About Form 1094 BInternal Revenue Service IRS Gov 2016

What is the About Form 1094 BInternal Revenue Service IRS gov

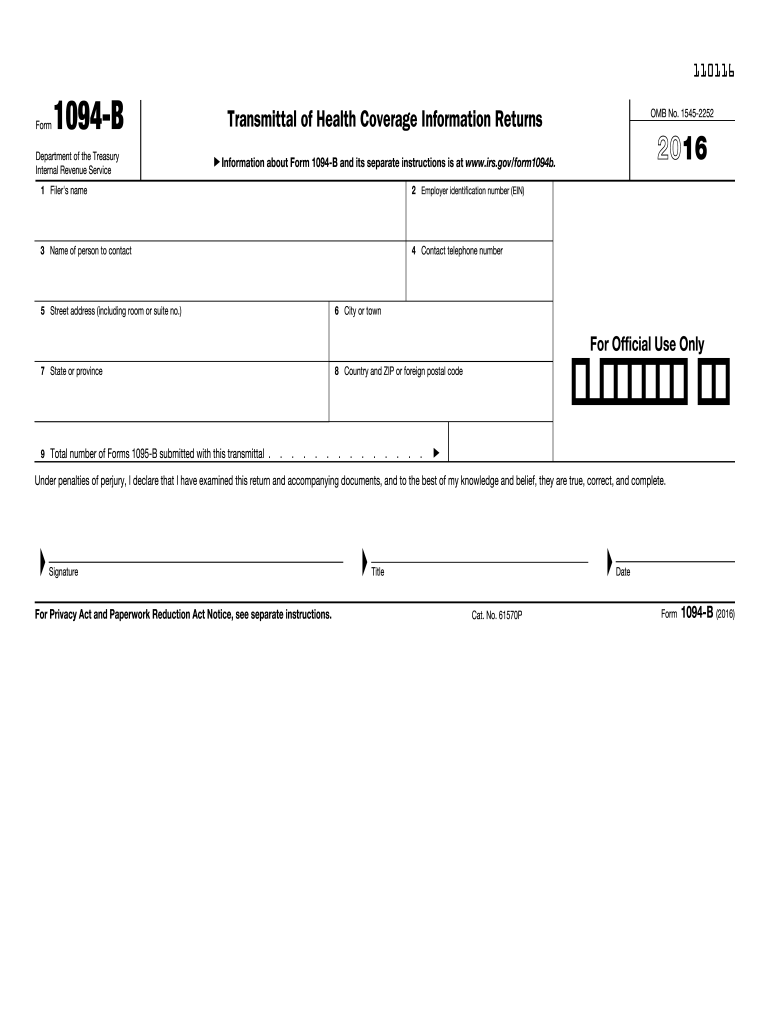

The About Form 1094-B is an important document issued by the Internal Revenue Service (IRS) that serves as a transmittal form for information returns filed under section 6055. This form is primarily used by health coverage providers to report information about individuals who are covered under minimum essential coverage. It helps the IRS ensure compliance with the Affordable Care Act (ACA) and facilitates the verification of health coverage for taxpayers. Understanding this form is crucial for both providers and recipients to ensure accurate reporting and compliance with federal regulations.

Steps to complete the About Form 1094 BInternal Revenue Service IRS gov

Completing the About Form 1094-B involves several key steps to ensure accurate reporting. First, gather all necessary information about your health coverage and the individuals covered. This includes names, addresses, and Social Security numbers. Next, fill out the form by providing details such as the name and Employer Identification Number (EIN) of the reporting entity. Ensure that all covered individuals are listed accurately. After completing the form, review it for any errors before submission. Finally, submit the form to the IRS by the specified deadline, either electronically or via mail, depending on your reporting method.

Legal use of the About Form 1094 BInternal Revenue Service IRS gov

The About Form 1094-B is legally binding when completed and submitted according to IRS guidelines. It must be filled out accurately to comply with federal regulations regarding health coverage reporting. Incorrect or incomplete information can lead to penalties or issues with compliance. The form serves as a crucial record for both the reporting entity and the IRS, ensuring that individuals receive proper credit for their health coverage when filing taxes. It is essential to retain copies of the submitted form and any related documentation for record-keeping purposes.

Filing Deadlines / Important Dates

Timely filing of the About Form 1094-B is critical to avoid penalties. The IRS typically sets specific deadlines for submission, which may vary based on whether the form is filed electronically or by mail. Generally, the deadline for filing the form with the IRS is the last day of February for paper filings and the last day of March for electronic submissions. It is advisable to check the IRS website or consult the latest guidelines for any updates or changes to these deadlines, as they can impact compliance and reporting requirements.

Form Submission Methods (Online / Mail / In-Person)

The About Form 1094-B can be submitted through various methods, providing flexibility for reporting entities. For electronic submissions, the IRS offers an online filing option that is often preferred for its efficiency and speed. Alternatively, the form can be mailed to the appropriate IRS address designated for tax returns. In-person submission is generally not an option for this form, as it is primarily processed through electronic or mail channels. Ensure that you choose the method that best suits your needs and complies with IRS requirements.

Penalties for Non-Compliance

Failure to file the About Form 1094-B accurately and on time can result in significant penalties. The IRS imposes fines for late filings, incorrect information, or failure to file altogether. These penalties can accumulate quickly, especially for large organizations with multiple filings. It is crucial to understand the potential consequences of non-compliance and to take proactive measures to ensure that all reporting is completed accurately and within the required timelines to avoid financial repercussions.

Quick guide on how to complete about form 1094 binternal revenue service irsgov

Complete About Form 1094 BInternal Revenue Service IRS gov effortlessly on any device

Digital document management has surged in popularity among businesses and individuals. It offers an ideal environmentally-friendly replacement for conventional printed and signed papers, as you can access the appropriate format and securely keep it online. airSlate SignNow equips you with all the tools you require to create, edit, and electronically sign your documents quickly without interruptions. Handle About Form 1094 BInternal Revenue Service IRS gov on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign About Form 1094 BInternal Revenue Service IRS gov with ease

- Locate About Form 1094 BInternal Revenue Service IRS gov and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of your documents or redact sensitive details using tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose how you wish to submit your form, via email, SMS, invite link, or download it to your computer.

Put an end to misplaced or lost documents, tedious form searches, and mistakes that necessitate printing new document versions. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and electronically sign About Form 1094 BInternal Revenue Service IRS gov and guarantee outstanding communication at any point of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 1094 binternal revenue service irsgov

Create this form in 5 minutes!

How to create an eSignature for the about form 1094 binternal revenue service irsgov

How to generate an electronic signature for your About Form 1094 Binternal Revenue Service Irsgov online

How to create an eSignature for the About Form 1094 Binternal Revenue Service Irsgov in Chrome

How to create an electronic signature for putting it on the About Form 1094 Binternal Revenue Service Irsgov in Gmail

How to create an electronic signature for the About Form 1094 Binternal Revenue Service Irsgov right from your smartphone

How to generate an eSignature for the About Form 1094 Binternal Revenue Service Irsgov on iOS devices

How to generate an electronic signature for the About Form 1094 Binternal Revenue Service Irsgov on Android devices

People also ask

-

What is Form 1094 B and why is it important?

Form 1094 B is used to report compliance information to the IRS regarding health coverage provided to employees. Understanding about Form 1094 BInternal Revenue Service IRS gov is crucial for businesses to ensure they meet federal reporting requirements and avoid potential penalties.

-

How can airSlate SignNow assist with Form 1094 B?

airSlate SignNow allows businesses to easily prepare, eSign, and store Form 1094 B documents securely. This efficient process minimizes the risk of errors and ensures compliance with about Form 1094 BInternal Revenue Service IRS gov. You can streamline your documentation workflow and stay organized.

-

Is there a cost associated with using airSlate SignNow for Form 1094 B?

airSlate SignNow offers a cost-effective solution with various pricing plans tailored to different business sizes. Knowing about Form 1094 BInternal Revenue Service IRS gov can help you determine the necessary features you need, making it easier to choose a suitable plan.

-

What features does airSlate SignNow offer for document management related to IRS forms?

With airSlate SignNow, you can access features like customizable document templates, secure eSigning, and automated reminders. These features ensure that you stay on track with critical documentation like about Form 1094 BInternal Revenue Service IRS gov and simplify the signing process.

-

Can I integrate airSlate SignNow with other applications for better management of Form 1094 B?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing your ability to manage documents related to about Form 1094 BInternal Revenue Service IRS gov. This versatility allows you to streamline your workflow and improve productivity across different platforms.

-

What benefits can I expect when using airSlate SignNow for compliance reporting?

Using airSlate SignNow for compliance reporting provides multiple benefits, including improved accuracy, enhanced security, and signNow time savings. By understanding about Form 1094 BInternal Revenue Service IRS gov, you'll be able to manage your compliance requirements effectively and minimize stress.

-

Does airSlate SignNow offer support for users dealing with Form 1094 B issues?

Absolutely! airSlate SignNow provides support services to help users navigate any issues related to Form 1094 B. Our knowledgeable team is available to guide you through questions pertaining to about Form 1094 BInternal Revenue Service IRS gov and ensure you have all the necessary resources.

Get more for About Form 1094 BInternal Revenue Service IRS gov

Find out other About Form 1094 BInternal Revenue Service IRS gov

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself