1094 B Download 2023

Understanding the 1094 B Download

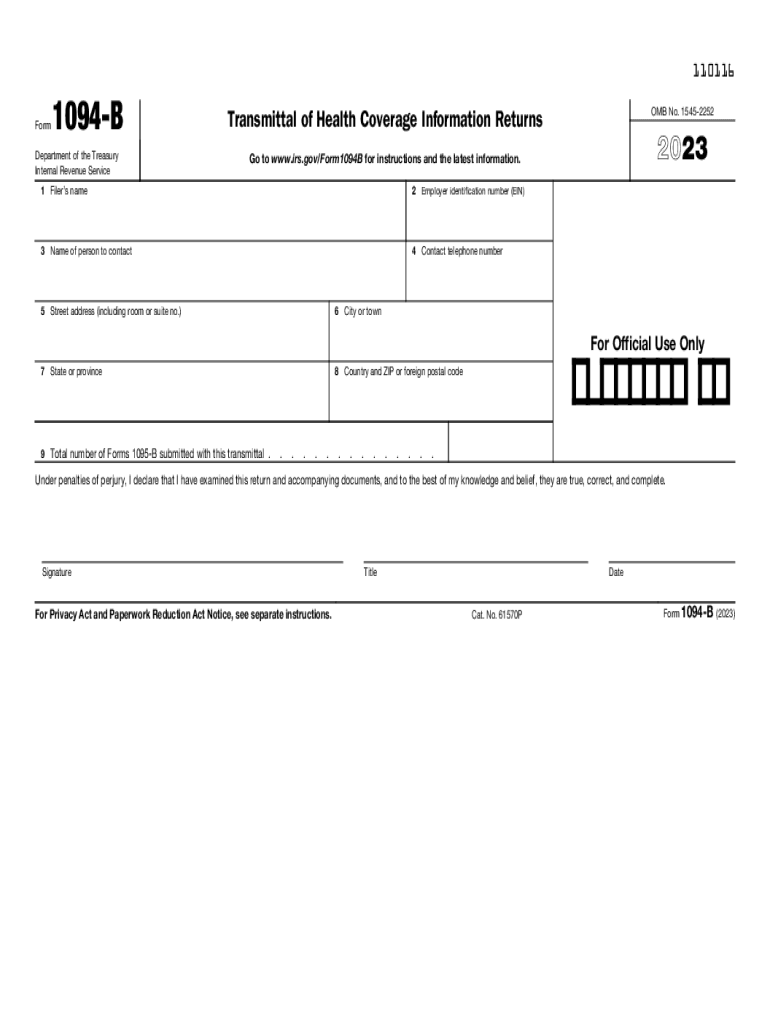

The 1094 B form serves as a transmittal document for information regarding health coverage provided to individuals. It is crucial for employers and health coverage providers to report this data accurately to the IRS. The form is specifically designed for those who offer minimum essential coverage and must be submitted alongside the 1095 B forms, which provide detailed information about each covered individual. Understanding the structure and purpose of the 1094 B is essential for compliance with IRS regulations.

Steps to Complete the 1094 B Download

Completing the 1094 B form requires careful attention to detail. The following steps can guide you through the process:

- Download the form: Obtain the latest version of the 1094 B form from the IRS website or trusted sources.

- Fill in your information: Enter the name of the reporting entity, Employer Identification Number (EIN), and contact details.

- Provide coverage information: Indicate the number of 1095 B forms being filed and the type of coverage provided.

- Review for accuracy: Ensure all information is correct and complete to avoid delays in processing.

- Submit the form: Choose your submission method—electronically or by mail—based on your preference and requirements.

IRS Guidelines for the 1094 B Download

The IRS has established clear guidelines for the completion and submission of the 1094 B form. These guidelines include:

- Filing deadlines: The form must be submitted by the specified deadlines to avoid penalties.

- Correct format: Use the official form and ensure all fields are filled out as required.

- Electronic filing: If filing electronically, ensure that you are using IRS-approved software that meets all technical specifications.

Legal Use of the 1094 B Download

The 1094 B form is legally required for certain employers and health coverage providers under the Affordable Care Act. It ensures compliance with federal regulations regarding health coverage reporting. Failure to file this form can result in penalties imposed by the IRS. Therefore, understanding the legal implications of the form is vital for any entity that provides health insurance coverage.

Filing Deadlines for the 1094 B Download

Filing deadlines for the 1094 B form are critical for compliance. Typically, the form must be submitted to the IRS by the last day of February for paper filings or by March thirty-first for electronic submissions. It is essential to stay informed about any changes to these deadlines, as they can vary from year to year. Late submissions may incur penalties, making timely filing a priority for all reporting entities.

Required Documents for the 1094 B Download

To complete the 1094 B form, certain documents are necessary. These may include:

- Employer Identification Number (EIN): Required for identifying the reporting entity.

- 1095 B forms: These forms detail the individual coverage information that corresponds with the 1094 B.

- Coverage details: Information about the type of health coverage provided, including the number of covered individuals.

Quick guide on how to complete 1094 b download

Complete 1094 B Download effortlessly on any device

Web-based document management has become increasingly popular among companies and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage 1094 B Download on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign 1094 B Download with ease

- Obtain 1094 B Download and then click Get Form to begin.

- Utilize the tools we supply to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with features that airSlate SignNow provides specifically for this purpose.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form retrieval, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device of your choice. Alter and eSign 1094 B Download and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1094 b download

Create this form in 5 minutes!

How to create an eSignature for the 1094 b download

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1094 b form and why is it important?

The 1094 b form is a crucial IRS document that provides information about health coverage provided to employees. It is essential for compliance with the Affordable Care Act, helping businesses avoid penalties. Proper management of this form ensures your organization is safely reporting employee health coverage.

-

How can airSlate SignNow help with 1094 b form management?

airSlate SignNow offers a streamlined solution for managing and signing your 1094 b forms securely. With easy document sharing and eSigning capabilities, businesses can ensure timely submissions and compliance. This will save time and reduce the stress associated with form management.

-

What are the pricing options for using airSlate SignNow for 1094 b forms?

airSlate SignNow provides flexible pricing plans to fit various business needs. Whether you are a small business or a large enterprise, there's a plan that can accommodate your requirements for managing documents like the 1094 b. For specific pricing details, visit our website to explore the options available.

-

Are there any integrations available for airSlate SignNow when handling 1094 b forms?

Yes, airSlate SignNow integrates seamlessly with popular software and applications to simplify your 1094 b form processes. Easily connect with tools like CRM systems and document management platforms for a smooth workflow. This level of integration enhances efficiency in handling important documents.

-

What security measures does airSlate SignNow provide for 1094 b documents?

AirSlate SignNow prioritizes the security of your documents, including the 1094 b forms, by using advanced encryption protocols. Your data is protected both in transit and at rest, ensuring that sensitive information remains confidential. Compliance with industry standards further enhances the security of your documents.

-

Can I track the status of my 1094 b forms with airSlate SignNow?

Yes, airSlate SignNow offers tracking features that allow you to monitor the status of your 1094 b forms in real-time. You can easily see who has viewed or signed the document, helping you stay organized. This visibility ensures that you can manage deadlines effectively.

-

Is it easy to collaborate with others on 1094 b forms using airSlate SignNow?

Absolutely! airSlate SignNow simplifies collaboration on 1094 b forms by allowing multiple users to review and sign documents simultaneously. This feature enhances teamwork and accelerates the process of getting forms finalized. Real-time updates ensure that everyone is on the same page.

Get more for 1094 B Download

Find out other 1094 B Download

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document