Schedule K 1 Form 41 Instructions TY 20231 19 24F PDF 2023-2026

Understanding the Schedule K-1 Form

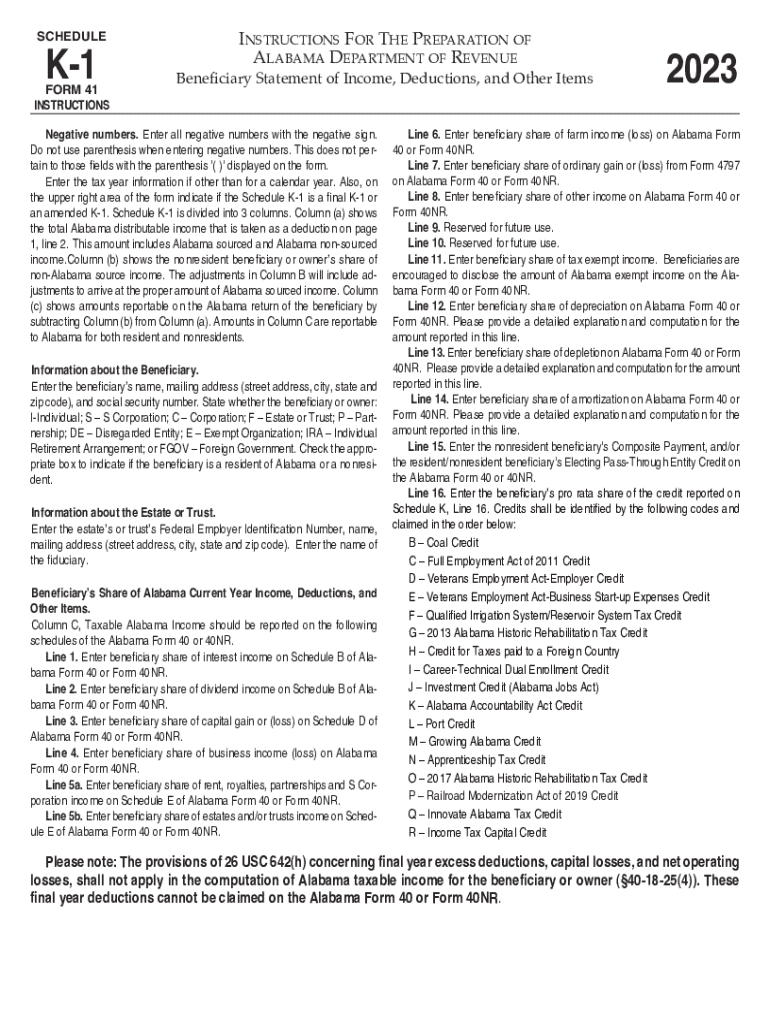

The Schedule K-1 form is a crucial document used in the United States tax system, primarily for reporting income, deductions, and credits from partnerships, S corporations, estates, and trusts. Each partner or shareholder receives a K-1, which details their share of the entity's income, losses, and other tax-related items. This form is essential for accurately reporting income on individual tax returns and ensuring compliance with IRS regulations.

Steps to Complete the Schedule K-1 Form

Completing the Schedule K-1 form involves several key steps:

- Gather necessary information: Collect details about the partnership or S corporation, including its name, address, and Employer Identification Number (EIN).

- Report income and deductions: Fill out the income, deductions, and credits sections based on the entity's financial statements.

- Distribute shares: Indicate each partner’s or shareholder’s share of income, losses, and other items accurately.

- Review and verify: Ensure all information is correct and complete to avoid discrepancies during tax filing.

Key Elements of the Schedule K-1 Form

The Schedule K-1 form includes several important sections that taxpayers must understand:

- Part I: Information about the partnership or S corporation, including its name and EIN.

- Part II: Information about the partner or shareholder, including their name, address, and tax identification number.

- Part III: Details of the income, deductions, and credits allocated to the partner or shareholder.

Each part is essential for accurately reporting income on individual tax returns and ensuring compliance with IRS requirements.

Filing Deadlines for the Schedule K-1 Form

Filing deadlines for the Schedule K-1 form are critical for compliance. Partnerships and S corporations must provide K-1s to their partners and shareholders by March 15 for the previous tax year. Recipients must then use the information to complete their individual tax returns, which are typically due by April 15. Timely issuance of the K-1 form helps prevent delays in personal tax filings.

IRS Guidelines for the Schedule K-1 Form

The IRS provides specific guidelines for completing and filing the Schedule K-1 form. These guidelines include:

- Accurate reporting of all income, deductions, and credits.

- Timely distribution of the K-1 forms to all partners and shareholders.

