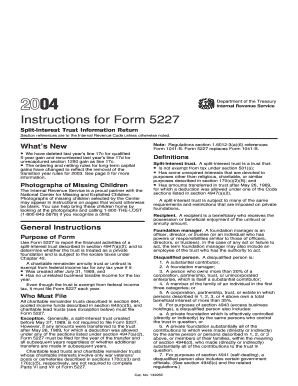

Instructions for Form 5227 Split Interest Trust Information Return Section References Are to the Internal Revenue Code unless Ot

Understanding Form 5227: Split Interest Trust Information Return

The Instructions For Form 5227 Split Interest Trust Information Return provide essential guidance for trustees of split-interest trusts. This form is used to report information about the trust's income, deductions, and distributions. The instructions outline the necessary steps to ensure compliance with the Internal Revenue Code, detailing specific requirements for reporting income and expenditures related to the trust. Understanding these instructions is critical for accurate tax reporting and to avoid penalties associated with non-compliance.

Steps to Complete Form 5227

Completing the Instructions For Form 5227 involves several key steps:

- Gather all relevant financial documents related to the trust, including income statements, expense receipts, and prior year tax returns.

- Review the specific sections of the form that pertain to your trust's activities, ensuring you understand the requirements for reporting income and deductions.

- Fill out the form accurately, ensuring all information is complete and reflects the trust's financial activities for the reporting period.

- Double-check all entries for accuracy, as errors can lead to delays or penalties.

- Submit the completed form by the due date to avoid penalties for late filing.

Legal Use of Form 5227

The Instructions For Form 5227 are legally binding and must be followed to ensure compliance with federal tax laws. Trustees are responsible for accurately reporting the trust's financial activities as stipulated by the Internal Revenue Code. Failure to adhere to these instructions can result in significant penalties, including fines and interest on unpaid taxes. It is essential for trustees to understand their legal obligations when using this form to avoid potential legal issues.

Filing Deadlines for Form 5227

Timely filing of the Form 5227 is crucial. The form is typically due on the fifteenth day of the fourth month following the end of the trust's tax year. For trusts operating on a calendar year basis, this means the form is due by April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Trustees should be aware of these deadlines to ensure compliance and avoid penalties for late submission.

Required Documents for Form 5227

When preparing to complete the Instructions For Form 5227, trustees should gather several key documents:

- Financial statements for the trust, including income and expense reports.

- Records of distributions made to beneficiaries during the tax year.

- Documentation of any deductions claimed, such as administrative expenses.

- Prior year tax returns for reference and consistency in reporting.

Form Submission Methods

Trustees can submit the Form 5227 through various methods. The form can be filed electronically using approved tax software, which may streamline the process and reduce errors. Alternatively, trustees may choose to mail the completed form to the appropriate IRS address based on the trust's location. In-person submission is generally not available for this form. It is important to retain copies of the submitted form and any supporting documents for future reference.

Quick guide on how to complete instructions for form 5227 split interest trust information return section references are to the internal revenue code unless

Easily Prepare [SKS] on Any Gadget

Digital document management has gained traction among companies and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without any holdups. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest way to modify and eSign [SKS] with ease

- Obtain [SKS] and click Get Form to commence.

- Use the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or mask sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to finalize your adjustments.

- Select your preferred method of delivering your form: via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, frustrating form navigation, or errors that require reprinting new document versions. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Instructions For Form 5227 Split Interest Trust Information Return Section References Are To The Internal Revenue Code Unless Ot

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 5227 split interest trust information return section references are to the internal revenue code unless

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the Instructions For Form 5227 Split Interest Trust Information Return?

The Instructions For Form 5227 Split Interest Trust Information Return are designed to provide guidance on how to accurately report transactions and comply with tax regulations. This form is essential for trustees of split-interest trusts to ensure they adhere to the Internal Revenue Code's stipulations, unless otherwise noted.

-

How can airSlate SignNow help with completing Form 5227?

airSlate SignNow simplifies the process of completing Form 5227 by allowing users to upload documents, fill out forms electronically, and securely obtain eSignatures. This easy-to-use solution ensures that you can efficiently manage your tax filings while adhering to the Instructions For Form 5227 Split Interest Trust Information Return Section References Are To The Internal Revenue Code Unless Otherwise Noted.

-

What features does airSlate SignNow offer for Document Management?

With airSlate SignNow, users benefit from features such as document templates, customizable workflows, and secure cloud storage. These tools enhance your ability to handle documents related to Form 5227, ensuring compliance with the Instructions For Form 5227 Split Interest Trust Information Return Section References Are To The Internal Revenue Code Unless Otherwise Noted.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial that allows prospective customers to explore its features without any commitment. During this trial, you can gain hands-on experience with functionalities relevant to the Instructions For Form 5227 Split Interest Trust Information Return Section References Are To The Internal Revenue Code Unless Otherwise Noted.

-

How does airSlate SignNow ensure document security?

airSlate SignNow prioritizes document security by employing advanced encryption and compliance with industry standards. This is crucial for handling sensitive documents related to the Instructions For Form 5227 Split Interest Trust Information Return Section References Are To The Internal Revenue Code Unless Otherwise Noted.

-

What integrations does airSlate SignNow support?

airSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and Microsoft Office. These integrations enhance your workflow, making it easier to manage the Instructions For Form 5227 Split Interest Trust Information Return Section References Are To The Internal Revenue Code Unless Otherwise Noted alongside other common tools.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for tax documents offers several benefits including reduced processing time, increased accuracy, and enhanced ease of access. This is particularly important when working through the Instructions For Form 5227 Split Interest Trust Information Return Section References Are To The Internal Revenue Code Unless Otherwise Noted.

Get more for Instructions For Form 5227 Split Interest Trust Information Return Section References Are To The Internal Revenue Code Unless Ot

Find out other Instructions For Form 5227 Split Interest Trust Information Return Section References Are To The Internal Revenue Code Unless Ot

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later