Instruction 943 X Rev March Instructions for Form 943 X, Adjusted Employer's Annual Federal Tax Return for Agricultural Emp

Understanding Instruction 943 X Rev March

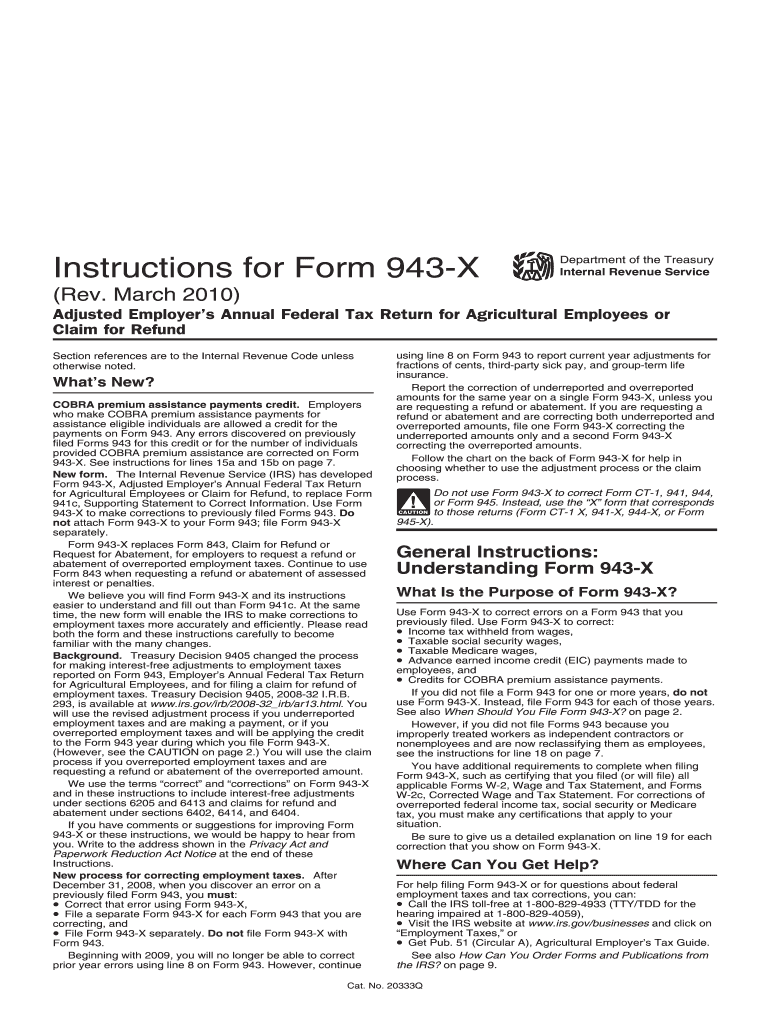

The Instruction 943 X Rev March provides essential guidelines for completing Form 943 X, which is the Adjusted Employer's Annual Federal Tax Return for Agricultural Employees or Claim for Refund. This form is specifically designed for agricultural employers who need to correct errors on previously filed Form 943 or claim a refund for overpaid taxes. Understanding this instruction is crucial for ensuring compliance with IRS regulations and accurately reporting tax obligations.

Steps to Complete Form 943 X

Completing Form 943 X involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including previous tax returns and relevant payroll records. Next, carefully review the instructions provided in the form to understand the specific adjustments needed. Fill out the form, ensuring that all information is accurate and complete. Finally, submit the form to the IRS by the specified deadline, either electronically or by mail, depending on your preference and the requirements outlined in the instructions.

Key Elements of Form 943 X

Form 943 X includes several critical components that must be addressed. These elements typically involve reporting the correct amounts of wages paid, taxes withheld, and any adjustments needed due to errors in previous filings. It is important to provide detailed explanations for each adjustment made, as this will help the IRS process your form efficiently. Additionally, ensure that all identifying information, such as the employer's name and identification number, is accurate to avoid delays.

Filing Deadlines for Form 943 X

Filing deadlines for Form 943 X are crucial to avoid penalties and interest on unpaid taxes. Generally, the form must be filed within three years of the original due date of the Form 943 that is being amended. It is important to keep track of these deadlines and submit your form in a timely manner. The IRS may also have specific deadlines for claiming refunds, so reviewing the latest guidelines is essential.

Legal Use of Form 943 X

The legal use of Form 943 X is primarily for correcting errors on previously submitted Forms 943 or for claiming refunds for overpaid taxes. Employers must ensure that they are using this form in accordance with IRS regulations to avoid potential legal issues. Proper documentation and adherence to the instructions are necessary to support any claims made on the form, particularly in the event of an audit.

Obtaining Form 943 X

Form 943 X can be obtained directly from the IRS website or through other authorized channels. It is important to ensure that you are using the most current version of the form to comply with IRS requirements. Additionally, employers may also find printed copies available at local IRS offices or through tax professionals who provide services related to agricultural employment.

Examples of Using Form 943 X

Examples of using Form 943 X include situations where an employer realizes that they reported incorrect wages or withheld taxes inaccurately on their original Form 943. For instance, if an employer discovers that they over-reported employee wages, they can use Form 943 X to correct this error and claim a refund for the excess taxes paid. Such adjustments are essential for maintaining accurate tax records and ensuring compliance with federal tax laws.

Quick guide on how to complete instruction 943 x rev march instructions for form 943 x adjusted employers annual federal tax return for agricultural employees

Complete [SKS] with ease on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to obtain the necessary forms and securely store them online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without any delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign [SKS] effortlessly

- Obtain [SKS] and hit Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information and press the Done button to save your changes.

- Choose how you prefer to send your form, via email, text message (SMS), or a shareable link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, laborious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you choose. Modify and eSign [SKS] while ensuring seamless communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Instruction 943 X Rev March Instructions For Form 943 X, Adjusted Employer's Annual Federal Tax Return For Agricultural Emp

Create this form in 5 minutes!

How to create an eSignature for the instruction 943 x rev march instructions for form 943 x adjusted employers annual federal tax return for agricultural employees

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 'Instruction 943 X Rev March Instructions For Form 943 X'?

The 'Instruction 943 X Rev March Instructions For Form 943 X' outlines the procedures for adjusting an employer's annual federal tax return specifically for agricultural employees or claiming a refund. This document is essential for ensuring compliance and accuracy when filing taxes related to agricultural operations.

-

How can airSlate SignNow help with the 'Instruction 943 X Rev March Instructions For Form 943 X' process?

airSlate SignNow streamlines the process of managing and eSigning documents related to the 'Instruction 943 X Rev March Instructions For Form 943 X'. Our platform allows businesses to efficiently prepare, send, and store important tax documents securely, ensuring compliance and simplicity.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features like customizable templates, bulk sending, and automated reminders, making it easier to manage documents like the 'Instruction 943 X Rev March Instructions For Form 943 X'. These tools help ensure that your tax filings are timely and accurate, reducing the risk of errors.

-

Is airSlate SignNow cost-effective for small businesses handling Form 943 X?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small farms managing their Form 943 X filings. Our pricing plans are flexible and include features that help reduce administrative costs associated with tax document management.

-

Can I integrate airSlate SignNow with my existing accounting software for Form 943 X?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, ensuring that the process of managing documents related to the 'Instruction 943 X Rev March Instructions For Form 943 X' is streamlined. This integration allows for easy syncing of data, reducing potential errors when filing taxes.

-

What are the benefits of using airSlate SignNow for agricultural tax documents?

Using airSlate SignNow for managing agricultural tax documents, such as the 'Instruction 943 X Rev March Instructions For Form 943 X', provides signNow benefits. These include improved efficiency in document handling, secure storage, and the assurance that your forms are compliant with federal guidelines, ultimately saving you time and reducing stress.

-

How does airSlate SignNow ensure document security for tax filings?

airSlate SignNow prioritizes document security by using advanced encryption protocols to protect files related to the 'Instruction 943 X Rev March Instructions For Form 943 X'. Our platform also features secure user authentication and access controls, ensuring that your sensitive data remains confidential and protected.

Get more for Instruction 943 X Rev March Instructions For Form 943 X, Adjusted Employer's Annual Federal Tax Return For Agricultural Emp

Find out other Instruction 943 X Rev March Instructions For Form 943 X, Adjusted Employer's Annual Federal Tax Return For Agricultural Emp

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document