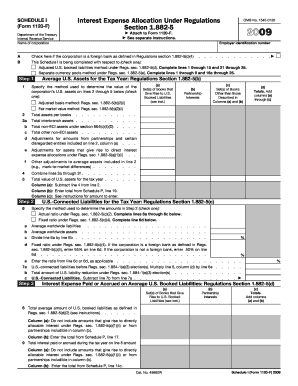

SCHEDULE I Form 1120 F Department of the Treasury Internal Revenue Service Name of Corporation Interest Expense Allocation under

Understanding the SCHEDULE I Form 1120 F

The SCHEDULE I Form 1120 F is a crucial document used by foreign corporations to report interest expense allocation under Regulations Section 1. This form is part of the U.S. tax filing process, specifically for corporations that are not based in the United States but have income sourced from within the country. It helps ensure compliance with U.S. tax laws by detailing how interest expenses are allocated, which can impact the corporation's taxable income.

Steps to Complete the SCHEDULE I Form 1120 F

Completing the SCHEDULE I Form 1120 F involves several important steps:

- Gather necessary financial documents, including income statements and balance sheets.

- Identify the total interest expenses incurred during the tax year.

- Determine the allocation of interest expenses based on the applicable regulations.

- Fill out the form accurately, ensuring all required information is included.

- Review the completed form for any errors or omissions before submission.

Legal Use of the SCHEDULE I Form 1120 F

The legal use of the SCHEDULE I Form 1120 F is essential for foreign corporations operating in the U.S. This form must be filed in accordance with the Internal Revenue Service (IRS) regulations to avoid penalties. Proper completion and submission of this form help ensure that the corporation meets its tax obligations and complies with U.S. tax laws.

Key Elements of the SCHEDULE I Form 1120 F

Key elements of the SCHEDULE I Form 1120 F include:

- Identification of the corporation, including its name and employer identification number (EIN).

- Details of the interest expenses incurred during the tax year.

- Allocation methods used to determine the interest expense for U.S. tax purposes.

- Signature of an authorized representative to certify the accuracy of the information provided.

Obtaining the SCHEDULE I Form 1120 F

The SCHEDULE I Form 1120 F can be obtained directly from the IRS website or through tax preparation software. It is important to ensure that you are using the most current version of the form to comply with the latest regulations. Additionally, physical copies may be available at local IRS offices or through tax professionals.

Filing Deadlines for the SCHEDULE I Form 1120 F

Filing deadlines for the SCHEDULE I Form 1120 F typically align with the corporate tax return due dates. Generally, foreign corporations must file this form by the 15th day of the sixth month following the end of their tax year. It is crucial to stay informed about any changes to these deadlines to avoid late filing penalties.

Quick guide on how to complete schedule i form 1120 f department of the treasury internal revenue service name of corporation interest expense allocation

Prepare [SKS] effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents quickly and without hassle. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to modify and eSign [SKS] with ease

- Locate [SKS] and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to finalize your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to missing or lost documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to SCHEDULE I Form 1120 F Department Of The Treasury Internal Revenue Service Name Of Corporation Interest Expense Allocation Under

Create this form in 5 minutes!

How to create an eSignature for the schedule i form 1120 f department of the treasury internal revenue service name of corporation interest expense allocation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the SCHEDULE I Form 1120 F Department Of The Treasury Internal Revenue Service Name Of Corporation Interest Expense Allocation Under Regulations Section 1?

The SCHEDULE I Form 1120 F is utilized by foreign corporations operating in the U.S. to report interest expense allocation under Regulations Section 1. This helps determine the deductible expenses related to interest for tax purposes, ensuring compliance with IRS regulations.

-

How does airSlate SignNow simplify the process of filing the SCHEDULE I Form 1120 F?

airSlate SignNow streamlines document management and eSigning, allowing businesses to easily prepare and send the SCHEDULE I Form 1120 F Department Of The Treasury Internal Revenue Service Name Of Corporation Interest Expense Allocation Under Regulations Section 1 electronically. This efficiency reduces the time and costs associated with traditional filing methods.

-

What features does airSlate SignNow offer for managing tax documents like the SCHEDULE I Form 1120 F?

With airSlate SignNow, you get features such as templates specifically for the SCHEDULE I Form 1120 F Department Of The Treasury Internal Revenue Service Name Of Corporation Interest Expense Allocation Under Regulations Section 1, customizable workflows, and secure storage. These tools ensure that your forms are compliant and easily accessible.

-

Is airSlate SignNow cost-effective for small businesses managing SCHEDULE I Form 1120 F filings?

Yes, airSlate SignNow offers flexible pricing plans suitable for businesses of all sizes, including small businesses. By using our platform, you can save on printing and mailing costs associated with SCHEDULE I Form 1120 F Department Of The Treasury Internal Revenue Service Name Of Corporation Interest Expense Allocation Under Regulations Section 1 submissions.

-

What integrations does airSlate SignNow support for tax filing processes?

airSlate SignNow seamlessly integrates with popular accounting and tax software, making it easy to manage your SCHEDULE I Form 1120 F Department Of The Treasury Internal Revenue Service Name Of Corporation Interest Expense Allocation Under Regulations Section 1 alongside other financial documents. This integration helps streamline your overall tax filing process.

-

Can airSlate SignNow help with compliance for SCHEDULE I Form 1120 F?

Absolutely! airSlate SignNow prioritizes compliance, enabling users to effectively manage their SCHEDULE I Form 1120 F Department Of The Treasury Internal Revenue Service Name Of Corporation Interest Expense Allocation Under Regulations Section 1. Our solution provides updates on IRS requirements to ensure your documents meet all necessary guidelines.

-

What benefits can businesses expect from using airSlate SignNow for SCHEDULE I Form 1120 F?

Businesses can expect numerous benefits, including reduced turnaround time for signature collection, enhanced security for sensitive tax documents like the SCHEDULE I Form 1120 F Department Of The Treasury Internal Revenue Service Name Of Corporation Interest Expense Allocation Under Regulations Section 1, and increased productivity through efficient document workflows.

Get more for SCHEDULE I Form 1120 F Department Of The Treasury Internal Revenue Service Name Of Corporation Interest Expense Allocation Under

Find out other SCHEDULE I Form 1120 F Department Of The Treasury Internal Revenue Service Name Of Corporation Interest Expense Allocation Under

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free