Form Fiduciary Federal Tax Deduction Schedule 5802

What is the Form Fiduciary Federal Tax Deduction Schedule 5802

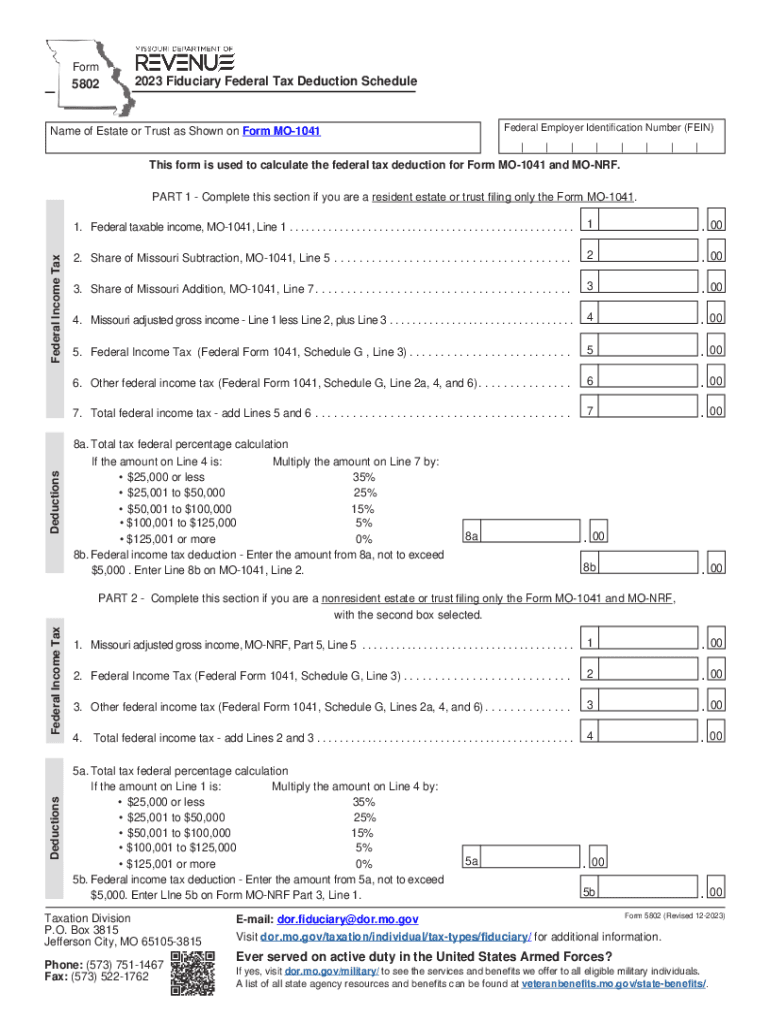

The Form Fiduciary Federal Tax Deduction Schedule 5802 is a tax form used by fiduciaries to report and claim deductions related to the administration of estates and trusts. This form is specifically designed to assist fiduciaries in detailing the allowable deductions that can be claimed on behalf of the estate or trust, thereby reducing the taxable income. Understanding this form is crucial for fiduciaries who manage financial matters for individuals who are unable to do so themselves, ensuring compliance with federal tax regulations.

How to use the Form Fiduciary Federal Tax Deduction Schedule 5802

Using the Form Fiduciary Federal Tax Deduction Schedule 5802 involves several key steps. First, fiduciaries must gather all necessary financial documents related to the estate or trust, including income statements and expense records. Next, they should carefully fill out the form, ensuring that all relevant deductions are accurately reported. It's important to follow IRS guidelines closely to avoid errors that could lead to penalties. Once completed, the form should be submitted along with the fiduciary's tax return to the IRS by the designated deadline.

Steps to complete the Form Fiduciary Federal Tax Deduction Schedule 5802

Completing the Form Fiduciary Federal Tax Deduction Schedule 5802 requires attention to detail. Here are the steps to follow:

- Gather all financial records related to the estate or trust.

- Review the IRS instructions for the form to understand the required information.

- Fill in the personal information of the fiduciary and the estate or trust.

- List all allowable deductions, ensuring that each is supported by documentation.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Key elements of the Form Fiduciary Federal Tax Deduction Schedule 5802

Several key elements must be included when filling out the Form Fiduciary Federal Tax Deduction Schedule 5802. These elements typically include:

- The fiduciary's name and contact information.

- The name of the estate or trust.

- A detailed list of deductions, such as administrative expenses, legal fees, and other allowable costs.

- The total income generated by the estate or trust during the tax year.

- Signature of the fiduciary, affirming the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the Form Fiduciary Federal Tax Deduction Schedule 5802 are crucial for compliance. Generally, the form must be filed by the 15th day of the fourth month following the end of the tax year for the estate or trust. For estates and trusts that operate on a calendar year, this typically means the deadline is April 15. It is essential to be aware of these deadlines to avoid late fees and penalties.

