14157 from 2023-2026

What is the 14157 Form

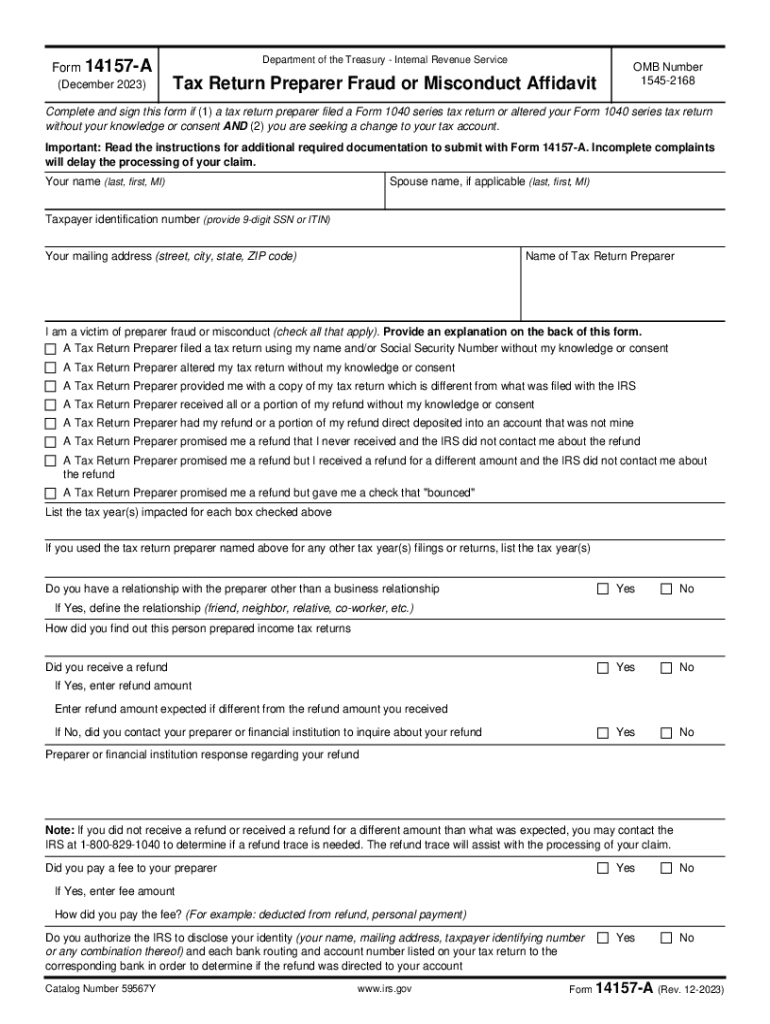

The 14157 form, officially known as the IRS Fraud Form, is utilized by taxpayers to report suspected misconduct related to tax preparers. This form is particularly important for individuals who believe they have been victims of fraudulent activities, such as identity theft or improper tax filing practices. By submitting this form, taxpayers can alert the IRS to potential fraud, ensuring that appropriate actions can be taken against dishonest preparers.

How to Use the 14157 Form

To effectively use the 14157 form, individuals should first gather all relevant information regarding the suspected fraudulent activity. This includes details about the tax preparer, such as their name and any associated business information. Once the form is filled out accurately, it should be submitted to the IRS, either online or by mail. It is crucial to keep a copy of the completed form for personal records and to track any follow-up communications from the IRS.

Steps to Complete the 14157 Form

Completing the 14157 form involves several key steps:

- Begin by downloading the form from the IRS website or accessing it through authorized channels.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide details about the tax preparer you are reporting, including their name, address, and any other identifying information.

- Describe the fraudulent activity you suspect, providing as much detail as possible to assist the IRS in their investigation.

- Review the form for accuracy before submitting it to ensure all information is correct.

Legal Use of the 14157 Form

The 14157 form serves a critical legal function by enabling taxpayers to report misconduct in compliance with IRS guidelines. By using this form, individuals can help protect themselves and others from tax fraud. It is important to understand that submitting false information on this form can lead to legal consequences. Therefore, it should only be used to report genuine concerns regarding tax preparer misconduct.

IRS Guidelines

The IRS provides specific guidelines for the use of the 14157 form. Taxpayers are encouraged to report any suspected fraud as soon as possible to facilitate timely investigations. The IRS emphasizes the importance of providing detailed and accurate information on the form to enhance the effectiveness of their review process. Additionally, individuals should be aware of their rights and responsibilities when reporting fraud, ensuring that they follow the proper procedures as outlined by the IRS.

Form Submission Methods

The 14157 form can be submitted to the IRS through various methods. Taxpayers have the option to file the form online via the IRS website, which may expedite processing times. Alternatively, the form can be printed and mailed to the appropriate IRS address, as specified in the form instructions. In some cases, individuals may also choose to deliver the form in person at designated IRS offices. Regardless of the submission method, it is essential to retain a copy for personal records.

Quick guide on how to complete 14157 from

Effortlessly Prepare 14157 From on Any Device

Managing documents online has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and electronically sign your documents promptly without any delays. Manage 14157 From on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Modify and Electronically Sign 14157 From with Ease

- Obtain 14157 From and then click Get Form to begin.

- Utilize the tools at your disposal to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and then click the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, exhausting form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign 14157 From to guarantee outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 14157 from

Create this form in 5 minutes!

How to create an eSignature for the 14157 from

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRS fraud form, and why do I need it?

The IRS fraud form is a crucial document used to report suspected tax fraud or economic crimes. Filing this form can help you alert the IRS to fraudulent activities and protect your financial interests. Understanding how to use the IRS fraud form effectively is vital for safeguarding your tax information.

-

How can airSlate SignNow help me with the IRS fraud form?

airSlate SignNow offers a seamless way to complete and eSign the IRS fraud form digitally. Our platform ensures that your documents are secure, accessible, and can be sent quickly to the appropriate authorities. Using airSlate SignNow simplifies the process, reducing the complexities involved in filing the IRS fraud form.

-

Is there a cost associated with using airSlate SignNow for IRS fraud form filings?

Yes, airSlate SignNow provides cost-effective plans that suit various business needs. We offer different pricing tiers, ensuring that our solutions are budget-friendly while helping you with any IRS fraud form requirements. Explore our subscription options to find the best fit for your document signing needs.

-

What features does airSlate SignNow offer for completing the IRS fraud form?

airSlate SignNow includes key features such as advanced eSignature capabilities, document templates, and streamlined workflows. These features are designed to enhance your efficiency when completing the IRS fraud form and ensure compliance with federal regulations. Our user-friendly interface makes the entire process straightforward and efficient.

-

Can I track the status of my IRS fraud form submission with airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking features that allow you to monitor the status of your IRS fraud form submissions. You'll receive notifications and updates, ensuring you stay informed throughout the submission process. This transparency helps you feel confident in your filing.

-

Does airSlate SignNow integrate with other tools for IRS fraud form management?

Yes, airSlate SignNow offers integrations with various software tools to streamline IRS fraud form management. By connecting with CRM systems, cloud storage solutions, and more, you can simplify your workflow and improve overall efficiency. Our integrations help ensure your documents are handled seamlessly.

-

Is it easy to use airSlate SignNow for someone unfamiliar with the IRS fraud form?

Definitely! airSlate SignNow is designed to be user-friendly, even for those unfamiliar with the IRS fraud form. Our step-by-step guidance and helpful resources make it easy to navigate the process and ensure accurate completion. You don't need to be an expert to use our platform effectively.

Get more for 14157 From

- For use with district court criminal rule 5 209 form

- Rule 7 206 arrest warrants nm r crim p metro casetext form

- For use with district court rule 5 211 form

- For use with district court rule 5 301 form

- How to handle a bench warrant or failure to appear in new form

- For use with district court rule 5 511 form

- Rule 5 401 pretrial release nm r crim p dist ct 5 form

- Fillable online for use with district court rule 5 401 nmra form

Find out other 14157 From

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors