Form 8453 EX Rev December Excise Tax Declaration for an IRS E File Return

Understanding Form 8453 EX Rev December Excise Tax Declaration

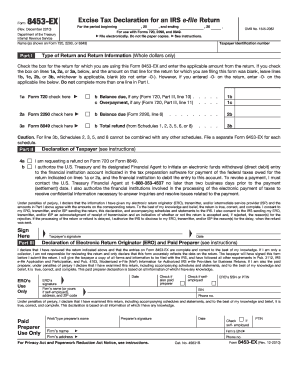

Form 8453 EX Rev December is a crucial document used for the Excise Tax Declaration in conjunction with an IRS e-file return. This form serves as a declaration for excise taxes imposed on certain goods and services, ensuring compliance with federal tax regulations. It is essential for businesses and individuals who must report excise taxes, providing the IRS with necessary information about the tax liabilities associated with specific transactions.

Steps to Complete Form 8453 EX Rev December

Completing Form 8453 EX Rev December involves several key steps to ensure accuracy and compliance. Begin by gathering all relevant information regarding your excise tax obligations. This includes details about the goods or services subject to excise tax, as well as any applicable exemptions. Next, fill out the form by entering your personal or business information, including your name, address, and taxpayer identification number. Ensure that you provide accurate figures for the excise tax amounts. Finally, review the completed form for any errors before submitting it as part of your e-file return.

Obtaining Form 8453 EX Rev December

Form 8453 EX Rev December can be obtained directly from the IRS website or through tax preparation software that supports e-filing. The form is available in a downloadable PDF format, which can be printed and filled out manually if needed. For those using tax software, the form is typically integrated into the e-filing process, allowing for seamless completion and submission.

Key Elements of Form 8453 EX Rev December

Form 8453 EX Rev December contains several key elements that are vital for accurate reporting. These include fields for taxpayer identification, details of the excise tax being reported, and any relevant deductions or credits. Additionally, the form requires a signature to validate the information provided, affirming that the taxpayer is responsible for the accuracy of the data submitted. Understanding these elements is crucial for ensuring compliance and avoiding potential penalties.

Legal Use of Form 8453 EX Rev December

The legal use of Form 8453 EX Rev December is primarily for reporting excise taxes to the IRS as part of an e-file return. This form is legally binding, meaning that the information provided must be accurate and truthful. Misrepresentation or errors can lead to penalties, including fines or additional taxes owed. It is essential for taxpayers to understand their obligations when using this form to avoid legal complications.

IRS Guidelines for Form 8453 EX Rev December

The IRS provides specific guidelines for the completion and submission of Form 8453 EX Rev December. These guidelines outline the necessary information required, the acceptable methods of submission, and the deadlines for filing. Following these guidelines is critical for ensuring that the form is processed correctly and that the taxpayer remains in compliance with federal tax laws. Taxpayers should consult the IRS website or a tax professional for the most current information and updates regarding these guidelines.

Quick guide on how to complete form 8453 ex rev december excise tax declaration for an irs e file return

Effortlessly Prepare [SKS] on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers a perfect environmentally friendly option compared to traditional printed and signed documents, allowing you to obtain the right format and securely store it online. airSlate SignNow provides all the necessary tools to swiftly create, modify, and electronically sign your documents without delays. Handle [SKS] on any device using the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

The Easiest Way to Modify and Electronically Sign [SKS] Seamlessly

- Find [SKS], then click Get Form to begin.

- Utilize the tools available to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive information with the specialized tools provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and has the same legal validity as a conventional handwritten signature.

- Review all the details, then click on the Done button to save your changes.

- Choose how you would like to submit your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and electronically sign [SKS] and ensure outstanding communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8453 EX Rev December Excise Tax Declaration For An IRS E file Return

Create this form in 5 minutes!

How to create an eSignature for the form 8453 ex rev december excise tax declaration for an irs e file return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8453 EX Rev December Excise Tax Declaration For An IRS E file Return?

Form 8453 EX Rev December Excise Tax Declaration For An IRS E file Return is a crucial document used to declare excise taxes when filing electronically with the IRS. It helps ensure compliance with tax regulations and streamlines the e-filing process. Properly completing this form can save time and reduce errors in your tax submissions.

-

How can airSlate SignNow assist in the completion of Form 8453 EX Rev December?

airSlate SignNow offers a user-friendly platform that simplifies the signing and submission process for Form 8453 EX Rev December Excise Tax Declaration For An IRS E file Return. With our solution, users can easily fill out the form electronically, add necessary signatures, and securely send it to the IRS in a matter of minutes. This reduces the hassle of traditional paper filings.

-

What are the pricing plans for using airSlate SignNow to manage Form 8453 EX Rev December?

airSlate SignNow provides flexible pricing plans that cater to various business needs, starting with a free trial. Our plans are cost-effective and allow users to utilize the features necessary for managing Form 8453 EX Rev December Excise Tax Declaration For An IRS E file Return without breaking the bank. Check our website for detailed pricing information.

-

What features does airSlate SignNow offer for Form 8453 EX Rev December?

airSlate SignNow includes features such as electronic signatures, document templates, and cloud storage, specifically designed to facilitate the handling of Form 8453 EX Rev December Excise Tax Declaration For An IRS E file Return. With our innovative tools, users can automate workflows, ensuring all necessary parties can review and sign the document efficiently.

-

How does airSlate SignNow ensure the security of my Form 8453 EX Rev December?

The security of your information is a top priority for airSlate SignNow. We implement industry-leading encryption protocols and compliance measures to protect your Form 8453 EX Rev December Excise Tax Declaration For An IRS E file Return during transmission and storage. Your data is secure, allowing you to eSign with confidence.

-

Can I integrate airSlate SignNow with other software for filing Form 8453 EX Rev December?

Yes, airSlate SignNow supports integrations with various software applications, making it easy to incorporate your workflow for managing Form 8453 EX Rev December Excise Tax Declaration For An IRS E file Return. Whether you're using accounting software, CRMs, or document storage systems, our platform can streamline your processes.

-

What benefits can I expect from using airSlate SignNow for Form 8453 EX Rev December?

Using airSlate SignNow for your Form 8453 EX Rev December Excise Tax Declaration For An IRS E file Return comes with numerous benefits, including increased efficiency, reduced processing time, and improved accuracy of your tax filings. Our platform enables seamless collaboration among team members, ensuring that all necessary steps are completed correctly and promptly.

Get more for Form 8453 EX Rev December Excise Tax Declaration For An IRS E file Return

- Sawyer trust form

- Elevated gas pressure request texas gas service form

- Interpretation of infrared spectra a practical approach form

- Home contents inventory worksheet nycm com form

- Agrat bat mahlat sigil form

- Prayers of the faithful examples form

- Gregs post form

- Port harcourt electricity distribution company phed form

Find out other Form 8453 EX Rev December Excise Tax Declaration For An IRS E file Return

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word