Tax Tables 2016

Understanding the Tax Tables

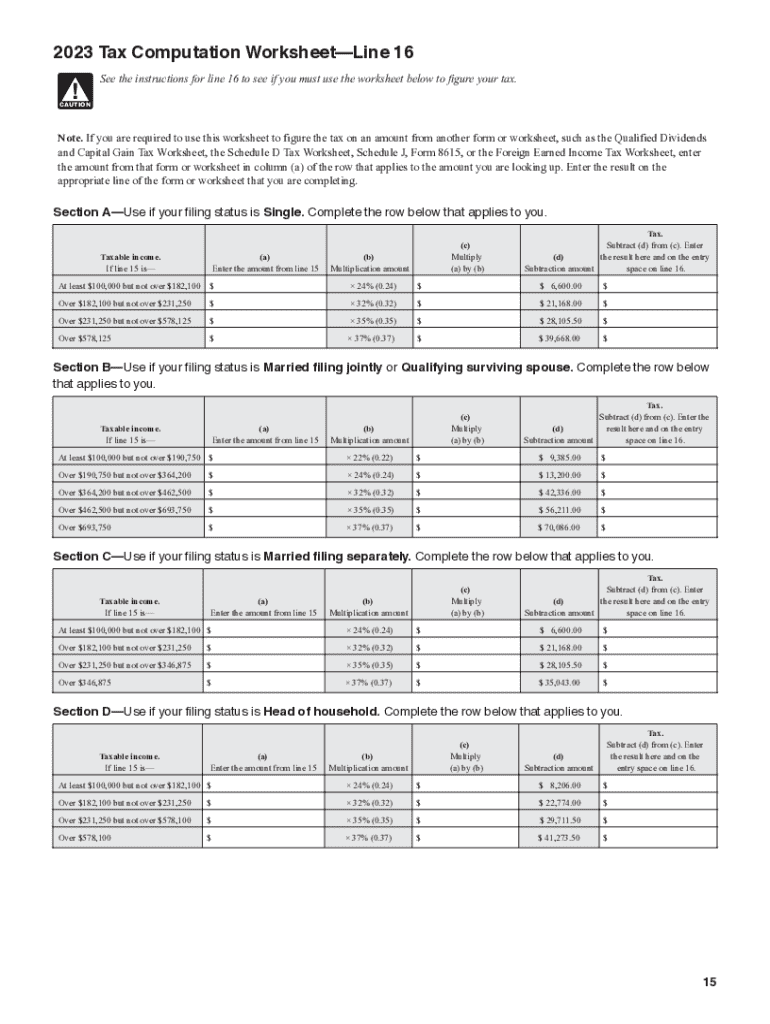

The tax tables are essential tools used to determine the amount of federal income tax owed based on taxable income. These tables provide a structured format that simplifies the process of calculating tax liabilities for individuals and businesses. The IRS publishes these tables annually, reflecting changes in tax laws and rates, ensuring taxpayers have the most accurate information available for their filings.

How to Use the Tax Tables

To effectively utilize the tax tables, taxpayers should first identify their filing status, which can significantly impact the tax calculation. The tables are organized by income brackets, allowing users to locate their taxable income and corresponding tax amount easily. For example, if a single filer has a taxable income of $50,000, they would find this figure in the appropriate section of the table to determine their tax liability. It is crucial to ensure that all income sources are accurately reported to reflect the correct taxable income.

Obtaining the Tax Tables

The IRS provides tax tables in various formats, including downloadable PDFs on their official website. Taxpayers can also access these tables through tax preparation software, which often integrates the latest tax tables for easy calculations. Additionally, many financial institutions and tax professionals offer printed copies and resources to help individuals understand their tax obligations.

Key Elements of the Tax Tables

Key elements of the tax tables include the income brackets, tax rates, and filing statuses. Each bracket corresponds to a specific range of income, with associated tax rates that increase progressively. Understanding these elements is vital for accurately calculating tax liabilities and ensuring compliance with federal tax laws. Taxpayers should also be aware of any credits or deductions that may apply to their situation, as these can affect the final tax amount owed.

IRS Guidelines for Using the Tax Tables

The IRS provides clear guidelines for using the tax tables, emphasizing the importance of accurate reporting of income and deductions. Taxpayers should refer to the IRS Publication 17, which outlines the rules for determining taxable income and how to apply the tax tables effectively. Following these guidelines helps prevent errors that could lead to penalties or audits.

Filing Deadlines and Important Dates

Filing deadlines are critical for tax compliance. Typically, individual tax returns are due on April 15 each year, unless this date falls on a weekend or holiday, in which case the deadline may be extended. Taxpayers should also be aware of any extensions available and the implications of late filing, which can include penalties and interest on unpaid taxes. Keeping track of these dates ensures that individuals meet their obligations without incurring unnecessary costs.

Quick guide on how to complete tax tables

Effortlessly Prepare Tax Tables on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a perfect environmentally-friendly substitute for conventional printed and signed documents, allowing you to locate the right form and securely preserve it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without any delays. Manage Tax Tables on any device using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

How to Modify and Electronically Sign Tax Tables with Ease

- Find Tax Tables and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive details with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature using the Sign feature, which takes just moments and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your updates.

- Select how you wish to send your form—via email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, and mistakes that require printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Tax Tables to ensure outstanding communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax tables

Create this form in 5 minutes!

How to create an eSignature for the tax tables

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how can it help me?

airSlate SignNow is a user-friendly solution designed for sending and eSigning documents efficiently. With its cost-effective features, businesses can streamline their document management processes and save time. This is particularly important when considering factors like 'how much is the standard deduction' on tax documents.

-

How much is the standard deduction this year?

The standard deduction amount can vary based on your filing status and the current tax year. It’s crucial to check the IRS guidelines for the latest figures. Understanding 'how much is the standard deduction' helps businesses ensure the accuracy of their financial documentation.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers several pricing plans designed to suit different business sizes and needs. Each plan provides various features aimed at enhancing your document signing experience. You can explore the options to find out how much is the standard deduction included in your overall cost of services.

-

Can airSlate SignNow integrate with other software?

Yes, airSlate SignNow seamlessly integrates with a variety of software such as CRM systems, document management tools, and more. This flexibility ensures that you can manage documents efficiently while considering aspects like how much is the standard deduction in your filings.

-

Is airSlate SignNow secure for eSigning documents?

Absolutely! airSlate SignNow prioritizes security by using industry-standard encryption and authentication processes. Knowing that your documents are secure can provide peace of mind when dealing with sensitive information, such as understanding how much is the standard deduction on your tax return.

-

What are the key benefits of using airSlate SignNow?

Some of the main benefits include increased efficiency, reduced costs, and simplified document tracking. These features allow businesses to focus on what matters most while ensuring compliance, especially when considering financial aspects like how much is the standard deduction.

-

Does airSlate SignNow offer a free trial?

Yes, airSlate SignNow provides a free trial for prospective users to explore its features. This allows you to determine how well the platform fits your needs before making a financial commitment. It's a great way to see how the standard deduction fits into your document signing process.

Get more for Tax Tables

Find out other Tax Tables

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template