Form 8328 Rev November Fill in Version Carryforward Election of Unused Private Activity Bond Volume Cap

Understanding Form 8328: Carryforward Election of Unused Private Activity Bond Volume Cap

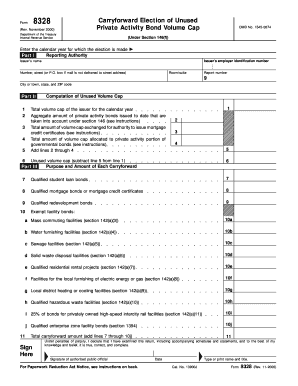

The Form 8328 is a crucial document used by taxpayers to make a carryforward election of unused private activity bond volume cap. This form is essential for entities that wish to utilize their allocated volume cap for tax-exempt private activity bonds in future years. By filing this form, taxpayers can ensure they maximize their available bond capacity, which can lead to significant financial advantages for qualifying projects.

How to Complete Form 8328

Completing Form 8328 involves several key steps. First, gather all necessary information regarding your unused private activity bond volume cap. This includes the amount of cap available and the specific projects for which you intend to use this cap. Next, accurately fill out the form, ensuring all figures are correct and align with your records. Finally, review the completed form for any errors before submission to ensure compliance with IRS requirements.

Obtaining Form 8328

Form 8328 can be obtained directly from the IRS website or through various tax preparation software. It is important to ensure you are using the most recent version of the form, as updates may occur that affect the filing process. Always check for the latest revisions to ensure compliance with current tax regulations.

Filing Deadlines for Form 8328

Timely filing of Form 8328 is essential to avoid penalties. The IRS typically sets specific deadlines for submitting this form, which may vary based on the fiscal year of the taxpayer. It is advisable to consult the IRS guidelines or a tax professional to confirm the exact filing dates relevant to your situation.

Legal Considerations for Form 8328

Using Form 8328 correctly is vital for legal compliance. Taxpayers must ensure that they meet all eligibility criteria for the carryforward election and adhere to any state-specific regulations that may apply. Failing to comply with these legal requirements can result in penalties or the loss of tax benefits associated with private activity bonds.

Examples of Using Form 8328

Form 8328 can be utilized in various scenarios. For instance, a nonprofit organization that has not fully utilized its private activity bond volume cap in a given year may file this form to carry forward the unused amount for future projects. Similarly, businesses planning large-scale developments can benefit from this election to optimize their financing options through tax-exempt bonds.

Quick guide on how to complete form 8328

Effortlessly prepare form 8328 on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, allowing you to find the necessary form and securely keep it online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents quickly and smoothly. Handle form 8328 on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to edit and electronically sign form 8328 with ease

- Find form 8328 and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark important sections of your documents or conceal sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about misplaced or lost files, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and electronically sign form 8328 and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8328

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask form 8328

-

What is form 8328 and how is it used?

Form 8328 is an important document used for certain IRS tax elections. It allows businesses to elect specific accounting methods, and its timely submission can optimize your tax benefits. With airSlate SignNow, you can easily complete and eSign form 8328, ensuring you meet all necessary regulatory requirements.

-

How can airSlate SignNow help with form 8328 processing?

airSlate SignNow streamlines the process of completing form 8328 by providing intuitive templates and easy editing features. Users can quickly fill out and electronically sign this form, expediting submission and reducing errors. Our platform ensures compliance and provides a secure method for handling sensitive information.

-

Is there a cost associated with using airSlate SignNow for form 8328?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including those seeking to manage form 8328. We provide a cost-effective solution that includes features specifically designed for document management and eSigning. You can choose a plan that fits your budget while benefiting from our robust capabilities.

-

Can I integrate airSlate SignNow with other applications for form 8328?

Absolutely! airSlate SignNow offers seamless integrations with numerous applications, enabling you to manage form 8328 efficiently. Whether you need to sync with CRMs or other document management systems, our integrations provide flexibility and enhance your workflow to ensure smooth processing.

-

What are the benefits of eSigning form 8328 using airSlate SignNow?

eSigning form 8328 with airSlate SignNow provides numerous benefits, including increased efficiency, improved accuracy, and enhanced security. Our platform allows for quick turnaround times, reducing paperwork delays and helping you submit form 8328 faster. Additionally, you gain access to audit trails to verify the signing process.

-

Is airSlate SignNow compliant with legal standards for form 8328?

Yes, airSlate SignNow is fully compliant with legal standards for eSigning and document management, making it suitable for form 8328 submissions. Our platform adheres to regulations such as the ESIGN Act and UETA, ensuring your electronic signatures are legally binding. This compliance provides peace of mind when handling sensitive tax documents.

-

How do I get started with airSlate SignNow for form 8328?

Getting started with airSlate SignNow for form 8328 is simple! Just sign up for an account, choose a pricing plan that fits your needs, and begin creating or uploading your form 8328. The user-friendly interface makes it easy to navigate and start utilizing our features right away.

Get more for form 8328

Find out other form 8328

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation