About Form 1094 BInternal Revenue Service IRS Gov 2016

What is the About Form 1094 BInternal Revenue Service IRS gov

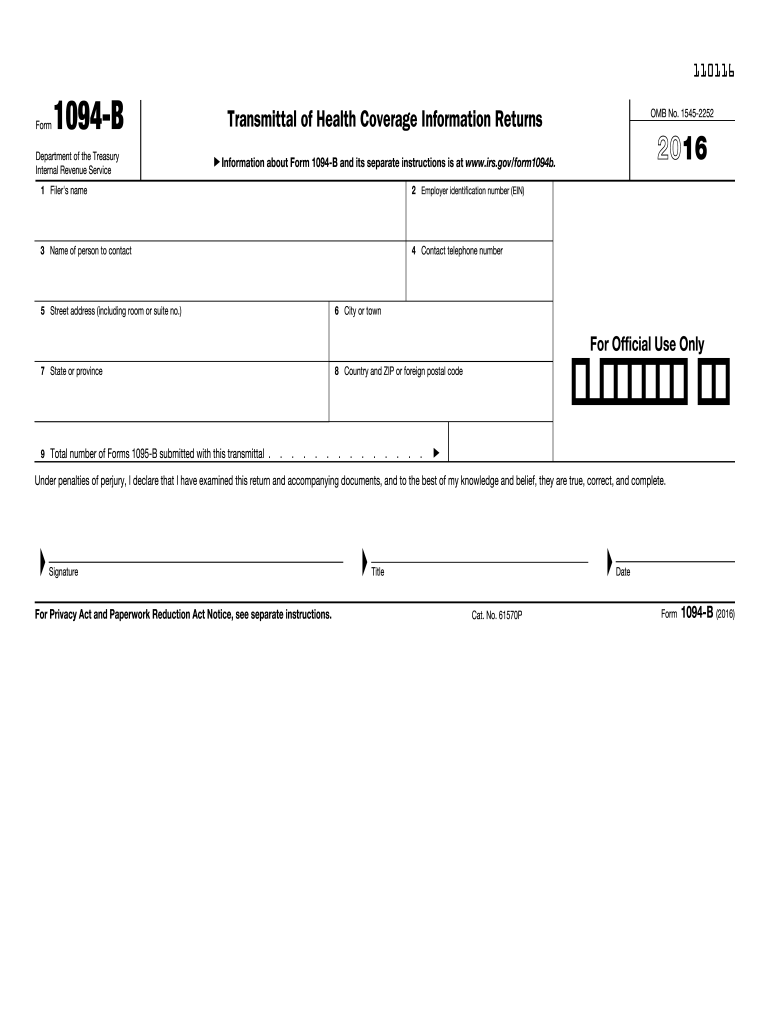

The About Form 1094-B is an important document issued by the Internal Revenue Service (IRS) that serves as a transmittal form for information returns filed under section 6055. This form is primarily used by health coverage providers to report information about individuals who are covered under minimum essential coverage. It helps the IRS ensure compliance with the Affordable Care Act (ACA) and facilitates the verification of health coverage for taxpayers. Understanding this form is crucial for both providers and recipients to ensure accurate reporting and compliance with federal regulations.

Steps to complete the About Form 1094 BInternal Revenue Service IRS gov

Completing the About Form 1094-B involves several key steps to ensure accurate reporting. First, gather all necessary information about your health coverage and the individuals covered. This includes names, addresses, and Social Security numbers. Next, fill out the form by providing details such as the name and Employer Identification Number (EIN) of the reporting entity. Ensure that all covered individuals are listed accurately. After completing the form, review it for any errors before submission. Finally, submit the form to the IRS by the specified deadline, either electronically or via mail, depending on your reporting method.

Legal use of the About Form 1094 BInternal Revenue Service IRS gov

The About Form 1094-B is legally binding when completed and submitted according to IRS guidelines. It must be filled out accurately to comply with federal regulations regarding health coverage reporting. Incorrect or incomplete information can lead to penalties or issues with compliance. The form serves as a crucial record for both the reporting entity and the IRS, ensuring that individuals receive proper credit for their health coverage when filing taxes. It is essential to retain copies of the submitted form and any related documentation for record-keeping purposes.

Filing Deadlines / Important Dates

Timely filing of the About Form 1094-B is critical to avoid penalties. The IRS typically sets specific deadlines for submission, which may vary based on whether the form is filed electronically or by mail. Generally, the deadline for filing the form with the IRS is the last day of February for paper filings and the last day of March for electronic submissions. It is advisable to check the IRS website or consult the latest guidelines for any updates or changes to these deadlines, as they can impact compliance and reporting requirements.

Form Submission Methods (Online / Mail / In-Person)

The About Form 1094-B can be submitted through various methods, providing flexibility for reporting entities. For electronic submissions, the IRS offers an online filing option that is often preferred for its efficiency and speed. Alternatively, the form can be mailed to the appropriate IRS address designated for tax returns. In-person submission is generally not an option for this form, as it is primarily processed through electronic or mail channels. Ensure that you choose the method that best suits your needs and complies with IRS requirements.

Penalties for Non-Compliance

Failure to file the About Form 1094-B accurately and on time can result in significant penalties. The IRS imposes fines for late filings, incorrect information, or failure to file altogether. These penalties can accumulate quickly, especially for large organizations with multiple filings. It is crucial to understand the potential consequences of non-compliance and to take proactive measures to ensure that all reporting is completed accurately and within the required timelines to avoid financial repercussions.

Quick guide on how to complete about form 1094 binternal revenue service irsgov

Complete About Form 1094 BInternal Revenue Service IRS gov effortlessly on any device

Digital document management has surged in popularity among businesses and individuals. It offers an ideal environmentally-friendly replacement for conventional printed and signed papers, as you can access the appropriate format and securely keep it online. airSlate SignNow equips you with all the tools you require to create, edit, and electronically sign your documents quickly without interruptions. Handle About Form 1094 BInternal Revenue Service IRS gov on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign About Form 1094 BInternal Revenue Service IRS gov with ease

- Locate About Form 1094 BInternal Revenue Service IRS gov and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of your documents or redact sensitive details using tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose how you wish to submit your form, via email, SMS, invite link, or download it to your computer.

Put an end to misplaced or lost documents, tedious form searches, and mistakes that necessitate printing new document versions. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and electronically sign About Form 1094 BInternal Revenue Service IRS gov and guarantee outstanding communication at any point of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 1094 binternal revenue service irsgov

Create this form in 5 minutes!

How to create an eSignature for the about form 1094 binternal revenue service irsgov

How to generate an electronic signature for your About Form 1094 Binternal Revenue Service Irsgov online

How to create an eSignature for the About Form 1094 Binternal Revenue Service Irsgov in Chrome

How to create an electronic signature for putting it on the About Form 1094 Binternal Revenue Service Irsgov in Gmail

How to create an electronic signature for the About Form 1094 Binternal Revenue Service Irsgov right from your smartphone

How to generate an eSignature for the About Form 1094 Binternal Revenue Service Irsgov on iOS devices

How to generate an electronic signature for the About Form 1094 Binternal Revenue Service Irsgov on Android devices

People also ask

-

What is Form 1094 B and how is it related to the IRS?

Form 1094 B is a transmittal form that businesses use to report information to the Internal Revenue Service (IRS) about health coverage provided to employees. Understanding About Form 1094 BInternal Revenue Service IRS gov is essential for compliance with ACA regulations. It helps ensure that your organization properly communicates health coverage details to the IRS.

-

Why do I need to eSign Form 1094 B?

eSigning Form 1094 B streamlines the process of submitting your health coverage information to the IRS. By utilizing airSlate SignNow, you can securely eSign this important document, ensuring that it is legally binding and efficiently submitted. This simplifies compliance with About Form 1094 BInternal Revenue Service IRS gov requirements.

-

What features does airSlate SignNow offer for managing Form 1094 B?

airSlate SignNow provides features like customizable templates, secure cloud storage, and easy document tracking for Form 1094 B. These tools make it easier to manage your submissions while ensuring compliance with About Form 1094 BInternal Revenue Service IRS gov regulations. Plus, our user-friendly interface simplifies the eSigning process.

-

How does airSlate SignNow ensure the security of my Form 1094 B documents?

At airSlate SignNow, we prioritize the security of your Form 1094 B documents with advanced encryption and compliance with industry standards. We understand the importance of confidentiality when dealing with About Form 1094 BInternal Revenue Service IRS gov submissions, thus providing a secure platform for all your eSigning needs.

-

Can I integrate airSlate SignNow with my existing software for Form 1094 B?

Yes, airSlate SignNow offers seamless integrations with various software platforms, making it easy to manage Form 1094 B alongside your existing systems. This integration capability enhances your workflow efficiency while ensuring compliance with About Form 1094 BInternal Revenue Service IRS gov requirements.

-

What is the pricing structure for airSlate SignNow services related to Form 1094 B?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes looking to manage Form 1094 B efficiently. By providing a cost-effective solution, we ensure that you can meet your compliance needs without overspending, all while adhering to About Form 1094 BInternal Revenue Service IRS gov guidelines.

-

How can airSlate SignNow help me stay compliant with Form 1094 B submissions?

With airSlate SignNow, you can easily track and manage your Form 1094 B submissions, ensuring timely and accurate filings. Our platform is designed to help you navigate the complexities of About Form 1094 BInternal Revenue Service IRS gov compliance, keeping your business aligned with federal regulations.

Get more for About Form 1094 BInternal Revenue Service IRS gov

Find out other About Form 1094 BInternal Revenue Service IRS gov

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation