IRS Notice 703 Fill and Sign PrintableIRS Notice 703 the Social Security Income Tax FormIRS Notice 703 Fill and Sign PrintableIR 2022

What is the IRS Notice 703?

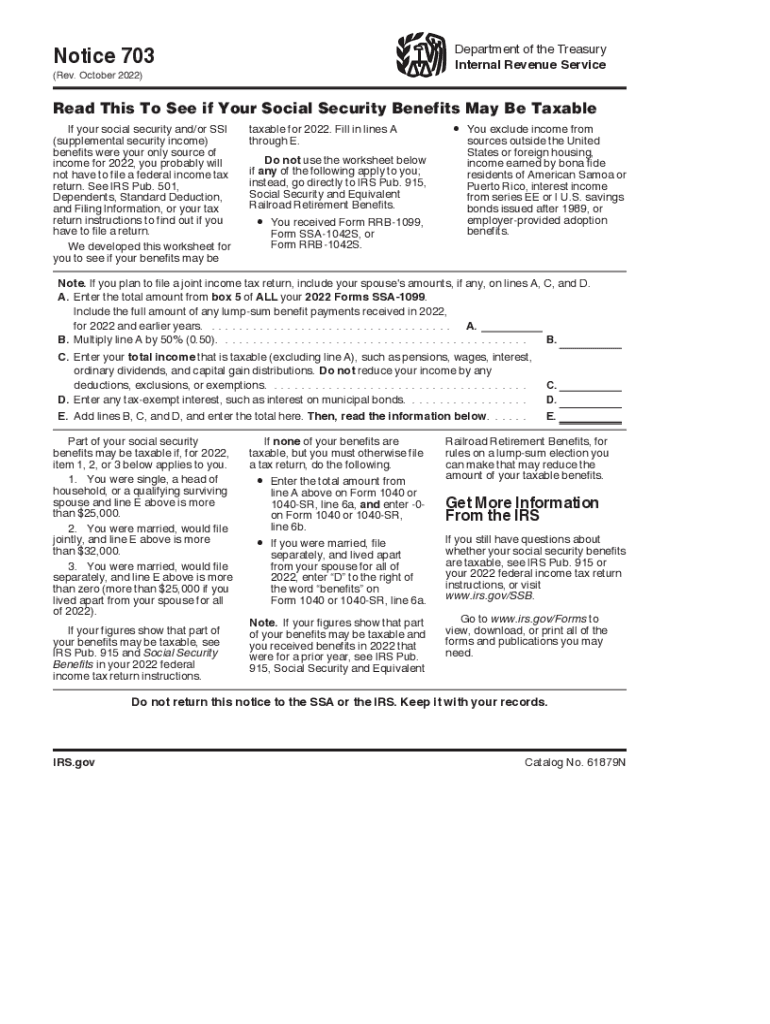

The IRS Notice 703 is a document issued by the Internal Revenue Service that relates to Social Security income tax matters. It serves as an important form for taxpayers who need to report their Social Security benefits accurately. Understanding this notice is crucial for ensuring compliance with tax regulations and for accurately calculating tax liabilities associated with Social Security income.

How to use the IRS Notice 703

Using the IRS Notice 703 involves several steps. First, you need to obtain the form, which can typically be found on the IRS website or through tax preparation software. Once you have the form, fill in the required information, including your Social Security benefits and any other relevant income details. After completing the form, you can sign it electronically using a trusted eSignature solution, ensuring that your submission is secure and legally binding.

Steps to complete the IRS Notice 703

Completing the IRS Notice 703 requires careful attention to detail. Here are the steps to follow:

- Gather necessary documents, including your Social Security statements and any other income records.

- Access the IRS Notice 703 form, either online or through tax software.

- Fill in your personal information, including your name, Social Security number, and the amounts of your Social Security benefits.

- Review the completed form for accuracy to avoid errors that could lead to penalties.

- Sign the form electronically using a secure eSignature platform to ensure compliance with legal standards.

- Submit the completed form to the IRS by the appropriate deadline.

Legal use of the IRS Notice 703

The IRS Notice 703 is legally binding when completed and signed according to IRS regulations. To ensure its legal validity, it is essential to use a reliable eSignature service that complies with the ESIGN Act and UETA. This guarantees that your electronic signature holds the same weight as a traditional handwritten signature, making the document acceptable for tax purposes.

Key elements of the IRS Notice 703

Several key elements must be included when filling out the IRS Notice 703 to ensure its validity:

- Personal Information: Accurate details about the taxpayer, including name and Social Security number.

- Income Reporting: Clear reporting of all Social Security benefits received during the tax year.

- Signature: A valid signature, either handwritten or electronic, to authenticate the document.

