Irs for 4802 Form

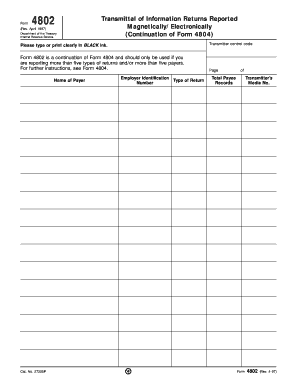

What is the IRS Form 4802?

The IRS Form 4802 is a specific document used for reporting certain financial information to the Internal Revenue Service. This form is typically utilized by businesses and individuals to disclose specific transactions or activities that may have tax implications. Understanding the purpose of this form is crucial for compliance with federal tax laws.

Steps to Complete the IRS Form 4802

Completing the IRS Form 4802 involves several key steps:

- Gather necessary information, including financial records relevant to the transactions being reported.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the form by the designated deadline to avoid penalties.

Legal Use of the IRS Form 4802

The IRS Form 4802 must be used in accordance with federal tax regulations. It is important to ensure that the information reported is truthful and complete. Misuse of this form can lead to legal consequences, including fines and audits. Therefore, understanding the legal implications of using this form is essential for all taxpayers.

Filing Deadlines for the IRS Form 4802

Filing deadlines for the IRS Form 4802 can vary based on the specific circumstances of the taxpayer. Typically, the form must be submitted by the tax return due date for the year in which the transactions occurred. Staying informed about these deadlines helps avoid late filing penalties.

Required Documents for the IRS Form 4802

When preparing to file the IRS Form 4802, certain documents are necessary to support the information reported. These may include:

- Financial statements that detail the transactions.

- Receipts or invoices related to the reported activities.

- Any correspondence with the IRS regarding previous filings.

Examples of Using the IRS Form 4802

Common scenarios where the IRS Form 4802 may be used include:

- Reporting income from freelance work or side businesses.

- Disclosing certain types of investment income.

- Documenting transactions that may affect tax liability.

Who Issues the IRS Form 4802?

The IRS Form 4802 is issued by the Internal Revenue Service, which is the federal agency responsible for tax collection and enforcement in the United States. This form is part of the IRS's efforts to ensure compliance with tax laws and regulations.

Quick guide on how to complete irs for 4802

Prepare Irs For 4802 effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It presents an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without interruptions. Manage Irs For 4802 on any device with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to edit and electronically sign Irs For 4802 without hassle

- Obtain Irs For 4802 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to secure your changes.

- Select your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Irs For 4802 and assure outstanding communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs for 4802

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of IRS Form 4802?

IRS Form 4802 is crucial for businesses that need to report certain types of income. Understanding how to properly fill out and file this form can save you from potential fines and penalties. At airSlate SignNow, we provide features to help you manage your documents related to IRS Form 4802 efficiently.

-

How can airSlate SignNow help with IRS Form 4802?

AirSlate SignNow streamlines the process of preparing and signing IRS Form 4802, making it easier for businesses to stay compliant. Our platform allows you to securely eSign your document, ensuring its integrity and authenticity. This saves time and reduces the risk of errors commonly associated with paper forms.

-

What are the pricing plans for using airSlate SignNow for IRS Form 4802?

AirSlate SignNow offers various pricing plans to meet the needs of different businesses. Whether you're a small startup or a larger enterprise, you can find a plan that fits your budget while ensuring you have the tools to manage IRS Form 4802 with ease. Check our website for the most up-to-date pricing information and features.

-

Is airSlate SignNow secure for handling documents like IRS Form 4802?

Yes, airSlate SignNow places a high priority on document security. We utilize advanced encryption protocols and compliance with regulations to ensure that your IRS Form 4802 and other sensitive documents are protected. You can trust our platform to maintain the confidentiality of your information while you eSign.

-

Can I integrate airSlate SignNow with other software for IRS Form 4802?

Absolutely! AirSlate SignNow seamlessly integrates with various third-party applications to enhance your workflow when dealing with IRS Form 4802. Whether you use accounting software or CRM systems, our integrations facilitate better document management and timely submissions.

-

What features does airSlate SignNow offer to assist with IRS Form 4802?

AirSlate SignNow provides several key features to simplify the management of IRS Form 4802, including customizable templates, bulk sending capabilities, and real-time tracking. These tools ensure that you can handle all aspects of your document with ease, from preparation through to eSigning.

-

What benefits do I gain from using airSlate SignNow for IRS Form 4802?

Using airSlate SignNow for IRS Form 4802 delivers numerous benefits, including faster processing time, reduced errors, and improved compliance. Our user-friendly interface allows for quick adjustments and signatures, saving you valuable time and resources while ensuring accuracy in your submissions.

Get more for Irs For 4802

- Optionshouse tutorial form

- Extended x petition school of public health indiana university form

- Dshs washington form

- 21 collyer quay 02 01 singapore 049320 monday to friday 930am to 5pm www form

- Self certification on usa citizenship tax residency status and central reporting standard form

- Construction safety audit scoring system consass audit checklist form

- Attestation by the consular officer of the missionpost vfs global form

- Cit 0010 f form

Find out other Irs For 4802

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form