#10 Comm Office 2022

IRS Guidelines

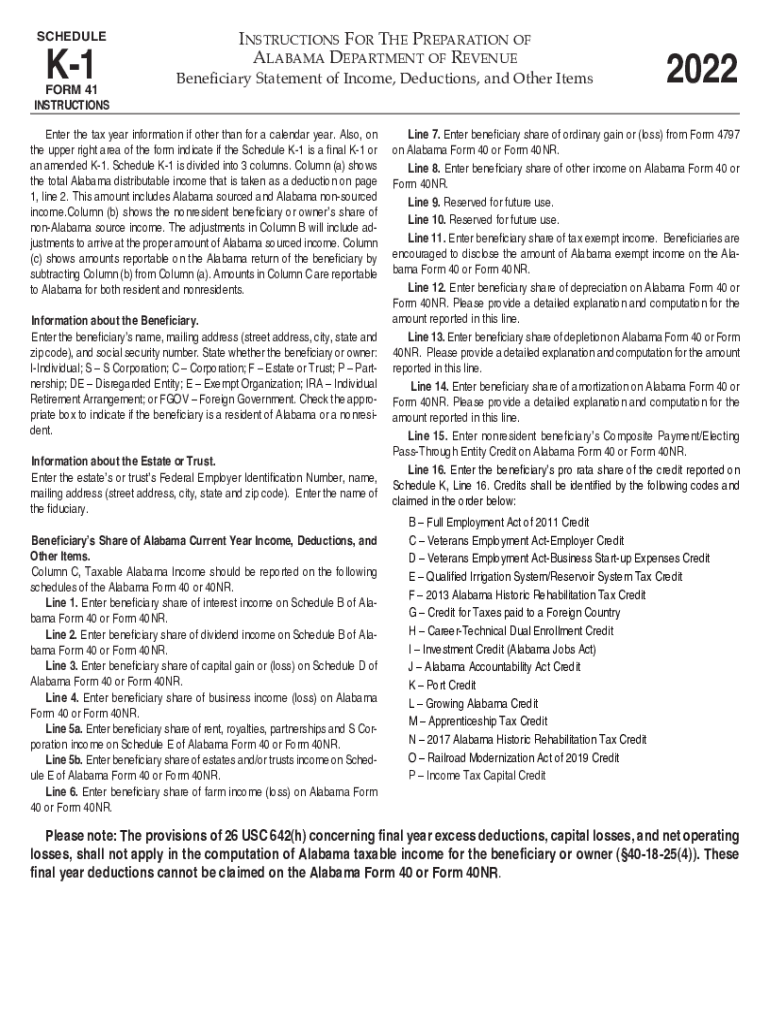

The Schedule K-1 form is crucial for reporting income, deductions, and credits from partnerships, S corporations, estates, and trusts. The IRS requires that the K-1 be accurately completed to ensure proper tax reporting. Each partner or shareholder receives a K-1 to report their share of the entity's income on their personal tax returns. It is essential to follow the IRS guidelines closely when filling out the form to avoid penalties or delays in processing your tax return.

Filing Deadlines / Important Dates

For partnerships and S corporations, the Schedule K-1 must be issued to partners and shareholders by March 15 of the following tax year. This deadline is critical for ensuring that all income is reported accurately on individual tax returns, which are typically due on April 15. If the entity files for an extension, the K-1 must still be distributed by the extended deadline, which is September 15 for partnerships and S corporations.

Required Documents

To complete the Schedule K-1, gather all necessary financial documents related to the partnership or S corporation. This includes the entity's tax return, profit and loss statements, and any documentation that outlines distributions, contributions, or other relevant financial transactions. Having accurate records will help ensure that the K-1 is filled out correctly and reflects the true financial position of the entity.

Form Submission Methods (Online / Mail / In-Person)

Schedule K-1 can be submitted electronically or via mail, depending on the type of entity. Partnerships and S corporations that file electronically must ensure that their software is compatible with IRS e-filing requirements. For those submitting by mail, it is essential to send the K-1 along with the entity's tax return. In-person submissions are typically not applicable for K-1 forms, as they are primarily filed with the IRS through electronic or postal methods.

Penalties for Non-Compliance

Failure to file a Schedule K-1 on time can result in penalties for both the entity and the individual partners or shareholders. The IRS imposes fines for late filings, which can accumulate if the form is not submitted within the required timeframe. Additionally, individuals may face issues with their tax returns, including delays in processing or incorrect tax assessments, if the K-1 is not accurately completed and submitted.

Taxpayer Scenarios (e.g., self-employed, retired, students)

Understanding how the Schedule K-1 affects different taxpayer scenarios is important. For self-employed individuals, the K-1 may report income that must be included in their self-employment calculations. Retired individuals receiving K-1s from trusts or estates need to be aware of how this income impacts their retirement distributions. Students may receive K-1s from family-owned businesses, which can influence their tax filings and eligibility for financial aid. Each scenario requires careful consideration of how the K-1 income is reported on personal tax returns.

Quick guide on how to complete 10 comm office

Prepare #10 Comm Office easily on any gadget

Digital document management has become widely accepted among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can obtain the appropriate template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle #10 Comm Office on any gadget with airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

The simplest way to modify and eSign #10 Comm Office seamlessly

- Locate #10 Comm Office and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant portions of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign #10 Comm Office and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 10 comm office

Create this form in 5 minutes!

How to create an eSignature for the 10 comm office

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Schedule K1 instructions?

Schedule K1 instructions are a set of guidelines for partners in a partnership or S corporations to report their income, deductions, and credits on their individual tax returns. Understanding these instructions is crucial for accurate tax reporting and compliance. Familiarizing yourself with Schedule K1 instructions helps ensure that you complete your tax forms correctly.

-

How can airSlate SignNow assist with Schedule K1 instructions?

airSlate SignNow streamlines the document signing process, making it easier for businesses to manage their Schedule K1 forms. Our platform lets you securely eSign and send documents, ensuring that all parties receive the Schedule K1 instructions and forms promptly. With airSlate SignNow, the complexity of tax-related documentation is simplified.

-

Are there any costs associated with using airSlate SignNow for Schedule K1 instructions?

Yes, airSlate SignNow offers various pricing plans designed to accommodate different business needs. Our cost-effective solutions ensure that you can access features that assist with Schedule K1 instructions without breaking the bank. Check our pricing page for more details on available plans.

-

What features does airSlate SignNow offer for handling Schedule K1 instructions?

airSlate SignNow provides features like customizable templates, secure eSigning, and real-time tracking for document workflows. These features are particularly useful for managing Schedule K1 instructions, helping you streamline your processes while ensuring accuracy and security. With these tools, you can focus more on your core business activities.

-

Can I integrate airSlate SignNow with other software for Schedule K1 instructions?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and document management software. This allows you to effortlessly manage your Schedule K1 instructions alongside your other business processes, enhancing efficiency and reducing the risk of errors. Check our integration options to find the ones that work for you.

-

Is airSlate SignNow suitable for individuals handling Schedule K1 instructions?

Yes, airSlate SignNow is suitable for both businesses and individuals dealing with Schedule K1 instructions. Our user-friendly interface makes it easy for anyone to eSign documents and manage their tax-related forms with confidence. Whether you are a sole proprietor or part of a larger entity, airSlate SignNow can streamline your paperwork.

-

How does airSlate SignNow enhance compliance for Schedule K1 instructions?

airSlate SignNow enhances compliance with Schedule K1 instructions by offering secure and traceable eSigning capabilities. This ensures that all signers have access to the correct documents and can verify their completion at each step. Maintaining compliance has never been easier, thanks to our documented workflows and audit trails.

Get more for #10 Comm Office

- Confidential statement of parties for child support order wyoming form

- Wyoming decree divorce 497432506 form

- Wyoming withholding form

- Certificate of mailing decree of divorce wyoming form

- Living trust for husband and wife with no children wyoming form

- Living trust for individual who is single divorced or widow or widower with no children wyoming form

- Wyoming trust form

- Living trust for husband and wife with one child wyoming form

Find out other #10 Comm Office

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT