Form 1041 T IRS Irs

What is the Form 1041 T IRS Irs

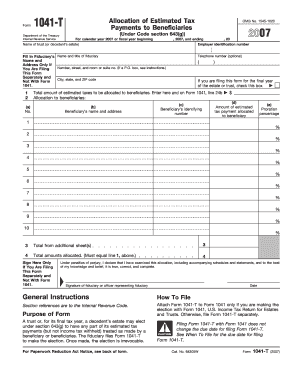

The Form 1041 T is a tax form used by estates and trusts to report income, deductions, and tax liability to the Internal Revenue Service (IRS). This form specifically addresses the tax obligations of estates and trusts, allowing them to calculate their taxable income and determine the amount of tax owed. The Form 1041 T is essential for fiduciaries managing the financial affairs of deceased individuals or those who have placed their assets in a trust.

How to use the Form 1041 T IRS Irs

Using the Form 1041 T involves several steps. First, the fiduciary must gather all necessary financial information related to the estate or trust, including income sources, deductions, and any distributions made to beneficiaries. Next, the fiduciary should fill out the form accurately, ensuring that all income and deductions are reported correctly. It is important to review the completed form for accuracy before submission, as errors can lead to delays or penalties.

Steps to complete the Form 1041 T IRS Irs

Completing the Form 1041 T requires careful attention to detail. Here are the steps to follow:

- Gather financial documents, including income statements and records of deductions.

- Fill out the identification section with the estate or trust's name, address, and taxpayer identification number.

- Report all income received by the estate or trust, including interest, dividends, and capital gains.

- List any deductions that apply, such as administrative expenses and distributions to beneficiaries.

- Calculate the total taxable income and the tax owed.

- Sign and date the form, ensuring that it is submitted by the appropriate deadline.

Filing Deadlines / Important Dates

The deadline for filing Form 1041 T typically aligns with the tax return deadlines for estates and trusts. Generally, the form must be filed by the fifteenth day of the fourth month following the end of the tax year. For estates and trusts operating on a calendar year basis, this means the form is due by April 15. It is crucial to be aware of these deadlines to avoid penalties for late filing.

Required Documents

To complete the Form 1041 T, certain documents are necessary. These include:

- Income statements for the estate or trust.

- Records of any deductions claimed.

- Documentation of distributions made to beneficiaries.

- Taxpayer identification number for the estate or trust.

Penalties for Non-Compliance

Failure to file the Form 1041 T on time or inaccuracies in the form can result in penalties from the IRS. These penalties may include fines for late filing or underpayment of taxes. In some cases, the IRS may also impose interest on any unpaid tax amounts. It is important for fiduciaries to understand these potential consequences and ensure compliance with all filing requirements.

Quick guide on how to complete form 1041 t irs irs

Complete [SKS] effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely keep it online. airSlate SignNow provides all the resources needed to create, modify, and eSign your documents swiftly without interruptions. Manage [SKS] on any device with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest way to alter and eSign [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive data with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or a shareable link, or download it to your computer.

Eliminate missing or lost documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign [SKS] and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1041 t irs irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1041 T IRS Irs and when should I use it?

Form 1041 T IRS Irs is used for reporting the income of estates and trusts. You should use this form when the estate or trust has any income that needs to be reported to the IRS. It's essential to file Form 1041 T IRS Irs accurately to ensure compliance with IRS regulations.

-

How can I electronically sign Form 1041 T IRS Irs with airSlate SignNow?

You can easily eSign Form 1041 T IRS Irs using airSlate SignNow by uploading your document to our platform. Once uploaded, you can invite other parties to sign electronically. This streamlined process saves time and ensures that your Form 1041 T IRS Irs is signed securely and legally.

-

What features does airSlate SignNow offer for Form 1041 T IRS Irs?

airSlate SignNow provides several features to assist you with Form 1041 T IRS Irs, including document templates, secure cloud storage, and automated reminders for signatures. These features simplify the signing process, enabling you to focus on what matters most—managing your estate or trust.

-

Is airSlate SignNow cost-effective for signing Form 1041 T IRS Irs?

Yes, airSlate SignNow offers a cost-effective solution for signing Form 1041 T IRS Irs. With flexible pricing plans, you can choose a package that suits your needs without breaking the bank. Our platform provides great value with robust features for both individuals and businesses.

-

Can I integrate airSlate SignNow with other software for Form 1041 T IRS Irs?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing you to manage your Form 1041 T IRS Irs more efficiently. You can integrate with accounting software, CRM systems, and more to streamline your workflow and enhance productivity.

-

Are documents signed with airSlate SignNow valid for Form 1041 T IRS Irs filings?

Yes, documents signed using airSlate SignNow are legally valid and comply with the requirements for Form 1041 T IRS Irs filings. Our platform uses advanced encryption and secure signing processes to ensure that your documents are protected and recognized by the IRS.

-

What benefits does airSlate SignNow provide for managing Form 1041 T IRS Irs?

Using airSlate SignNow to manage Form 1041 T IRS Irs offers a range of benefits including enhanced security, faster turnaround times, and increased efficiency. With easy document sharing and tracking features, you can ensure that all necessary signatures are obtained quickly, making the filing process smoother.

Get more for Form 1041 T IRS Irs

- Onn clock radio onb13av001 manual form

- Dilko prestige 12 1 cevap anahtar form

- Enhancement document template form

- Patient profiling are you a victimpamela wible md form

- Form 12 airside vehicle pass application form heathrow airport

- Nbm code of conduct form

- Vat exemption form charity bakare

- Passenger waiver form

Find out other Form 1041 T IRS Irs

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy

- Sign Massachusetts Business Letter Template Fast

- Can I Sign Virginia Business Letter Template

- Can I Sign Ohio Startup Costs Budget Worksheet

- How Do I Sign Maryland 12 Month Sales Forecast

- How Do I Sign Maine Profit and Loss Statement

- How To Sign Wisconsin Operational Budget Template

- Sign North Carolina Profit and Loss Statement Computer