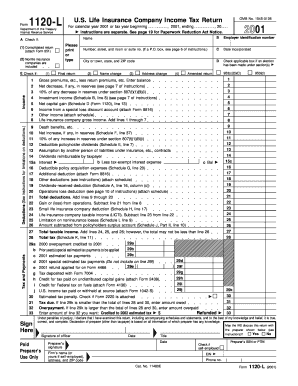

Life Insurance Company Income Tax Return for Calendar Year or Tax Year Beginning , , Ending , 20 Instructions Are Separate Form

What is the Life Insurance Company Income Tax Return

The Life Insurance Company Income Tax Return is a specific tax form used by life insurance companies to report their income, deductions, and tax liabilities for a given calendar year or tax year. This form is essential for ensuring compliance with federal tax regulations set forth by the Internal Revenue Service (IRS). It captures various financial details, including premiums collected, investment income, and claims paid, allowing the IRS to assess the company's tax obligations accurately.

Steps to Complete the Life Insurance Company Income Tax Return

Completing the Life Insurance Company Income Tax Return involves several key steps:

- Gather necessary financial documents, including income statements, balance sheets, and previous tax returns.

- Fill out the required sections of the form, ensuring accurate reporting of income and deductions.

- Calculate the total tax liability based on the reported income and applicable tax rates.

- Review the completed form for accuracy and completeness to avoid potential penalties.

- Submit the form by the designated filing deadline, either electronically or via mail.

Filing Deadlines / Important Dates

It is crucial for life insurance companies to adhere to specific filing deadlines to avoid penalties. Generally, the Life Insurance Company Income Tax Return must be filed by the fifteenth day of the third month following the end of the tax year. For calendar year filers, this typically falls on March 15. If additional time is needed, companies may request an extension, which can extend the deadline by six months.

Required Documents

To complete the Life Insurance Company Income Tax Return, several documents are typically required:

- Financial statements, including income statements and balance sheets.

- Records of premiums collected and claims paid during the tax year.

- Documentation of investment income and expenses.

- Previous year’s tax return for reference.

IRS Guidelines

The IRS provides specific guidelines for completing the Life Insurance Company Income Tax Return. These guidelines include instructions on how to report various types of income, allowable deductions, and the calculation of tax credits. It is essential for companies to refer to the latest IRS publications and instructions to ensure compliance with current tax laws and regulations.

Penalties for Non-Compliance

Failure to file the Life Insurance Company Income Tax Return on time or inaccuracies in reporting can result in significant penalties. The IRS may impose fines based on the amount of tax owed and the length of time the return is late. Additionally, companies may face interest charges on any unpaid taxes, further increasing their financial liability.

Quick guide on how to complete life insurance company income tax return for calendar year or tax year beginning ending 20 instructions are separate

Complete [SKS] effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can locate the necessary form and securely keep it online. airSlate SignNow provides you with all the tools needed to create, edit, and eSign your documents quickly without delays. Manage [SKS] on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign [SKS] seamlessly

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow specially provides for that purpose.

- Generate your eSignature with the Sign tool, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow caters to your document management needs in a few clicks from any device of your choice. Edit and eSign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Life Insurance Company Income Tax Return For Calendar Year Or Tax Year Beginning , , Ending , 20 Instructions Are Separate

Create this form in 5 minutes!

How to create an eSignature for the life insurance company income tax return for calendar year or tax year beginning ending 20 instructions are separate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is included in the Life Insurance Company Income Tax Return For Calendar Year Or Tax Year Beginning , , Ending , 20 Instructions Are Separate?

The Life Insurance Company Income Tax Return For Calendar Year Or Tax Year Beginning , , Ending , 20 Instructions Are Separate provides detailed guidance on reporting income, deductions, and credits specific to life insurance companies. This document ensures compliance with IRS regulations while helping you maximize tax benefits pertinent to your business.

-

How can airSlate SignNow help with the Life Insurance Company Income Tax Return?

airSlate SignNow streamlines the process of completing the Life Insurance Company Income Tax Return For Calendar Year Or Tax Year Beginning , , Ending , 20 Instructions Are Separate through its user-friendly eSigning features. This helps eliminate paperwork hassles, allowing you to focus on your financial reporting.

-

Are there pricing plans for airSlate SignNow related to tax document management?

Yes, airSlate SignNow offers various pricing plans tailored for businesses seeking efficient document management, including tax-related documents like the Life Insurance Company Income Tax Return For Calendar Year Or Tax Year Beginning , , Ending , 20 Instructions Are Separate. You can choose a plan that fits your size and needs, ensuring cost-effectiveness.

-

What features does airSlate SignNow offer to simplify tax document processing?

With features like customizable templates, secure cloud storage, and electronic signature integration, airSlate SignNow simplifies the processing of the Life Insurance Company Income Tax Return For Calendar Year Or Tax Year Beginning , , Ending , 20 Instructions Are Separate. These tools enhance efficiency while ensuring accuracy in your submissions.

-

Can airSlate SignNow be integrated with other financial software for tax returns?

Absolutely! airSlate SignNow can seamlessly integrate with popular financial software, making it easier to manage the Life Insurance Company Income Tax Return For Calendar Year Or Tax Year Beginning , , Ending , 20 Instructions Are Separate and other tax documents. This integration boosts productivity and reduces the chance of errors in your returns.

-

What are the benefits of using airSlate SignNow for tax documentation?

Using airSlate SignNow for the Life Insurance Company Income Tax Return For Calendar Year Or Tax Year Beginning , , Ending , 20 Instructions Are Separate offers numerous benefits including reduced processing time, enhanced security, and improved collaboration among team members. These advantages make it an invaluable tool for businesses preparing tax documents.

-

Is airSlate SignNow compliant with IRS regulations for tax filings?

Yes, airSlate SignNow is designed to comply with IRS regulations, ensuring that documents, including the Life Insurance Company Income Tax Return For Calendar Year Or Tax Year Beginning , , Ending , 20 Instructions Are Separate, meet legal standards. This compliance helps you avoid potential penalties associated with improper tax filing.

Get more for Life Insurance Company Income Tax Return For Calendar Year Or Tax Year Beginning , , Ending , 20 Instructions Are Separate

Find out other Life Insurance Company Income Tax Return For Calendar Year Or Tax Year Beginning , , Ending , 20 Instructions Are Separate

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe