Irs 14157 a Form 2018

What is the IRS 14157 A Form

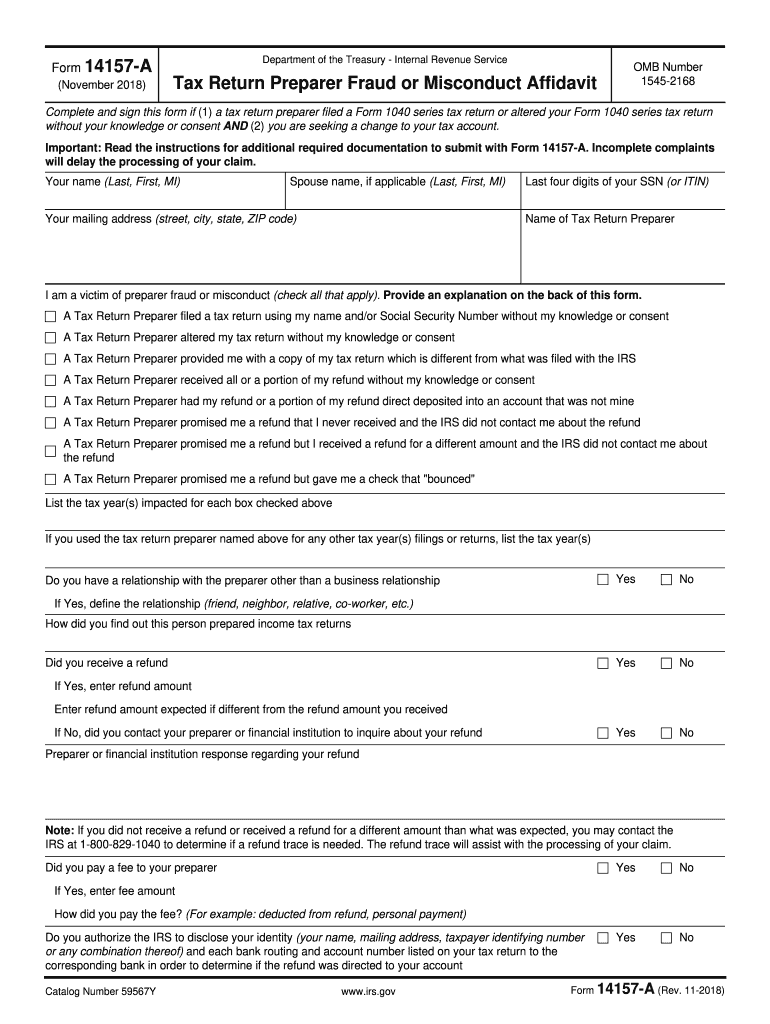

The IRS Form 14157 A is a document used to report suspected misconduct by tax preparers. This form is essential for taxpayers who believe their preparer has engaged in fraudulent activities, including filing false returns or misrepresenting information. By submitting this form, individuals can help the IRS investigate and take appropriate action against unethical practices in tax preparation. The form is part of the IRS's efforts to maintain integrity in the tax system and protect taxpayers from potential fraud.

How to Use the IRS 14157 A Form

Using the IRS Form 14157 A involves several steps to ensure that your report is complete and accurate. First, gather all relevant information regarding the misconduct you are reporting. This includes details about the tax preparer, specific actions that raised your concerns, and any supporting documentation. Next, fill out the form thoroughly, providing as much detail as possible. Once completed, submit the form to the IRS using the appropriate submission method, which can be online or by mail. It is crucial to keep a copy of the submitted form for your records.

Steps to Complete the IRS 14157 A Form

Completing the IRS Form 14157 A requires careful attention to detail. Follow these steps:

- Begin by entering your personal information, including your name, address, and contact details.

- Provide information about the tax preparer, including their name, business name, and address.

- Describe the specific misconduct you are reporting, detailing any fraudulent actions or misrepresentations.

- Include any relevant documentation that supports your claims, such as copies of tax returns or correspondence.

- Review the completed form for accuracy and completeness before submission.

Legal Use of the IRS 14157 A Form

The IRS Form 14157 A is legally recognized as a means to report tax preparer misconduct. When used appropriately, it provides a structured way for taxpayers to communicate their concerns to the IRS. It is essential that the information provided is truthful and accurate, as submitting false information could lead to legal repercussions. The IRS uses the data collected from this form to investigate potential fraud and take necessary actions against violators, thus contributing to the integrity of the tax system.

Form Submission Methods

Taxpayers have multiple options for submitting the IRS Form 14157 A. The primary methods include:

- Online Submission: If available, submitting the form electronically through the IRS website can expedite processing.

- Mail: You can print the completed form and send it via postal mail to the designated IRS address.

- In-Person: In some cases, you may choose to deliver the form in person at your local IRS office.

It is advisable to check the IRS website for the most current submission guidelines and addresses.

Required Documents

When filing the IRS Form 14157 A, certain documents may be required to support your claims. These documents can include:

- Copies of tax returns prepared by the tax preparer in question.

- Correspondence between you and the tax preparer.

- Any other documents that substantiate your allegations of misconduct.

Providing thorough documentation can enhance the credibility of your report and assist the IRS in their investigation.

Quick guide on how to complete irs 14157 a 2018 2019 form

Discover the simplest method to complete and authorize your Irs 14157 A Form

Are you still spending time preparing your official documents on paper instead of managing them online? airSlate SignNow offers a superior way to complete and approve your Irs 14157 A Form and associated forms for public services. Our advanced eSignature platform provides you with all the tools necessary to handle paperwork efficiently and in compliance with legal standards - robust PDF editing, managing, securing, signing, and sharing capabilities all available within an easy-to-use interface.

Only a few steps are needed to complete and authorize your Irs 14157 A Form:

- Upload the editable template to the editor using the Get Form button.

- Review the information required in your Irs 14157 A Form.

- Move through the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to complete the fields with your information.

- Update the content with Text boxes or Images from the toolbar above.

- Emphasize what is important or Redact fields that are no longer relevant.

- Select Sign to create a legally valid eSignature using any method you prefer.

- Insert the Date next to your signature and finalize your task with the Done button.

Store your completed Irs 14157 A Form in the Documents folder within your account, download it, or send it to your preferred cloud storage. Our platform also allows for convenient file sharing. There’s no need to print out your documents when sending them to the relevant public office - do it via email, fax, or by requesting USPS “snail mail” delivery from your profile. Give it a try now!

Create this form in 5 minutes or less

Find and fill out the correct irs 14157 a 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

How can I fill out an IRS form 8379?

Form 8379, the Injured Spouse declaration, is used to ensure that a spouse’s share of a refund from a joint tax return is not used by the IRS as an offset to pay a tax obligation of the other spouse.Before you file this, make sure that you know the difference between this and the Innocent Spouse declaration, Form 8857. You use Form 8379 when your spouse owes money for a legally enforeceable tax debt (such as a student loan which is in default) for which you are not jointly liable. You use Form 8857 when you want to be released from tax liability for an understatement of tax that resulted from actions taken by your spouse of which you had no knowledge, and had no reason to know.As the other answers have specified, you follow the Instructions for Form 8379 (11/2016) on the IRS Web site to actually fill it out.

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

Create this form in 5 minutes!

How to create an eSignature for the irs 14157 a 2018 2019 form

How to create an electronic signature for your Irs 14157 A 2018 2019 Form online

How to create an electronic signature for your Irs 14157 A 2018 2019 Form in Google Chrome

How to make an electronic signature for signing the Irs 14157 A 2018 2019 Form in Gmail

How to create an electronic signature for the Irs 14157 A 2018 2019 Form from your smart phone

How to make an electronic signature for the Irs 14157 A 2018 2019 Form on iOS

How to create an electronic signature for the Irs 14157 A 2018 2019 Form on Android devices

People also ask

-

What is the Irs 14157 A Form and how can airSlate SignNow help?

The Irs 14157 A Form is a document used by the IRS for reporting tax-related issues, specifically regarding tax preparer misconduct. airSlate SignNow streamlines the process of completing and submitting such forms by providing a user-friendly platform for eSigning and sending documents securely.

-

How does airSlate SignNow ensure the security of the Irs 14157 A Form?

Security is a top priority at airSlate SignNow. We provide advanced security measures, including encryption and secure cloud storage, to protect your Irs 14157 A Form and other sensitive documents from unauthorized access.

-

Is airSlate SignNow affordable for small businesses needing to file the Irs 14157 A Form?

Yes, airSlate SignNow offers cost-effective pricing plans that cater to businesses of all sizes, including small businesses. This makes it easy to manage your document needs, such as filing the Irs 14157 A Form, without breaking the bank.

-

Can I integrate airSlate SignNow with other software for managing the Irs 14157 A Form?

Absolutely! airSlate SignNow offers seamless integrations with various software tools, allowing you to manage your Irs 14157 A Form alongside your other business applications efficiently. Popular integrations include CRM systems and accounting software.

-

What features does airSlate SignNow offer for handling the Irs 14157 A Form?

airSlate SignNow provides a range of features designed to simplify the handling of the Irs 14157 A Form, including customizable templates, real-time tracking, and automated reminder notifications. These tools enhance your document workflow and ensure timely submissions.

-

How can airSlate SignNow improve my workflow for filing the Irs 14157 A Form?

Using airSlate SignNow can signNowly streamline your workflow for filing the Irs 14157 A Form. Our platform allows for quick document preparation, easy eSigning, and fast delivery, which all contribute to more efficient processing and fewer delays.

-

What customer support options are available for users of the Irs 14157 A Form on airSlate SignNow?

airSlate SignNow offers comprehensive customer support to assist users with the Irs 14157 A Form and any other inquiries. Our support team is available via live chat, email, and phone to ensure that your questions are answered promptly.

Get more for Irs 14157 A Form

- It is with regret that i inform you that you are being laid off from your position as

- Notice of bcommencementb city of delray beach form

- Printable hipaa quiz form

- Bof 116 form

- Background data form minnesota historical society mnhs

- Vital statics form

- Entyvio patient assistance program patient assistance program form

- Stocking agreement template 787747900 form

Find out other Irs 14157 A Form

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF