Types of Withholding Forms Idaho State Tax Commission 2023-2026

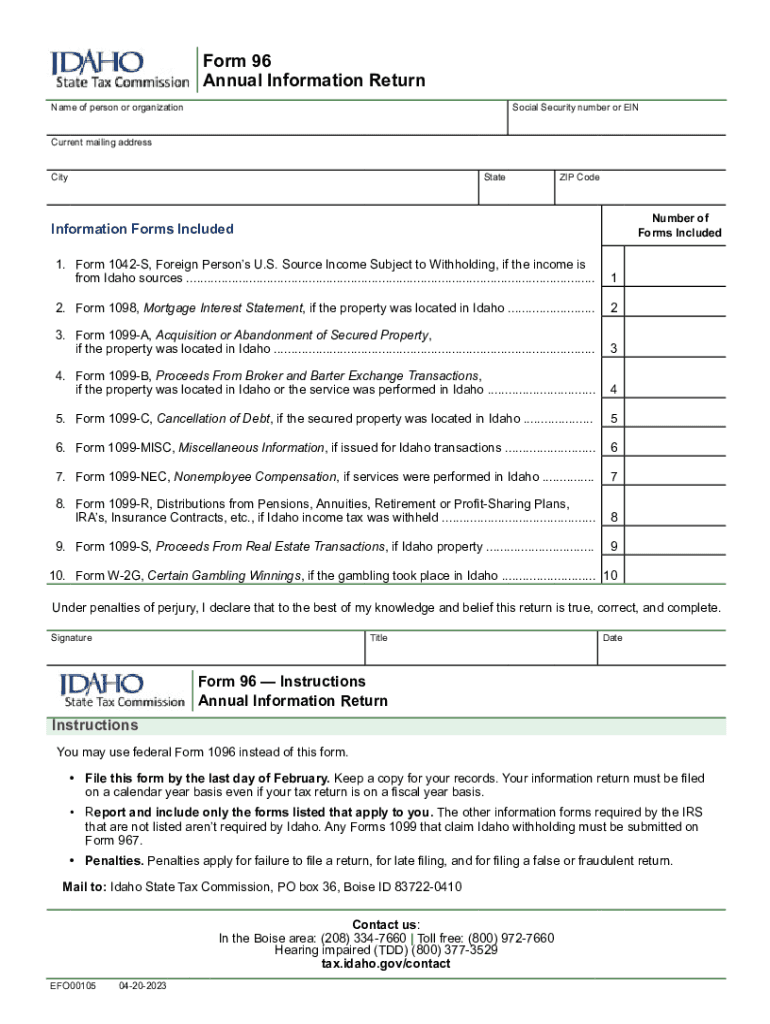

Overview of Idaho Form 96

Idaho Form 96, also known as the Idaho Individual Income Tax Return, is a crucial document for residents filing their state taxes. This form is specifically designed for individuals who need to report their income, deductions, and credits to the Idaho State Tax Commission. Understanding this form is essential for compliance and to ensure accurate tax reporting.

Key Elements of Idaho Form 96

When filling out Idaho Form 96, several key elements must be included:

- Personal Information: This includes your name, address, and Social Security number.

- Income Reporting: You must report all sources of income, including wages, interest, and dividends.

- Deductions and Credits: Identify any eligible deductions and tax credits that can reduce your taxable income.

- Tax Calculation: Accurately calculate your tax liability based on the information provided.

Steps to Complete Idaho Form 96

Completing Idaho Form 96 involves several steps to ensure accuracy:

- Gather all necessary documents, including W-2s and 1099s.

- Fill out your personal information at the top of the form.

- Report your total income from all sources.

- List any deductions and credits you qualify for.

- Calculate your total tax liability.

- Sign and date the form before submission.

Filing Deadlines for Idaho Form 96

It is important to be aware of the filing deadlines for Idaho Form 96 to avoid penalties:

- The standard deadline for filing is April 15 of each year.

- If you file for an extension, the extended deadline is typically October 15.

Form Submission Methods for Idaho Form 96

Idaho Form 96 can be submitted through various methods, ensuring convenience for taxpayers:

- Online Submission: Use the Idaho State Tax Commission's e-file system for quick processing.

- Mail: Send your completed form to the appropriate address provided by the tax commission.

- In-Person: Deliver your form directly to a local tax commission office.

Penalties for Non-Compliance with Idaho Form 96

Failing to file Idaho Form 96 on time or inaccurately can result in penalties:

- Late Filing Penalty: A percentage of the unpaid tax may be charged for each month the return is late.

- Interest Charges: Interest may accrue on any unpaid taxes from the due date until paid in full.

Create this form in 5 minutes or less

Find and fill out the correct types of withholding forms idaho state tax commission

Create this form in 5 minutes!

How to create an eSignature for the types of withholding forms idaho state tax commission

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Idaho Form 96?

The Idaho Form 96 is a legal document used for various purposes, including tax filings and business registrations in Idaho. Understanding its requirements is crucial for compliance. airSlate SignNow simplifies the process of completing and signing the Idaho Form 96 electronically.

-

How can airSlate SignNow help with the Idaho Form 96?

airSlate SignNow provides an easy-to-use platform for filling out and eSigning the Idaho Form 96. With our solution, you can streamline the document management process, ensuring that your forms are completed accurately and submitted on time.

-

Is there a cost associated with using airSlate SignNow for the Idaho Form 96?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our cost-effective solution ensures that you can manage the Idaho Form 96 and other documents without breaking the bank. Check our website for detailed pricing information.

-

What features does airSlate SignNow offer for the Idaho Form 96?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking specifically for the Idaho Form 96. These features enhance efficiency and ensure that your documents are handled securely and professionally.

-

Can I integrate airSlate SignNow with other software for the Idaho Form 96?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to manage the Idaho Form 96 alongside your existing tools. This seamless integration helps streamline your workflow and improve productivity.

-

What are the benefits of using airSlate SignNow for the Idaho Form 96?

Using airSlate SignNow for the Idaho Form 96 provides numerous benefits, including time savings, enhanced security, and improved accuracy. Our platform allows you to complete and sign documents quickly, reducing the risk of errors and ensuring compliance.

-

Is airSlate SignNow secure for handling the Idaho Form 96?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling the Idaho Form 96. Our platform uses advanced encryption and secure storage to protect your sensitive information throughout the signing process.

Get more for Types Of Withholding Forms Idaho State Tax Commission

- Gutter contract template form

- Vtu revaluation application form

- Government of rajasthan district e governance society jaipur form

- Gct form

- Axa equitable change of ownership form

- Beneath our feet the four layers of earth 629674590 form

- Application to transfer or retain a vehicle registration number form

- Form 3548

Find out other Types Of Withholding Forms Idaho State Tax Commission

- How Do I eSign Idaho Car Dealer Lease Termination Letter

- eSign Indiana Car Dealer Separation Agreement Simple

- eSign Iowa Car Dealer Agreement Free

- eSign Iowa Car Dealer Limited Power Of Attorney Free

- eSign Iowa Car Dealer Limited Power Of Attorney Fast

- eSign Iowa Car Dealer Limited Power Of Attorney Safe

- How Can I eSign Iowa Car Dealer Limited Power Of Attorney

- How To eSign Illinois Business Operations Stock Certificate

- Can I eSign Louisiana Car Dealer Quitclaim Deed

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement