Idaho Form 910 2017

What is the Idaho Form 910

The Idaho Form 910 is a state-specific tax form used for reporting various types of income and tax obligations within Idaho. This form is essential for individuals and businesses to accurately disclose their financial information to the Idaho State Tax Commission. It serves as a declaration of income, deductions, and credits, ensuring compliance with state tax laws.

How to obtain the Idaho Form 910

The Idaho Form 910 can be obtained directly from the Idaho State Tax Commission's official website. Users can download a fillable PDF version of the form, which allows for easy completion on a computer. Additionally, physical copies may be available at local tax offices or government buildings throughout Idaho.

Steps to complete the Idaho Form 910

Completing the Idaho Form 910 involves several key steps:

- Gather all necessary financial documents, including income statements, previous tax returns, and any relevant deductions.

- Download the Idaho Form 910 from the official website or obtain a physical copy.

- Fill out the form carefully, ensuring all information is accurate and complete.

- Review the form for any errors or omissions before signing.

- Submit the completed form by the designated deadline, either electronically or via mail.

Legal use of the Idaho Form 910

The Idaho Form 910 is legally recognized as a valid document for tax reporting purposes in the state of Idaho. It must be completed in accordance with Idaho tax laws and regulations. Filing this form accurately is crucial to avoid penalties and ensure compliance with state tax obligations.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the Idaho Form 910. Typically, the form must be submitted by April 15 of the tax year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also keep an eye on any updates from the Idaho State Tax Commission regarding changes to deadlines.

Form Submission Methods (Online / Mail / In-Person)

The Idaho Form 910 can be submitted through various methods:

- Online: Taxpayers can file the form electronically through the Idaho State Tax Commission's online portal.

- Mail: Completed forms can be mailed to the appropriate tax office address listed on the form.

- In-Person: Individuals may also choose to submit the form in person at local tax offices.

Penalties for Non-Compliance

Failure to file the Idaho Form 910 accurately and on time can result in significant penalties. These may include late filing fees, interest on unpaid taxes, and potential legal action. It is essential for taxpayers to adhere to all filing requirements to avoid these consequences.

Quick guide on how to complete file this form by the last day of february

Your assistance manual on how to prepare your Idaho Form 910

If you’re curious about how to generate and submit your Idaho Form 910, here are some straightforward instructions to simplify your tax declaration process.

Initially, you just need to register your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an extremely user-friendly and powerful document solution that allows you to edit, draft, and finalize your tax documents with ease. With its editor, you can alternate between text, check boxes, and electronic signatures, returning to modify answers when necessary. Enhance your tax management with advanced PDF editing, electronic signing, and user-friendly sharing.

Follow the steps below to complete your Idaho Form 910 in just a few minutes:

- Set up your account and start working on PDFs within minutes.

- Utilize our catalog to obtain any IRS tax form; review various versions and schedules.

- Select Get form to access your Idaho Form 910 in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding electronic signature (if required).

- Examine your document and rectify any mistakes.

- Save the adjustments, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Keep in mind that submitting in paper form can lead to more errors and delays in refunds. It’s advisable to check the IRS website for filing regulations specific to your state before e-filing your taxes.

Create this form in 5 minutes or less

Find and fill out the correct file this form by the last day of february

FAQs

-

What is the most unreasonable customer complaint you've heard?

I’ve had too many to count. Working at customer service at Walmart you will see just about anything. I’ll give you a few.• A woman comes up with a bag of what appears to be red mud. She plops it on my counter with a wet sploosh. The customer shoved a receipt in my face while explaining she needs to exchange her dress for a new one. She’d only gotten to wear it to church once before she tripped and landed in a mud puddle.I blinked before prodding the muddy dress in the bag. I took a deep breath before explaining, as nicely as I could, that clothing exchanges just don’t work that way. The only way we could exchange or refund an article of clothing was if there was a factory defect or if the clothing was in new condition.The woman insisted that she had always exchanged her ‘stained’ clothing with us. I explained that after items left the store, they belonged to the customer, unless damaged by the manufacturer, or in new condition, and we did not exchange stained clothing. She blew up and went through two CSMs and a front end manager before grabbing her muddy dress and storming from the store.• A woman came in with a totally empty cake box and demanded another cake and her money back. The cake, she said, had been for her daughter’s birthday party and it had been stale and was disgusting. I asked her where the cake was and she huffed and rolled her eyes, telling me that it was a party and they HAD to eat it. I turned it over to the bakery manager. She took great pleasure in telling the customer she had to have at least a bit of the cake to do anything.• A man came in with a swimming pool that he claimed was two years old because grass had grown through the liner. It smelled so bad all the customers in line left. I was gagging too much to do anything until a coworker shrink wrapped the nasty thing.The customer had no receipt but claimed he paid $500 for it. I told him that even with a receipt, we could only do an exchange within 90 days. I had a CSM over ride me on this one, even though we didn’t even carry the same pool. There was no way to even ring it into the system.I told my CSM that I would have nothing to do with the transaction and made her sign everything. I warned her someone would get fired over this transaction and it would not be me. True to my words, I was called into the store manager’s office and told to explain myself. I explained that the whole thing was the CSM’s fault and she was fired.• A lady brought in an opened DVD and wanted her money back. Copyright law prohibits this. We can exchange for the exact same title but no refunds or title swaps. I told her I was sorry and explained the law. She goes into a full blown rant because she wanted the same movie she saw in the theater but this one was modified.I asked the customer what she was talking about and she tells me it says it’s been modified right at the beginning of the movie and she wanted the same one from the theater, not some modified crap. Obviously, she was talking about the screen that tells you the film has been modified to fit your tv screen. I asked her if she had watched the movie. No. She hadn’t wanted to bother since she knew it wasn’t what she wanted. I explained the modification was only to the size of the film, not the content. She gives me this blank stare and tells me not to blow smoke up her butt. Okay. I try again. Telling her to just take the movie home and watch it, promising that it’s the same movie.The customer became so upset that I had to call in both a CSM and the Electronics manager. They pulled her aside and tried to explain things to her with no success. The customer threw the DVD at us and stormed off.• A customer came in with a desktop computer to exchange. I asked him what was wrong with it and he told me it was an oversized paper weight. He said it did nothing and would not even turn on. I pulled it out of the box, plugged it up, hit the power button, and it immediately started booting up. The guy gapes at me for a moment before asking what I did. I told him I had plugged it in and pushed the power button. He said he hadn’t realized there was a power button. We packed it back up and he took it back home.

-

Is it possible to prepare for UPSC within 4 months?

This is my story. Only CSE aspirants can relate to this.I had left my job on 31st Jan 2017 and moved to my brother’s place in Ghaziabad from Bangalore. It was already February, 2017 when I started and the exam was to begin in June with the Prelims. And 4 months aren’t considered enough to comfortably finish the syllabus. Is it just a myth? I started reading the basic material from scratch for various subjects – Geography, History, Polity, Culture, and Environment. I finished the basic material by mid March along with basic current affairs (booklets of VisionIAS and Insights). I didn’t read any newspapers. Everything appeared to be simple until I started attempting questions of the past year. I also gave a mock test and got 57/200. This was pathetic.In order to qualify for next stage I would require around 120 marks to be on safe side. I thought that clearing the exam this year is too ambitious. Even if I cleared the prelims, I would surely not qualify for interview as I am not preparing for Mains in anyway- I was not following opinions in Newspapers, no answer writing practice, not even started on optional ie Mathematics which, I heard, requires generally 6-7 months for thorough preparation. Then if I am not qualifying this year, it means I have till June 2018 i.e., 16 months before I appear in the exam. This is a lot of time.When the application form for the exam came in March 2017, I decided to fill in as I felt that 6 allowed attempts are more than enough for me to try and if I fill the form I would at least spend my time productively preparing for the exam. I also signed up for a Prelims test series.Now, since I was not able to answer the questions in the past year exam, I decided to analyze further what was that I was missing. It appeared to me that the questions based on static portion of the syllabus could be solved from the basic material only if I can get a thorough grasp. Next, I started revision of all the basic books that I had read. I again gave a mock, the score declined to 54/200. :(Then I created notes from all the monthly current affairs modules collecting all the information that appeared relevant for the prelims. I did that because I had realized that before the actual exam, I would not be in a position to revise from so many pdfs. I reappeared in another mock and got 60/200. A little improvement but far from what is required. The month of March had ended.Unable to improve the score despite constant efforts was depressing. I looked at other available material that would help me and started reading that. It was a mistake as the cost-benefit ratio was very poor. I could hardly remember the new information and it was making the revision process very difficult. Therefore, I took a step back and restarted revision of my notes on current affairs, the basic books, and few chapters of year book. Did this process again and again and again. My score started improving slowly but steadily. I also enrolled for another prelims test series and there also my score was looking better test by test. By mid-May, I started feeling that I should be able to qualify given I continue my process of revision and solving mock tests.At the same time, I started reading PT365 materials, a lot of which was already familiar to me as I had prepared notes for monthly current affairs.Apart from knowledge, the prelims also requires calculated risk taking in the exam. A lot of questions can be solved only partially from the information we have, but still there remains a doubt among 2 options or 3 options. In such cases one cannot leave these questions, else it would be very difficult to get a score beyond 100. Here I used my intuition and attempted those question where I am able to eliminate 2 options and in some cases even when I could only eliminate one option but had a gut feeling towards right answer. Many times these guesses would turn out to be wrong, but overall contribution would remain positive. [out of 20 such questions 11 went wrong and 9 went correct, so I got 9 times 2 minus 11 times 2/3, which is positive]IPL and ICC Champions Trophy acted as stress buster during this time.Here is my test series score, the final 141/200 was just days before the prelims.This is how my revision plan looked.(Here PT is PT365 booklet- Vision+Insights; file, register, onenote, folded pages, etc are all my notes.)Now as I started scoring well in these modules, I came to conclusion that as I am reading their current affair material, I am bound to improve on my score as the questions are based out of that material itself. So, I tried online free pdf tests from few other sources and did reasonably well. One week before the actual prelims I realized that its highly likely that I would qualify in the prelims exam. But as my mains preparation were zero, I had a tough task ahead. Therefore, I had ordered notes for Mathematics 3 days before the prelims, in anticipation of success and to not waste any time if that happens.It was the day of ICC Champions Trophy final and India was to face Pak. India badly defeated Pakistan in an initial match but since then Pakistan team had gained new energy from somewhere and they defeated SA, SL and Eng to face India again in finals. Unfortunately, it was also the day of the Prelims exam for me, 18 June 2017.I took an early morning metro to signNow the venue. During my journey, I saw colorful coaching materials in hands of various aspirants and many were trying to revise in metro. I didn’t do that as I had been a student of probability. The expected value of such revision is negative in my opinion (you rarely get any question form that revision and such revision would not remain in your memory if its already not there, it also creates stress as you feel you don’t know so many things).Two hours exam and I attempted 85/100 questions, 55 of which I was sure of and rest attempted on probabilistic methods. Then CSAT was over by 4:30 pm. On my way back I got to know that Fakhar Zaman was playing well and India team was unable to get many wickets.As I signNowed my home, Pak had scored more than 300 and I checked that my score was around 140/200. Within few overs of Indian innings, I knew that Indian team had screwed up but fortunately I hadn’t.PS- I have added my test series score improvement pic to inspire future aspirants to keep working hard even when they don’t see big improvements. The results only show up after a time delay. Same with my timetable pic.See this for the books/ study material that I used in above phase. Tanmay Vashistha Sharma's answer to What was your optional subject? Can you give a fair booklist for every phase of the exam?I have received many messages regarding notes making for mains. Please have a look at this- Tanmay Vashistha Sharma's answer to How did you prepare for international relations for the UPSC?

-

I didn't file my taxes last year. What are the forms that I will have to fill out? When is the last day to do so?

If you are required to file a US return, you have until April 15 to file your Federal tax return.As far as "telling you how to" do it, or what forms you have to fill out - that's impossible without a review of your situation. It could be as simple as filing Form 1040EZ, Income Tax Return for Single and Joint Filers With No Dependents if you had no dependents, no income other than wages, interest, and/or unemployment compensation, no deductions other than the standard deduction, and no tax payments or credits other than withholding and the Earned Income Tax Credit (EITC). Every additional item of income, deduction, or credit can add an additional layer of complexity to the return you must file.You should consider a visit to a tax professional in your area - and you should do it quickly since you only have about two weeks left to file a return in the US.

-

Which is the last day to fill out the form for CPT December 2017?

Hi, Last date to register with ICAI for CPC course to appear in December 2017 exam is 01st October ‘2017. For more information about CA CPT exam, study material, past year question paper, sample paper and mock test you can visit Online classes for CA CPT, CA IPCC & CA Final from JK Shah Classes - CAPrep18

-

There is curfew in my area and Internet service is blocked, how can I fill my exam form as today is the last day to fill it out?

Spend less time using your blocked Internet to ask questions on Quora, andTravel back in time to when there was no curfew and you were playing Super Mario Kart, and instead, fill out your exam form.

Create this form in 5 minutes!

How to create an eSignature for the file this form by the last day of february

How to make an electronic signature for your File This Form By The Last Day Of February in the online mode

How to make an eSignature for the File This Form By The Last Day Of February in Google Chrome

How to create an electronic signature for signing the File This Form By The Last Day Of February in Gmail

How to generate an eSignature for the File This Form By The Last Day Of February straight from your smart phone

How to make an electronic signature for the File This Form By The Last Day Of February on iOS

How to make an eSignature for the File This Form By The Last Day Of February on Android OS

People also ask

-

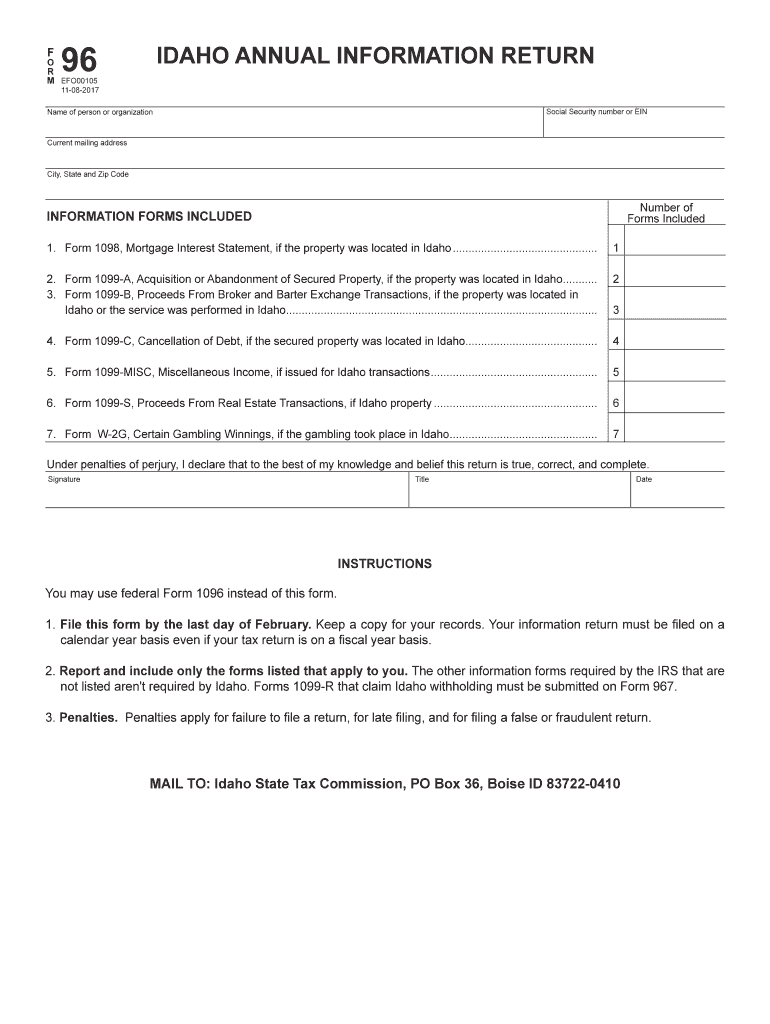

What is the form 96 return form?

The form 96 return form is a crucial document required for certain tax filings. It allows businesses to report their income accurately and ensure compliance with tax regulations. Understanding how to fill this form correctly can help avoid penalties and streamline your filing process.

-

How can airSlate SignNow assist with the form 96 return form?

airSlate SignNow simplifies the process of sending, receiving, and eSigning the form 96 return form. Our platform provides users with a secure and efficient way to handle these documents digitally. This not only saves time but also enhances accuracy in your submissions.

-

Is there a cost associated with using airSlate SignNow for the form 96 return form?

Yes, using airSlate SignNow involves a subscription plan that provides access to various features for managing forms like the form 96 return form. Pricing varies based on the selected plan, but it is designed to be cost-effective for businesses of all sizes. We also offer a free trial to help you evaluate our services.

-

What features does airSlate SignNow offer for managing the form 96 return form?

AirSlate SignNow offers features such as customizable templates, secure eSigning, and automated workflows for the form 96 return form. These tools help streamline your document management process and ensure that you always have access to the most recent version of your forms. Plus, all documents are stored securely in the cloud.

-

Can I integrate airSlate SignNow with other applications for the form 96 return form?

Absolutely! airSlate SignNow supports integrations with various applications that streamline your workflow related to the form 96 return form. Whether it's cloud storage services or CRMs, our platform can connect to multiple tools, enhancing your overall document management experience.

-

What are the benefits of using airSlate SignNow for the form 96 return form?

Using airSlate SignNow for the form 96 return form provides benefits like enhanced efficiency, reduced paper usage, and improved compliance. Our user-friendly interface makes it easy to send and sign documents, allowing you to focus on your core business activities. You can also track the status of your documents in real-time.

-

Is airSlate SignNow secure for handling sensitive information on the form 96 return form?

Yes, airSlate SignNow prioritizes your security, employing industry-standard encryption to protect your information related to the form 96 return form. We take data privacy seriously and comply with regulations to ensure that your documents are safe from unauthorized access. You can trust us to handle your sensitive tax documents.

Get more for Idaho Form 910

- Ldss 3113 form

- U s usda form usda vs 17 8 u s federal forms

- Ewing irrigation service visit checklist form

- G7 schb quarterly return form

- Kennebunk high school community service form rsu 21 rsu21

- Georgia s geography scavenger hunt schoolwires henry k12 ga form

- Internship inquiry email example form

- Navmc 10935 24419515 form

Find out other Idaho Form 910

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online