- Date of Submission: The date when the form is completed and submitted to the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Notice 703 are typically aligned with the overall tax filing deadlines. For most taxpayers, this means submitting the form by April 15 each year. However, if you are unable to meet this deadline, you may apply for an extension. It is important to stay informed about any changes to deadlines, especially in light of special circumstances that may affect tax filing.

Quick guide on how to complete irs notice 703 2021 2022 fill and sign printableirs notice 703 the social security income tax formirs notice 703 2021 2022 fill

Complete IRS Notice 703 Fill And Sign PrintableIRS Notice 703 The Social Security Income Tax FormIRS Notice 703 Fill And Sign PrintableIR seamlessly on any device

Digital document management has gained traction among companies and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can obtain the correct template and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage IRS Notice 703 Fill And Sign PrintableIRS Notice 703 The Social Security Income Tax FormIRS Notice 703 Fill And Sign PrintableIR on any system using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to modify and electronically sign IRS Notice 703 Fill And Sign PrintableIRS Notice 703 The Social Security Income Tax FormIRS Notice 703 Fill And Sign PrintableIR with ease

- Locate IRS Notice 703 Fill And Sign PrintableIRS Notice 703 The Social Security Income Tax FormIRS Notice 703 Fill And Sign PrintableIR and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or conceal sensitive information with tools specifically designed for that purpose provided by airSlate SignNow.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and click the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid files, arduous form searching, or mistakes that require printing out new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign IRS Notice 703 Fill And Sign PrintableIRS Notice 703 The Social Security Income Tax FormIRS Notice 703 Fill And Sign PrintableIR and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs notice 703 2021 2022 fill and sign printableirs notice 703 the social security income tax formirs notice 703 2021 2022 fill

Create this form in 5 minutes!

People also ask

-

What is an IRS Notice 703?

An IRS Notice 703 is a communication from the Internal Revenue Service indicating that a tax return has been selected for review. This notice often requests additional information or documentation to help clarify your tax situation. Understanding IRS Notice 703 is essential for maintaining compliance and avoiding further complications with your tax filings.

-

How can airSlate SignNow help in responding to an IRS Notice 703?

airSlate SignNow provides an efficient platform to send and eSign documents required in response to your IRS Notice 703. With our user-friendly interface, you can quickly create, sign, and share the necessary documents with tax professionals or the IRS. This streamlines the process and helps ensure your response is timely and accurate.

-

Is airSlate SignNow cost-effective for handling IRS notices like 703?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses dealing with IRS notices, including the IRS Notice 703. Our pricing plans are flexible and cater to various needs, ensuring you get value for your investment. You can manage your document flow efficiently without incurring excessive costs.

-

What features does airSlate SignNow offer for document management related to IRS Notice 703?

airSlate SignNow offers a suite of features tailored for effective document management, including templates, eSignature capabilities, and tracking options. When dealing with an IRS Notice 703, these features allow you to prepare required documents effectively and keep tabs on their status. This enhances your overall efficiency and compliance.

-

Can I integrate airSlate SignNow with other software for handling IRS notices?

Absolutely! airSlate SignNow supports integration with various CRM systems and cloud storage solutions, which can be beneficial when managing responses to IRS notices like the IRS Notice 703. This connectivity allows you to centralize your document handling and improve workflow, ensuring your team can respond quickly to IRS inquiries.

-

What benefits does airSlate SignNow provide for businesses dealing with IRS notices?

Using airSlate SignNow to handle IRS notices like Notice 703 offers several advantages, including increased efficiency, enhanced security, and improved collaboration. Our platform ensures your documents are safely stored and easily accessible, allowing for seamless communication with tax advisors and the IRS. This approach minimizes the stress associated with tax compliance.

-

How secure is airSlate SignNow for handling sensitive IRS communication?

airSlate SignNow prioritizes the security of all documents, including those related to IRS notices such as IRS Notice 703. We utilize advanced encryption and compliance with industry standards to protect your data and ensure confidentiality. This commitment to security helps you manage sensitive tax communication with peace of mind.

Get more for IRS Notice 703 Fill And Sign PrintableIRS Notice 703 The Social Security Income Tax FormIRS Notice 703 Fill And Sign PrintableIR

- Letter landlord demand form

- Letter tenant landlord template 497319210 form

- Letter tenant landlord repair 497319211 form

- New jersey tenant landlord form

- Tenant landlord demand form

- Letter from tenant to landlord with demand that landlord provide proper outdoor garbage receptacles new jersey form

- Letter from tenant to landlord about landlords failure to make repairs new jersey form

- Nj letter rent form

Find out other IRS Notice 703 Fill And Sign PrintableIRS Notice 703 The Social Security Income Tax FormIRS Notice 703 Fill And Sign PrintableIR

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free