Who Issues the Form

The Form Fiduciary Federal Tax Deduction Schedule 5802 is issued by the Internal Revenue Service (IRS). The IRS provides the necessary guidelines and instructions for completing the form, ensuring fiduciaries have the resources needed to comply with federal tax regulations. It is important for fiduciaries to refer to the official IRS website or publications for the most current version of the form and any updates regarding its use.

Quick guide on how to complete form fiduciary federal tax deduction schedule 5802

Complete Form Fiduciary Federal Tax Deduction Schedule 5802 effortlessly on any gadget

Digital document management has gained traction among enterprises and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to locate the appropriate format and securely store it online. airSlate SignNow equips you with all the essential tools to create, modify, and eSign your documents promptly without obstacles. Handle Form Fiduciary Federal Tax Deduction Schedule 5802 on any device with airSlate SignNow's Android or iOS apps and simplify any document-related task today.

How to modify and eSign Form Fiduciary Federal Tax Deduction Schedule 5802 seamlessly

- Obtain Form Fiduciary Federal Tax Deduction Schedule 5802 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant portions of your documents or obscure sensitive details with tools that airSlate SignNow has specifically for that purpose.

- Create your eSignature with the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or mislaid files, tedious form searching, or errors that require new document prints. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign Form Fiduciary Federal Tax Deduction Schedule 5802 and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form fiduciary federal tax deduction schedule 5802

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form Fiduciary Federal Tax Deduction Schedule 5802?

The Form Fiduciary Federal Tax Deduction Schedule 5802 is a specialized tax form used by fiduciaries to claim deductions on behalf of a trust or estate. This form helps ensure that all applicable deductions are accurately reported to the IRS, thereby optimizing tax liabilities. Proper usage of this form can signNowly impact the overall tax strategy of a fiduciary entity.

-

How can airSlate SignNow assist with Form Fiduciary Federal Tax Deduction Schedule 5802?

airSlate SignNow provides a seamless platform for sending and eSigning documents, including the Form Fiduciary Federal Tax Deduction Schedule 5802. Our user-friendly interface allows fiduciaries to streamline the signing process, ensuring timely submissions without the hassle of paper forms. This transforms the filing experience, making it more efficient and straightforward.

-

What benefits does using airSlate SignNow offer for filing tax forms like the Form Fiduciary Federal Tax Deduction Schedule 5802?

Using airSlate SignNow for filing tax forms like the Form Fiduciary Federal Tax Deduction Schedule 5802 offers numerous benefits, including enhanced security, ease of access, and time efficiency. Our platform enables tracked document status, reducing the risk of lost paperwork. Additionally, the digital nature of our service helps you stay compliant with IRS requirements for electronic submissions.

-

Are there any costs associated with using airSlate SignNow for the Form Fiduciary Federal Tax Deduction Schedule 5802?

Yes, while airSlate SignNow is a cost-effective solution, there are subscription plans that provide different features. Depending on your business needs, you can choose a plan that best fits your requirements for sending and signing the Form Fiduciary Federal Tax Deduction Schedule 5802. We aim to offer transparent pricing that aligns with the value provided.

-

Is it safe to eSign the Form Fiduciary Federal Tax Deduction Schedule 5802 through airSlate SignNow?

Absolutely! airSlate SignNow employs industry-leading encryption and security measures to safeguard your documents, including the Form Fiduciary Federal Tax Deduction Schedule 5802. Our platform complies with legal standards for electronic signatures, ensuring that your signed documents are legally binding and secure.

-

Can I integrate airSlate SignNow with other software for managing the Form Fiduciary Federal Tax Deduction Schedule 5802?

Yes, airSlate SignNow allows integration with various software applications that are commonly used for tax management and document handling. By integrating with your current workflow tools, you can simplify the preparation and eSigning of the Form Fiduciary Federal Tax Deduction Schedule 5802, enhancing productivity and reducing errors.

-

What features does airSlate SignNow offer for managing tax documents like the Form Fiduciary Federal Tax Deduction Schedule 5802?

airSlate SignNow offers a variety of features tailored for managing tax documents like the Form Fiduciary Federal Tax Deduction Schedule 5802, including customizable templates, automated reminders, and real-time tracking. These features ensure that the signing process is smooth and all parties are kept informed throughout. This minimizes delays and enhances efficiency.

Get more for Form Fiduciary Federal Tax Deduction Schedule 5802

- Utah note form

- Utah note 497427717 form

- Notice of option for recording utah form

- Utah documents form

- General durable power of attorney for property and finances or financial effective upon disability utah form

- Essential legal life documents for baby boomers utah form

- General durable power of attorney for property and finances or financial effective immediately utah form

- Revocation of general durable power of attorney utah form

Find out other Form Fiduciary Federal Tax Deduction Schedule 5802

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free