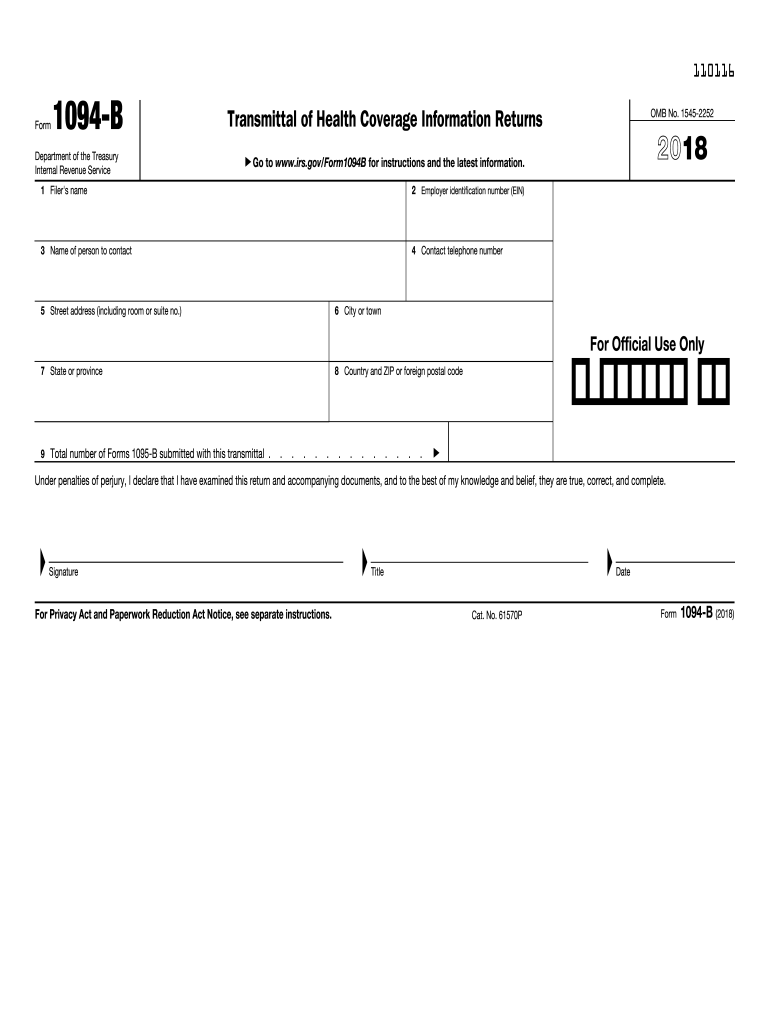

Irs Form 1094b 2018

What is the IRS Form 1094-B?

The IRS Form 1094-B is a transmittal form used to report health insurance coverage provided to individuals. It is part of the Affordable Care Act (ACA) requirements and must be submitted to the IRS by certain entities, such as health insurance issuers and self-insured employers. The form includes details about the coverage offered and the individuals covered under that plan. Understanding this form is crucial for compliance with federal regulations regarding health insurance reporting.

How to Use the IRS Form 1094-B

To effectively use the IRS Form 1094-B, begin by gathering all necessary information about the health coverage provided. This includes the names and Social Security numbers of covered individuals, along with the months they were covered. Once you have compiled this data, complete the form accurately, ensuring that all required fields are filled out. After completing the form, it must be submitted to the IRS, either electronically or by mail, depending on your filing preference.

Steps to Complete the IRS Form 1094-B

Completing the IRS Form 1094-B involves several key steps:

- Gather all relevant information about the health coverage provided, including the names and Social Security numbers of covered individuals.

- Fill out the form, ensuring that all required fields are completed accurately.

- Review the form for any errors or omissions before submission.

- Choose your submission method: electronic filing is recommended for efficiency and accuracy.

