April Department of the Treasury Internal Revenue Service Transmittal of Information Returns Reported MagneticallyElectronically

Understanding the April Department Of The Treasury Internal Revenue Service Transmittal Of Information Returns Reported MagneticallyElectronically Continuation Of Form 4804

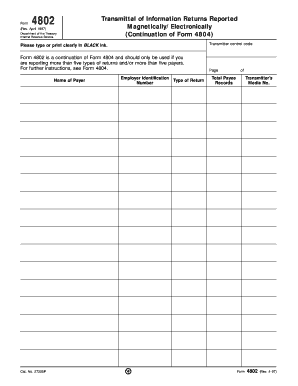

The April Department Of The Treasury Internal Revenue Service Transmittal Of Information Returns Reported MagneticallyElectronically Continuation Of Form 4804 is a crucial document for businesses and organizations that report information returns to the IRS. This form is specifically designed for those who transmit information electronically or magnetically. It serves as a cover sheet that provides essential details about the transmitter and the returns being submitted. Understanding this form is vital for compliance with IRS regulations and for ensuring accurate reporting of financial information.

Steps to Complete the April Department Of The Treasury Internal Revenue Service Transmittal Of Information Returns Reported MagneticallyElectronically Continuation Of Form 4804

Completing the April Department Of The Treasury Internal Revenue Service Transmittal Of Information Returns Reported MagneticallyElectronically Continuation Of Form 4804 involves several key steps:

- Gather all necessary information regarding the returns you are submitting.

- Ensure that all data is accurate and complete to avoid delays or penalties.

- Fill out the transmitter control code section clearly, using black ink.

- Verify that all required signatures are included.

- Submit the form along with the information returns by the specified deadline.

Legal Use of the April Department Of The Treasury Internal Revenue Service Transmittal Of Information Returns Reported MagneticallyElectronically Continuation Of Form 4804

The legal use of the April Department Of The Treasury Internal Revenue Service Transmittal Of Information Returns Reported MagneticallyElectronically Continuation Of Form 4804 is governed by IRS regulations. This form must be used by entities that are required to report information returns electronically. Failure to comply with the requirements can lead to penalties, including fines and increased scrutiny from the IRS. It is essential for businesses to understand their obligations under the law to ensure proper use of this form.

Key Elements of the April Department Of The Treasury Internal Revenue Service Transmittal Of Information Returns Reported MagneticallyElectronically Continuation Of Form 4804

Several key elements are essential when completing the April Department Of The Treasury Internal Revenue Service Transmittal Of Information Returns Reported MagneticallyElectronically Continuation Of Form 4804:

- Transmitter Control Code: A unique code that identifies the transmitter.

- Contact Information: Accurate details for the individual or organization submitting the form.

- Return Type: Specify the type of information returns being submitted.

- Signature: Required for verification and compliance purposes.

Filing Deadlines / Important Dates for the April Department Of The Treasury Internal Revenue Service Transmittal Of Information Returns Reported MagneticallyElectronically Continuation Of Form 4804

Filing deadlines for the April Department Of The Treasury Internal Revenue Service Transmittal Of Information Returns Reported MagneticallyElectronically Continuation Of Form 4804 are critical for compliance. Typically, the deadline for submitting information returns is set by the IRS and may vary based on the type of return. It is important to stay informed about these dates to avoid penalties and ensure timely processing of your submissions.

Form Submission Methods for the April Department Of The Treasury Internal Revenue Service Transmittal Of Information Returns Reported MagneticallyElectronically Continuation Of Form 4804

The April Department Of The Treasury Internal Revenue Service Transmittal Of Information Returns Reported MagneticallyElectronically Continuation Of Form 4804 can be submitted through various methods:

- Electronically: Most common and preferred method for submitting information returns.

- Mail: Physical submission is allowed but may result in longer processing times.

- In-Person: Certain situations may allow for in-person submission at designated IRS offices.

Quick guide on how to complete april department of the treasury internal revenue service transmittal of information returns reported

Complete [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents quickly without interruptions. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused procedure today.

The easiest way to modify and eSign [SKS] without any hassle

- Locate [SKS] and then click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the information and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Adjust and eSign [SKS] and ensure smooth communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to April Department Of The Treasury Internal Revenue Service Transmittal Of Information Returns Reported MagneticallyElectronically

Create this form in 5 minutes!

How to create an eSignature for the april department of the treasury internal revenue service transmittal of information returns reported

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the April Department Of The Treasury Internal Revenue Service Transmittal Of Information Returns Reported MagneticallyElectronically Continuation Of Form 4804?

The April Department Of The Treasury Internal Revenue Service Transmittal Of Information Returns Reported MagneticallyElectronically Continuation Of Form 4804 is a key document specifically for reporting information returns electronically. It serves as a cover sheet that helps transmit multiple forms to the IRS. Utilizing airSlate SignNow simplifies the submission process, ensuring you comply with IRS requirements efficiently.

-

How can airSlate SignNow assist me with the Submission process for Form 4804?

airSlate SignNow offers an easy-to-use platform that allows you to complete and submit the April Department Of The Treasury Internal Revenue Service Transmittal Of Information Returns Reported MagneticallyElectronically Continuation Of Form 4804 electronically. The platform guides you through each step, ensuring that you enter all necessary details clearly and correctly before submission.

-

What features does airSlate SignNow offer for managing my tax documents?

With airSlate SignNow, you gain access to an array of features designed to streamline document management, particularly for tax forms like the April Department Of The Treasury Internal Revenue Service Transmittal Of Information Returns Reported MagneticallyElectronically Continuation Of Form 4804. These features include electronic signing, templates for repeated use, custom workflows, and secure storage of all your documents to enhance your operational efficiency.

-

Is airSlate SignNow a cost-effective solution for businesses?

Yes, airSlate SignNow is a cost-effective solution that empowers businesses of all sizes to manage documents efficiently. By simplifying processes like the submission of the April Department Of The Treasury Internal Revenue Service Transmittal Of Information Returns Reported MagneticallyElectronically Continuation Of Form 4804, it helps you save time and reduce operational costs associated with paperwork.

-

What integrations does airSlate SignNow support?

airSlate SignNow integrates with a variety of applications, allowing you to connect seamlessly with other tools you may already be using for business management. This includes software for accounting, customer relationship management, and more, facilitating the smooth transmission of the April Department Of The Treasury Internal Revenue Service Transmittal Of Information Returns Reported MagneticallyElectronically Continuation Of Form 4804 within your ecosystem.

-

How secure is my information when using airSlate SignNow?

Security is a top priority for airSlate SignNow. Your data, including the details entered in the April Department Of The Treasury Internal Revenue Service Transmittal Of Information Returns Reported MagneticallyElectronically Continuation Of Form 4804, is protected through advanced encryption and compliance with industry security standards. This ensures that your sensitive information remains confidential and secure throughout your digital transactions.

-

Can I track the status of my submissions with airSlate SignNow?

Absolutely! airSlate SignNow provides tracking features that allow you to monitor the status of all your document submissions, including the April Department Of The Treasury Internal Revenue Service Transmittal Of Information Returns Reported MagneticallyElectronically Continuation Of Form 4804. You’ll receive notifications about any updates or required actions, keeping you informed throughout the process.

Get more for April Department Of The Treasury Internal Revenue Service Transmittal Of Information Returns Reported MagneticallyElectronically

- Nfl week 16 pick em sheet form

- Glencoe algebra 1 chapter 7 answer key pdf form

- Online transfer application for health department form

- E ticket itinerary receipt and tax invoice form

- Telex release request letter form

- Td ameritrade w9 form

- Statutory declaration for name variations sample form

- Isf form template

Find out other April Department Of The Treasury Internal Revenue Service Transmittal Of Information Returns Reported MagneticallyElectronically

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template

- How Can I Electronic signature Missouri Unlimited Power of Attorney

- Electronic signature Montana Unlimited Power of Attorney Secure

- Electronic signature Missouri Unlimited Power of Attorney Fast

- Electronic signature Ohio Unlimited Power of Attorney Easy

- How Can I Electronic signature Oklahoma Unlimited Power of Attorney