Re My Valid Canadian HSTGST Number is Not B 2023-2026

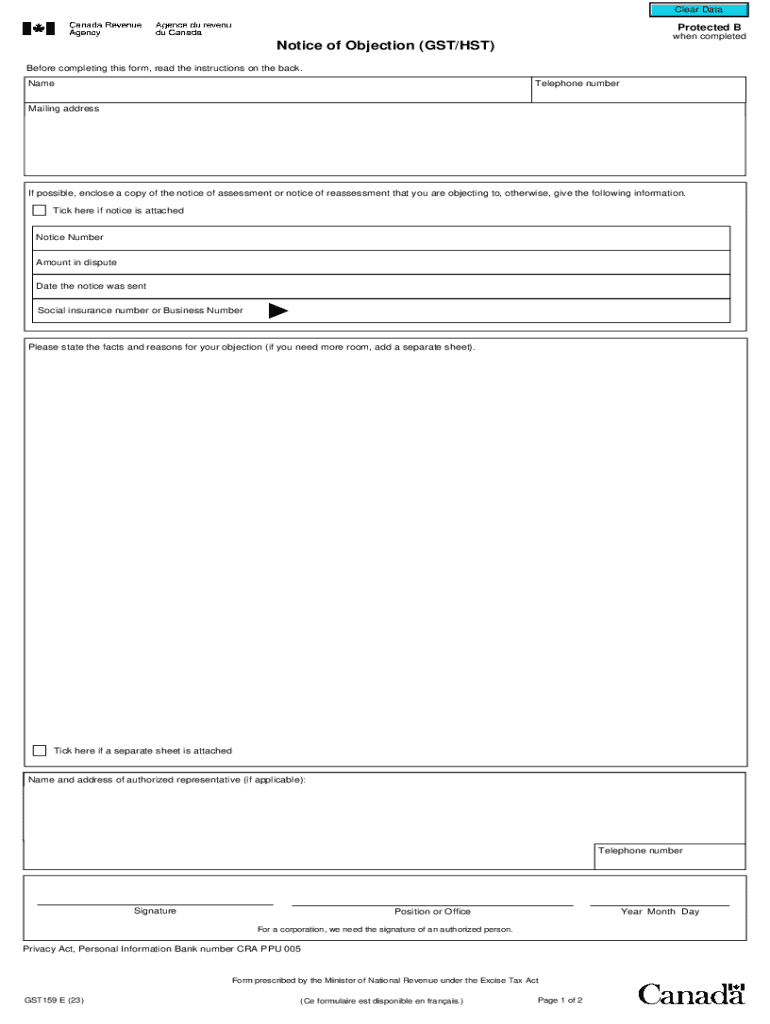

Understanding the Canada GST159 Form

The Canada GST159 form, also known as the GST/HST Registration Form, is essential for businesses that need to register for the Goods and Services Tax (GST) or the Harmonized Sales Tax (HST) in Canada. This form is crucial for both new and existing businesses that meet the revenue threshold for GST/HST registration. It allows businesses to collect and remit these taxes, ensuring compliance with Canadian tax laws.

Steps to Complete the Canada GST159 Form

Filling out the Canada GST159 form involves several key steps:

- Gather necessary information, including your business name, address, and contact details.

- Determine your business structure (e.g., sole proprietorship, partnership, corporation) and provide relevant details.

- Specify your estimated annual revenue to determine eligibility for GST/HST registration.

- Complete the form accurately, ensuring all required fields are filled out.

- Review the completed form for any errors before submission.

Required Documents for GST159 Submission

When submitting the Canada GST159 form, certain documents may be required to support your application. These may include:

- Proof of business registration, such as articles of incorporation or a business license.

- Identification documents for the business owner or authorized signatory.

- Financial statements or records that demonstrate your business's revenue.

Legal Use of the Canada GST159 Form

The Canada GST159 form is legally binding and must be filled out truthfully to avoid penalties. It is used by the Canada Revenue Agency (CRA) to assess your eligibility for GST/HST registration. Providing false information can lead to significant fines or legal repercussions. Therefore, it is essential to ensure that all details are accurate and complete.

Form Submission Methods

You can submit the Canada GST159 form through various methods:

- Online submission via the CRA's online services, which is the fastest method.

- Mailing the completed form to the appropriate CRA address, which may take longer for processing.

- In-person submission at a local CRA office, allowing for immediate assistance if needed.

Examples of Using the Canada GST159 Form

Businesses in various sectors may need to use the Canada GST159 form. For instance:

- A small retail shop that expects to exceed the revenue threshold for GST collection.

- A freelance graphic designer starting a new business and planning to charge clients GST.

- A partnership that needs to register for GST/HST to comply with tax regulations.

Filing Deadlines and Important Dates

It is crucial to be aware of filing deadlines when completing the Canada GST159 form. Typically, businesses must register for GST/HST before they exceed the revenue threshold, which is currently set at thirty thousand dollars in a twelve-month period. Late registration can result in penalties, so timely submission is essential.

Quick guide on how to complete re my valid canadian hstgst number is not b

Effortlessly prepare Re My Valid Canadian HSTGST Number Is Not B on any device

The management of online documents has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, edit, and eSign your documents quickly without delays. Handle Re My Valid Canadian HSTGST Number Is Not B on any device using airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

How to edit and eSign Re My Valid Canadian HSTGST Number Is Not B with ease

- Obtain Re My Valid Canadian HSTGST Number Is Not B and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of your documents or redact sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method of sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and eSign Re My Valid Canadian HSTGST Number Is Not B and ensure outstanding communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct re my valid canadian hstgst number is not b

Create this form in 5 minutes!

How to create an eSignature for the re my valid canadian hstgst number is not b

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is canada gst159?

The canada gst159 form is used for Goods and Services Tax (GST) registration in Canada. It is essential for businesses looking to collect GST from customers and remit it to the Canada Revenue Agency (CRA). Understanding how to effectively manage the canada gst159 can simplify your tax compliance process.

-

How does airSlate SignNow help with canada gst159 documentation?

airSlate SignNow makes it easy to create, send, and eSign canada gst159 forms. Our platform ensures that all your GST-related documents are securely managed and easily accessible. By using airSlate SignNow, you can streamline your documentation process and avoid any potential compliance issues.

-

What are the pricing options for using airSlate SignNow for canada gst159?

airSlate SignNow offers flexible pricing plans tailored to suit different business needs. Whether you are a small business or a large enterprise, our plans provide features that accommodate the management of important documents like the canada gst159. Sign up today for a free trial to explore how our pricing can fit your budget.

-

Can I integrate airSlate SignNow with my accounting software for canada gst159 handling?

Yes, airSlate SignNow easily integrates with popular accounting software, enhancing your canada gst159 management. This integration helps you synchronize your document workflow with your financial operations, ensuring that your GST filings are up-to-date and accurate. Boost your productivity with seamless software integration.

-

What features does airSlate SignNow offer for managing canada gst159 documents?

airSlate SignNow provides a range of features to manage canada gst159 documents effectively. These include electronic signatures, document templates, and real-time tracking of document status. With our user-friendly interface, you can simplify the preparation and submission of your GST forms.

-

Is airSlate SignNow compliant with Canadian law for canada gst159?

Absolutely! airSlate SignNow complies with all applicable laws and regulations in Canada, including those governing the canada gst159. We prioritize data security and legal validity, giving you peace of mind that your GST documents are handled appropriately and securely.

-

What are the benefits of using airSlate SignNow for the canada gst159 process?

Using airSlate SignNow for the canada gst159 process provides numerous benefits, including time savings and enhanced efficiency. With our electronic solutions, you can signNowly reduce the time spent on preparing and sending GST documents. Additionally, the ease of tracking and managing your documents ensures you stay compliant with CRA requirements.

Get more for Re My Valid Canadian HSTGST Number Is Not B

- Tsca certification form

- Icici lombard health care claim form filled sample 100336108

- Certificate of occupancy template form

- Jordan school district homeschool affidavit form

- Landlord verification form pdf

- Mail boxes etc courier service near meparcel delivery form

- Sponsorship request application fiscal year form

- Sponsorship request application fiscal year 612714052 form

Find out other Re My Valid Canadian HSTGST Number Is Not B

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template