- Keep a copy of the completed form for your records.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines for the IRS Form 1094-B to avoid penalties. Generally, the form must be filed by the last day of February if submitting by mail or by March 31 if filing electronically. Additionally, ensure that you are aware of any changes in deadlines that may occur due to federal regulations or specific circumstances affecting your entity.

Legal Use of the IRS Form 1094-B

The IRS Form 1094-B must be used in accordance with federal regulations governing health insurance reporting. This means that only eligible entities should file the form, and it must accurately reflect the coverage provided. Failure to comply with these legal requirements can result in penalties, making it essential to understand the proper use of the form and to ensure that all information reported is truthful and complete.

Key Elements of the IRS Form 1094-B

Key elements of the IRS Form 1094-B include:

- Transmitter information, including the name and Employer Identification Number (EIN).

- Information about the health coverage, such as the type of coverage offered.

- Details about covered individuals, including their names and Social Security numbers.

- Months of coverage for each individual, indicating the time period they were covered.

Quick guide on how to complete 2017 1094 b 2018 2019 form

Uncover the easiest method to complete and endorse your Irs Form 1094b

Are you still spending time preparing your official papers on paper instead of doing it digitally? airSlate SignNow offers a superior approach to complete and endorse your Irs Form 1094b and related forms for public services. Our advanced eSignature platform equips you with all the tools necessary to edit, manage, secure, sign, and disseminate documents swiftly and in accordance with official standards - all accessible through a user-friendly interface.

Only a few steps are needed to finish completing and signing your Irs Form 1094b:

- Insert the fillable template into the editor by selecting the Get Form button.

- Identify the information required for your Irs Form 1094b.

- Move between the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to complete the fields with your information.

- Modify the content with Text boxes or Images from the top toolbar.

- Emphasize what is genuinely important or Cover up fields that are no longer relevant.

- Press Sign to create a legally valid eSignature using any preferred method.

- Add the Date beside your signature and conclude your task with the Done button.

Store your completed Irs Form 1094b in the Documents folder of your profile, download it, or transfer it to your preferred cloud storage solution. Our platform also provides adaptable form sharing options. There’s no need to print your templates when you need to submit them to the appropriate public office - send them via email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it out today!

Create this form in 5 minutes or less

Find and fill out the correct 2017 1094 b 2018 2019 form

FAQs

-

How do I fill out the NTSE form 2017- 2018 Jharkhand online?

You cannot gove NTSE online or at your own level you have to belong to a school which is conducting ntse. Then download the form online from the page of ntse, fill it and submit it to your school along with fee. If your school is not conducting ntse, sorry to say but you cannot give ntse. It can only be given through, no institutions are allowed to conduct thos exam.

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

What is the link of the official website to fill out the IBPS RRB 2017-2018 form?

Hello,The notification of IBPS RRB 2017–18 is soon going to be announce by the Officials.With this news, the candidates are now looking for the official links to apply for the IBPS RRB Exam and the complete Step by step procedure of how to apply online.The link of Official website to apply is given below:Welcome to IBPS ::Below are the steps to apply online for the exam.Firstly, visit the official link mentioned above.After click on the link ‘CWE RRB’ at the left side of the page.As soon as the official sources will release the IBPS RRB Notification 2017, the candidates will be able to see another link ‘Common Written Examination – Regional Rural Banks Phase VI’ on the page.After clicking on this link, you can start your IBPS RRB Online Application process.Enter all the required details and upload scanned photographs and signature to proceed with the registration process.After entering all these details, candidates will get a registration number and password through which they can login anytime and make changes in IBPS RRB Online Application.For the final submission, fee payment is required.Application Fee for Officer Scale (I, II & III) and Office Assistant – INR 100 for ST/SC/PWD Candidates and INR 600 for all others.The payment can be made by using Debit Cards (RuPay/ Visa/ MasterCard/ Maestro), Credit Cards, Internet Banking, IMPS, Cash Cards/ Mobile Wallets by providing information as asked on the screen.8. Check all the details before you finally submit the form.9. Take a print out of the form for future use.Hope the above information is useful for you!Thankyou!

-

Which session assignment must be submitted for 2nd year B.Com exam 2017-2018 or 2018-2019 if we have filled our form in January (2018)?

At the most at my time the teacher used to give us assignments of all subjects and there were dedlines to submit the assignment but there were projects and ennumber of things to submit in second year of bcom .Right now everything might be changed a bit more but it may be assignments .Ask your teachers about it and they will guide in right direction and in better manner and also remain in touch with friends if you are not attending the college this might help and not but not least all the bestThank you

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can we fill out the NEET application form (2018) in general after filling in SC (2017)?

Yes, you may do so. The details of the previous year shall not be carried forward in the current year. However, it can only be confirmed once the application form will be released.

Create this form in 5 minutes!

How to create an eSignature for the 2017 1094 b 2018 2019 form

How to make an eSignature for your 2017 1094 B 2018 2019 Form online

How to generate an electronic signature for your 2017 1094 B 2018 2019 Form in Chrome

How to create an electronic signature for signing the 2017 1094 B 2018 2019 Form in Gmail

How to generate an eSignature for the 2017 1094 B 2018 2019 Form from your smart phone

How to generate an electronic signature for the 2017 1094 B 2018 2019 Form on iOS devices

How to make an eSignature for the 2017 1094 B 2018 2019 Form on Android OS

People also ask

-

What is IRS Form 1094B and why do I need it?

IRS Form 1094B is a transmittal form used by health coverage providers to report information about health insurance coverage offered to employees. It is crucial for compliance with the Affordable Care Act (ACA), and businesses must submit it to avoid penalties. Using airSlate SignNow, you can easily eSign and submit your IRS Form 1094B to ensure timely and accurate reporting.

-

How does airSlate SignNow help with completing IRS Form 1094B?

airSlate SignNow simplifies the process of completing IRS Form 1094B by providing user-friendly templates and electronic signing capabilities. You'll save time by easily filling out necessary information and securely signing the form online. Our platform ensures that your IRS Form 1094B is completed accurately and efficiently.

-

Is there a cost associated with using airSlate SignNow for IRS Form 1094B?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solution provides unlimited eSigning and document management features, allowing you to handle IRS Form 1094B and other documents without breaking the bank. Explore our pricing options to find the plan that best suits your requirements.

-

Can I integrate airSlate SignNow with other software for IRS Form 1094B processing?

Absolutely! airSlate SignNow integrates seamlessly with popular software applications such as Google Drive, Dropbox, and various CRM systems. This means you can streamline your workflow and easily manage your IRS Form 1094B alongside other business documents, enhancing efficiency and productivity.

-

What are the benefits of using airSlate SignNow for IRS Form 1094B submission?

Using airSlate SignNow for IRS Form 1094B submission offers numerous benefits, including enhanced security, faster processing times, and ease of use. Our platform ensures that your documents are securely stored and can be accessed anytime, giving you peace of mind while maintaining compliance with IRS regulations.

-

How can I ensure my IRS Form 1094B is compliant when using airSlate SignNow?

To ensure compliance when using airSlate SignNow for IRS Form 1094B, make sure to fill out all required fields accurately and review your information before submission. Our platform provides helpful reminders and guidelines to assist you throughout the process, ensuring your form meets IRS standards.

-

What features does airSlate SignNow provide for managing IRS Form 1094B?

airSlate SignNow offers features such as customizable templates, electronic signatures, and document tracking to help you manage IRS Form 1094B efficiently. With our intuitive interface, you can create, edit, and securely sign your forms, making the entire process hassle-free and organized.

Get more for Irs Form 1094b

- Downloads blank music form

- Florida realtor far bar as is 2003 form

- Dr 309639 form

- 1942 54 form

- Fire safety risk assessment for small to medium sized premises form

- West virginia abstract form

- Residential guarantee of applicants electric bill duke energy form

- Final judgment and decree long form free divorce forms

Find out other Irs Form 1094b

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy