Schedule 3 Form 1040A

What is the Schedule 3 Form 1040A

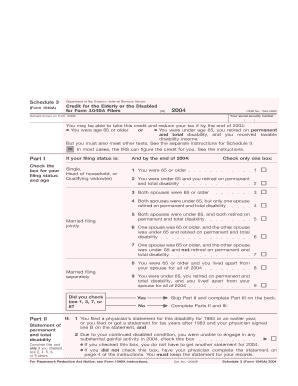

The Schedule 3 Form 1040A is a supplemental tax form used by individual taxpayers in the United States. It allows taxpayers to report various nonrefundable credits and other payments that can reduce their overall tax liability. This form is typically attached to the Form 1040A when filing federal income taxes. Understanding the Schedule 3 Form 1040A is essential for accurately reporting tax credits and ensuring compliance with IRS regulations.

How to use the Schedule 3 Form 1040A

To use the Schedule 3 Form 1040A, taxpayers should first determine their eligibility for specific credits listed on the form. Common credits include the child and dependent care credit, education credits, and the retirement savings contributions credit. Once eligibility is confirmed, taxpayers should fill out the relevant sections of the form, providing necessary details such as the amount of each credit. After completing the form, it should be attached to the main Form 1040A when submitting taxes to the IRS.

Steps to complete the Schedule 3 Form 1040A

Completing the Schedule 3 Form 1040A involves several key steps:

- Review the form to understand the credits available.

- Gather necessary documentation to support your claims, such as receipts or tax statements.

- Fill in personal information at the top of the form, including your name and Social Security number.

- Complete the sections for each credit you are claiming, ensuring accuracy in amounts.

- Double-check your calculations and ensure all required fields are filled.

- Attach the completed Schedule 3 to your Form 1040A before submission.

Key elements of the Schedule 3 Form 1040A

The Schedule 3 Form 1040A includes several important elements that taxpayers should be aware of:

- Personal Information: This section requires the taxpayer's name and Social Security number.

- Credit Sections: Each section corresponds to a specific tax credit, requiring detailed information about eligibility and amounts.

- Total Credits: At the end of the form, taxpayers must sum their credits to determine the total amount that can be applied against their tax liability.

Filing Deadlines / Important Dates

Taxpayers must be aware of key deadlines when filing the Schedule 3 Form 1040A. Typically, the deadline for filing federal income tax returns is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to file the Schedule 3 along with the Form 1040A by this deadline to avoid penalties and interest on unpaid taxes.

Who Issues the Form

The Schedule 3 Form 1040A is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and enforcement in the United States. The IRS provides the necessary forms and instructions for taxpayers to accurately report their income and claim any eligible credits. It is crucial for taxpayers to use the most current version of the form, as updates may occur annually.

Quick guide on how to complete schedule 3 form 1040a

Easily Prepare [SKS] on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to find the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage [SKS] on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The Easiest Way to Edit and eSign [SKS] Seamlessly

- Locate [SKS] and select Get Form to begin.

- Utilize the tools provided to complete your form.

- Highlight important sections of the documents or redact confidential information using the tools specifically designed for this purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, exhausting form navigation, and mistakes that require printing new copies. airSlate SignNow manages all your document handling needs in just a few clicks from any device you choose. Edit and eSign [SKS] and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule 3 Form 1040A

Create this form in 5 minutes!

How to create an eSignature for the schedule 3 form 1040a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule 3 Form 1040A?

The Schedule 3 Form 1040A is used by individual taxpayers to report additional credits and payments on their federal income tax return. It allows you to detail various credits like the foreign tax credit or the education credit which can reduce your overall tax liability. Understanding how to fill out the Schedule 3 Form 1040A correctly is essential for maximizing your tax benefits.

-

How can airSlate SignNow assist me with the Schedule 3 Form 1040A?

airSlate SignNow provides an easy-to-use platform for electronically signing and managing your Schedule 3 Form 1040A documents. With our service, you can streamline the signing process with clients or tax professionals, ensuring your documents are completed accurately and promptly. This simplification saves you time and helps you focus on more critical tax preparation tasks.

-

What features does airSlate SignNow offer for tax forms like Schedule 3 Form 1040A?

airSlate SignNow offers features such as secure eSignature, document templates, and automated reminders, which are particularly useful for managing tax forms like the Schedule 3 Form 1040A. Our platform ensures that your document transactions are legally binding, making it easier to obtain signatures from multiple parties. These features enhance the efficiency of your tax filing processes.

-

Is airSlate SignNow cost-effective for handling Schedule 3 Form 1040A?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, making it a cost-effective solution for handling the Schedule 3 Form 1040A. By using our platform, you can reduce overhead costs associated with paper documents and mailing, thus allowing you to invest more in your tax-related activities. Our transparent pricing structure helps you choose the best plan for your needs.

-

Can I integrate airSlate SignNow with other tax software for Schedule 3 Form 1040A?

Absolutely! airSlate SignNow integrates seamlessly with various tax software solutions to enhance your experience with the Schedule 3 Form 1040A. This integration facilitates the smooth transfer of information, ensuring that your tax documents are accurately populated and ready for eSigning without any manual data entry. This means less error-prone filing and efficient document workflow.

-

What are the advantages of using airSlate SignNow for business tax filings, including Schedule 3 Form 1040A?

Using airSlate SignNow for business tax filings, including the Schedule 3 Form 1040A, provides signNow advantages such as increased efficiency, enhanced security, and compliance with legal standards. By digitizing the signing process, businesses can ensure all transactions are securely managed and easily auditable. This leads to a smoother tax filing experience and helps you stay organized.

-

How do I get started with airSlate SignNow for the Schedule 3 Form 1040A?

Getting started with airSlate SignNow for managing the Schedule 3 Form 1040A is simple. You can sign up for a free trial on our website, which allows you to explore our features and understand how they can benefit your tax filing process. After signing up, you can easily upload your Schedule 3 Form 1040A and start sending it for signatures right away.

Get more for Schedule 3 Form 1040A

Find out other Schedule 3 Form 1040A

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online