N703 Department of the Treasury Internal Revenue Service 2020

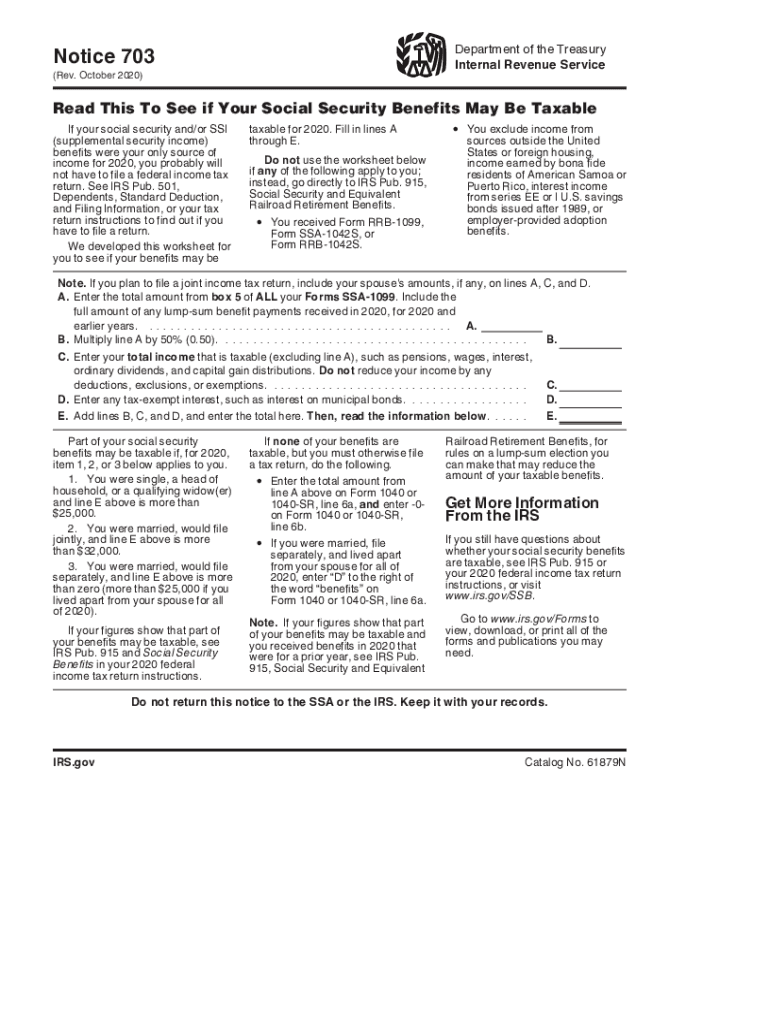

What is the IRS Notice 703?

The IRS Notice 703 is a communication from the Department of the Treasury Internal Revenue Service, primarily used to inform taxpayers about specific tax-related issues. It serves as a notification regarding potential discrepancies or requirements related to tax filings. Understanding this notice is crucial for ensuring compliance with IRS regulations and addressing any concerns promptly.

How to Use the IRS Notice 703

Utilizing the IRS Notice 703 involves carefully reviewing the information provided within the notice. Taxpayers should assess the details, such as the nature of the notification and any actions required. It is important to follow the instructions outlined in the notice to resolve any issues effectively. If necessary, consulting with a tax professional can provide additional guidance on how to proceed.

Steps to Complete the IRS Notice 703

Completing the IRS Notice 703 requires a systematic approach:

- Read the notice thoroughly to understand the specific requirements.

- Gather any necessary documentation that supports your case or response.

- Complete any forms or provide information as requested in the notice.

- Review your response for accuracy before submission.

- Submit the response by the deadline indicated in the notice.

Legal Use of the IRS Notice 703

The IRS Notice 703 is legally binding, meaning that the information and requirements stated must be adhered to by the taxpayer. Failure to comply with the notice can result in penalties or further action from the IRS. It is essential to treat this notice with the seriousness it deserves and respond appropriately to maintain compliance with tax laws.

Filing Deadlines / Important Dates

Each IRS Notice 703 will specify important dates relevant to the taxpayer's situation. Adhering to these deadlines is crucial to avoid penalties. Taxpayers should mark these dates on their calendars and ensure that all required actions are completed in a timely manner. Being proactive can help mitigate any potential issues with the IRS.

Required Documents

When responding to the IRS Notice 703, taxpayers may need to provide specific documents. These can include:

- Previous tax returns related to the notice.

- Supporting documentation for any claims or discrepancies.

- Correspondence with the IRS, if applicable.

Having these documents ready can facilitate a smoother response process.

Penalties for Non-Compliance

Ignoring the IRS Notice 703 can lead to various penalties, including fines or additional tax liabilities. The IRS may also take further action, such as audits or legal proceedings. It is vital for taxpayers to address the notice promptly to avoid these consequences and ensure compliance with tax obligations.

Quick guide on how to complete n703 department of the treasury internal revenue service

Effortlessly prepare N703 Department Of The Treasury Internal Revenue Service on any device

Online document management has become increasingly favored by businesses and individuals. It offers a perfect environmentally friendly substitute to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents rapidly without delays. Manage N703 Department Of The Treasury Internal Revenue Service on any device with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign N703 Department Of The Treasury Internal Revenue Service effortlessly

- Obtain N703 Department Of The Treasury Internal Revenue Service and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to preserve your changes.

- Choose your delivery method for the form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or mislaid documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign N703 Department Of The Treasury Internal Revenue Service and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct n703 department of the treasury internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the n703 department of the treasury internal revenue service

How to create an electronic signature for a PDF in the online mode

How to create an electronic signature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

How to create an eSignature right from your smart phone

How to create an eSignature for a PDF on iOS devices

How to create an eSignature for a PDF on Android OS

People also ask

-

What is the IRS Notice 703 for and why is it important?

The IRS Notice 703 for is a correspondence sent to taxpayers who may have discrepancies in their tax filings. Understanding this notice is crucial, as it can inform you about potential issues that could affect your tax return. By addressing the information in the notice promptly, you can avoid penalties and ensure compliance with IRS regulations.

-

How can airSlate SignNow help with IRS Notice 703 for document management?

airSlate SignNow offers a streamlined process for handling IRS Notice 703 for correspondence. You can easily eSign and share necessary documents securely, helping to ensure that any required responses to the IRS are submitted in a timely manner. This efficient approach reduces the risk of errors and enhances overall productivity.

-

What are the pricing options for airSlate SignNow to manage IRS notices?

AirSlate SignNow provides flexible pricing plans that cater to various business needs, whether you're an individual or part of a larger enterprise. Each plan includes features that facilitate the management of IRS documents like Notice 703 for. By choosing the right plan, you can effectively manage your tax correspondence without breaking the bank.

-

Does airSlate SignNow offer features specifically for IRS documentation?

Yes, airSlate SignNow includes features specifically designed to simplify the management of IRS documentation, including IRS Notice 703 for. Users can create templates, track document status, and securely store sensitive information. These features enhance organization and compliance, making tax-related processes more efficient.

-

Can I integrate airSlate SignNow with other accounting software for IRS notice management?

Absolutely! AirSlate SignNow offers integrations with popular accounting software that can help you manage IRS Notice 703 for better. Connecting your tools allows for seamless data transfer and improved collaboration, ensuring that all your tax-related information is easily accessible whenever needed.

-

What security measures does airSlate SignNow implement for IRS-related documents?

AirSlate SignNow prioritizes security, employing advanced encryption and authentication protocols to protect your IRS-related documents, including Notice 703 for. User permissions and audit trails ensure that your sensitive information is only accessible to authorized personnel, providing peace of mind during the eSigning process.

-

Is there customer support available for issues related to IRS Notice 703 for?

Yes, airSlate SignNow provides comprehensive customer support to assist users with any issues related to IRS Notice 703 for. Our support team is available to help you navigate any challenges and ensure that your document management processes flow smoothly. We are committed to your success and satisfaction.

Get more for N703 Department Of The Treasury Internal Revenue Service

- Fillable online general referral form to schedule 310

- Portable oxygen concentrator 30881 medical authorization form

- Truliant bank statement form

- Debt killer calendar form

- Fillable personal financial statement form

- Personal financial statement first community bank and trust form

- Software development partnership agreement form

- Event photography contract jimmy mcdonald photography form

Find out other N703 Department Of The Treasury Internal Revenue Service

- Can I Sign West Virginia Personal loan contract template

- How Do I Sign Hawaii Real estate sales contract template

- Sign Kentucky New hire forms Myself

- Sign Alabama New hire packet Online

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe