieve and submit your forms whenever needed.

-

Is there a cost associated with using airSlate SignNow for IRS Form 703 for my business?

Yes, there is a cost associated with using airSlate SignNow for IRS Form 703, but we offer flexible pricing plans to suit different business needs. Our plans are designed to be cost-effective, providing great value considering the time and resources saved through our efficient eSigning solution. You can choose a plan that best fits your business requirements.

-

Can I integrate airSlate SignNow with other software for managing IRS Form 703 for my accounting needs?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and document management software, making it easier to manage IRS Form 703 for your accounting needs. This integration allows for smooth data transfer and enhances your workflow, ensuring you stay organized and compliant.

-

What are the benefits of using airSlate SignNow for IRS Form 703 for small businesses?

Using airSlate SignNow for IRS Form 703 offers numerous benefits for small businesses, including time savings, reduced paperwork, and improved accuracy. Our platform allows for quick electronic signing, which expedites the submission process. Additionally, the secure nature of our service ensures your sensitive information remains protected.

-

How can airSlate SignNow help ensure compliance when using IRS Form 703 for tax filings?

airSlate SignNow helps ensure compliance when using IRS Form 703 for tax filings by providing a secure and legally binding electronic signature solution. Our platform adheres to industry standards for security and compliance, giving you peace of mind that your signed documents are valid. This reduces the risk of errors and penalties associated with tax filings.

Get more for Irs Form 703 For

- 2020 form 5329 additional taxes on qualified plans including iras and other tax favored accounts

- 2020 instructions for form 8027 internal revenue service

- Form 8804 pdf internal revenue service

- Tut appilcation form for employment

- Tafe payment plan form

- Dd form 2752 nsep service agreement for scholarship and fellowship awards november 2014

- Adobe reader 8 or higher adobe support community form

- About the forms village settlements

Find out other Irs Form 703 For

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document