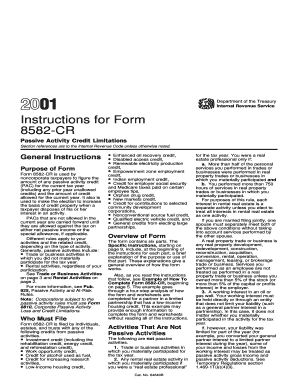

Instructions for Form 8582 CR Passive Activity Credit Limitations

What is the Instructions For Form 8582 CR Passive Activity Credit Limitations

The Instructions For Form 8582 CR Passive Activity Credit Limitations provide detailed guidance on how to determine the amount of passive activity credits that can be claimed on a tax return. This form is essential for taxpayers who have passive activities, such as rental real estate, that may generate tax credits. Understanding these instructions helps ensure compliance with IRS regulations and maximizes potential tax benefits.

Steps to complete the Instructions For Form 8582 CR Passive Activity Credit Limitations

Completing the Instructions For Form 8582 CR involves several key steps:

- Gather all necessary financial documents related to passive activities.

- Review the eligibility criteria to determine if you qualify for passive activity credits.

- Follow the step-by-step instructions provided in the form to calculate your credit limitations.

- Record your calculations accurately on the form.

- Ensure all required signatures and dates are included before submission.

Key elements of the Instructions For Form 8582 CR Passive Activity Credit Limitations

Several key elements are crucial when working with the Instructions For Form 8582 CR:

- Passive Activity Definition: Understanding what constitutes a passive activity is fundamental to applying the instructions correctly.

- Credit Limitations: The instructions outline how to calculate the maximum allowable credits based on your income and tax situation.

- Filing Requirements: Detailed information on when and how to file the form is provided, ensuring compliance with IRS deadlines.

- Examples: Practical examples illustrate common scenarios to enhance understanding of the instructions.

IRS Guidelines

The IRS provides specific guidelines that govern the use of Form 8582 CR. These guidelines include:

- Criteria for determining passive activities and material participation.

- Rules regarding the carryover of unused credits to future tax years.

- Clarifications on how to report passive activity credits on your tax return.

Eligibility Criteria

To utilize the Instructions For Form 8582 CR, taxpayers must meet certain eligibility criteria. These include:

- Having passive activities that generate credits.

- Meeting income thresholds set by the IRS, which may affect the ability to claim credits.

- Being compliant with previous tax filings, as outstanding issues may impact eligibility.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with Form 8582 CR. Key dates include:

- The typical filing deadline for individual tax returns, which is April 15.

- Extensions that may apply for late filings, generally allowing an additional six months.

- Any specific deadlines for amended returns if corrections are necessary.

Quick guide on how to complete instructions for form 8582 cr passive activity credit limitations

Effortlessly Prepare [SKS] on Any Device

Managing documents online has become increasingly popular among companies and individuals. It offers a superb eco-friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without any delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Modify and eSign [SKS] with Ease

- Find [SKS] and click on Get Form to begin.

- Use the tools provided to fill out your form.

- Mark necessary sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal weight as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, text message (SMS), invitation link, or by downloading it to your computer.

Eliminate concerns about missing or lost documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from your selected device. Modify and eSign [SKS] and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Instructions For Form 8582 CR Passive Activity Credit Limitations

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 8582 cr passive activity credit limitations

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Instructions For Form 8582 CR Passive Activity Credit Limitations?

The Instructions For Form 8582 CR Passive Activity Credit Limitations provide guidelines on how to calculate and report passive activity credits on your tax return. This form helps taxpayers determine how much of their passive credits can be utilized or carried forward if they exceed the limitations. Understanding these instructions is crucial for ensuring compliance and maximizing tax benefits.

-

How can airSlate SignNow help with the completion of Form 8582 CR?

airSlate SignNow offers a user-friendly platform that simplifies the process of completing Form 8582 CR. With our eSigning features, you can easily fill out, sign, and send the form electronically, ensuring that all information is captured accurately. This streamlines the filing process, allowing you to focus on maximizing your passive activity credits.

-

Is there a cost associated with using airSlate SignNow for tax forms?

Yes, airSlate SignNow is a cost-effective solution for managing your document needs, including tax forms like Form 8582 CR. Our pricing plans are designed to cater to businesses of all sizes, ensuring that you only pay for what you need. Explore our flexible pricing options to find the best fit for your organization.

-

Are the services provided by airSlate SignNow secure for sensitive tax documents?

Absolutely! airSlate SignNow prioritizes the security of all documents, including sensitive tax forms like Form 8582 CR. Our platform includes advanced encryption and security protocols to ensure that your information is protected at all stages of the document signing and management process.

-

What features does airSlate SignNow offer for managing tax forms?

airSlate SignNow includes a variety of features that streamline the management of tax forms, such as customizable templates, audit trails, and automated reminders for signing deadlines. These features ensure that you stay organized and compliant while efficiently processing forms like the Instructions For Form 8582 CR Passive Activity Credit Limitations.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Yes, airSlate SignNow integrates seamlessly with numerous financial and tax preparation software, enhancing your ability to manage forms like Form 8582 CR. This integration allows for easy data import and export, making it simpler to keep your records aligned across platforms. Enjoy greater flexibility and efficiency in your tax preparation process.

-

How can I ensure I'm following the latest Instructions For Form 8582 CR?

To stay updated on the latest Instructions For Form 8582 CR Passive Activity Credit Limitations, regularly check the IRS website or consult a tax professional. airSlate SignNow also keeps its users informed through our resources and updates, making it easier for you to comply with current tax regulations. Staying informed is key to maximizing your passive activity credits.

Get more for Instructions For Form 8582 CR Passive Activity Credit Limitations

- Open cds account online form

- Hostel admission form suresh gyan vihar university gyanvihar

- City of sweetwater building department form

- Mixed word based operations crossnumber puzzle basic math form

- Prepared food and beverage tax return in mt vernon illinois form

- Notice of inquest form

- Mass etiquette worksheet 448595761 form

- Used tire transportation registration application illinois docx form

Find out other Instructions For Form 8582 CR Passive Activity Credit Limitations

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document