- Ensuring that all information matches the entity's tax filings.

Following these guidelines helps avoid penalties and ensures that all parties fulfill their tax obligations correctly.

State-Specific Rules for the Schedule K-1 Form

Different states may have specific rules regarding the Schedule K-1 form. For example, some states require additional information or have unique filing deadlines. It is essential for taxpayers to be aware of their state's requirements to ensure compliance and avoid any potential penalties. Consulting state tax authorities or a tax professional can provide clarity on these regulations.

Examples of Using the Schedule K-1 Form

Understanding how to use the Schedule K-1 form can be illustrated through various scenarios:

- A partner in a limited liability company (LLC) receives a K-1 detailing their share of the LLC's profits and losses, which they report on their personal tax return.

- An S corporation shareholder receives a K-1 that includes dividends and capital gains, which must be reported accordingly.

These examples highlight the importance of the K-1 form in accurately reflecting income and ensuring compliance with tax laws.

Quick guide on how to complete schedule k 1 form 41 instructions ty 20231 19 24f pdf

Effortlessly Prepare Schedule K 1 Form 41 Instructions TY 20231 19 24F pdf on Any Device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed forms, enabling you to access the appropriate document and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Schedule K 1 Form 41 Instructions TY 20231 19 24F pdf on any platform using the airSlate SignNow Android or iOS applications and simplify any documentation process today.

How to Modify and eSign Schedule K 1 Form 41 Instructions TY 20231 19 24F pdf with Ease

- Locate Schedule K 1 Form 41 Instructions TY 20231 19 24F pdf and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent parts of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Formulate your signature with the Sign feature, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or mislaid documents, time-consuming form searches, or mistakes that necessitate printing additional copies. airSlate SignNow addresses all your document management requirements in just a few clicks from a device of your choice. Modify and eSign Schedule K 1 Form 41 Instructions TY 20231 19 24F pdf and guarantee outstanding communication at every phase of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule k 1 form 41 instructions ty 20231 19 24f pdf

Create this form in 5 minutes!

How to create an eSignature for the schedule k 1 form 41 instructions ty 20231 19 24f pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Schedule K-1 form?

A Schedule K-1 form is a tax document used to report income, deductions, and credits from partnerships, S corporations, estates, and trusts. It provides detailed information about each partner's share of the entity's income, which is essential for accurate tax filing. Understanding the Schedule K-1 form is crucial for ensuring compliance with tax regulations.

-

How can airSlate SignNow help with Schedule K-1 forms?

airSlate SignNow simplifies the process of sending and eSigning Schedule K-1 forms. With our user-friendly platform, you can easily prepare, send, and track these important tax documents, ensuring that all parties can sign them securely and efficiently. This streamlines your workflow and helps you stay organized during tax season.

-

Is there a cost associated with using airSlate SignNow for Schedule K-1 forms?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our cost-effective solution allows you to manage your Schedule K-1 forms without breaking the bank. You can choose a plan that fits your budget while enjoying all the features necessary for efficient document management.

-

What features does airSlate SignNow offer for managing Schedule K-1 forms?

airSlate SignNow provides features such as customizable templates, real-time tracking, and secure eSigning for Schedule K-1 forms. These tools enhance your document management process, making it easier to collaborate with partners and ensure timely submissions. Our platform is designed to improve efficiency and reduce the risk of errors.

-

Can I integrate airSlate SignNow with other software for Schedule K-1 forms?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and tax software, allowing you to manage your Schedule K-1 forms more effectively. This connectivity ensures that your data flows smoothly between platforms, reducing manual entry and enhancing accuracy in your financial reporting.

-

What are the benefits of using airSlate SignNow for Schedule K-1 forms?

Using airSlate SignNow for Schedule K-1 forms provides numerous benefits, including increased efficiency, enhanced security, and improved collaboration. Our platform allows you to manage documents from anywhere, ensuring that you can meet deadlines and maintain compliance with tax regulations. Experience a hassle-free way to handle your tax documents.

-

How secure is airSlate SignNow when handling Schedule K-1 forms?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure cloud storage to protect your Schedule K-1 forms and sensitive information. Our platform complies with industry standards to ensure that your documents are safe from unauthorized access.

Get more for Schedule K 1 Form 41 Instructions TY 20231 19 24F pdf

- Sheetrock drywall contractor package maine form

- Flooring contractor package maine form

- Trim carpentry contractor package maine form

- Fencing contractor package maine form

- Hvac contractor package maine form

- Landscaping contractor package maine form

- Commercial contractor package maine form

- Excavation contractor package maine form

Find out other Schedule K 1 Form 41 Instructions TY 20231 19 24F pdf

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT