Form 8453 OL Fill in Capable U S Individual Income Tax Declaration for an IRS E File Online Return

Understanding Form 8453 OL

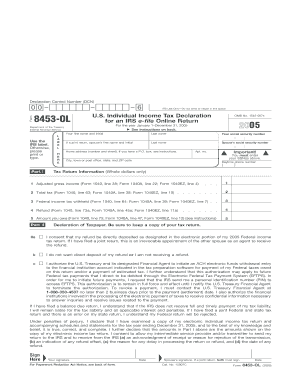

Form 8453 OL is a crucial document for U.S. taxpayers who are filing their income tax returns electronically. This form serves as a declaration for submitting an IRS e-file online return, allowing taxpayers to authenticate their identity and confirm the accuracy of their submitted information. It is specifically designed for individuals who choose to file their taxes through electronic means, streamlining the process and enhancing security.

How to Complete Form 8453 OL

Completing Form 8453 OL involves several key steps. First, ensure you have all necessary information at hand, including your Social Security number, details of your income, and any deductions or credits you plan to claim. After gathering your information, fill out the form accurately, ensuring that all fields are complete. Once filled, you will need to sign the form electronically, which confirms your consent to submit your tax return electronically. This process not only simplifies filing but also helps in maintaining compliance with IRS regulations.

Obtaining Form 8453 OL

Form 8453 OL can be easily obtained from the IRS website or through tax preparation software that supports e-filing. Many tax software programs automatically generate this form when you prepare your return, making it readily accessible. If you prefer a paper version, you can also download and print it from the IRS website. Ensure you are using the most current version of the form to avoid any issues during submission.

Key Elements of Form 8453 OL

Several key elements are essential to understand when working with Form 8453 OL. These include your personal identification information, the type of return you are filing, and your electronic signature. Additionally, the form may require you to provide information about any third-party designees, such as tax preparers, if applicable. Each section of the form must be completed accurately to ensure a smooth filing process.

Legal Use of Form 8453 OL

Form 8453 OL is legally recognized by the IRS as part of the electronic filing process. By signing this form, you affirm that the information provided in your e-filed tax return is true and accurate to the best of your knowledge. This legal affirmation is crucial, as it helps prevent fraud and ensures compliance with tax laws. Understanding the legal implications of this form is vital for all taxpayers engaging in electronic filing.

Filing Deadlines for Form 8453 OL

Filing deadlines for Form 8453 OL align with the standard tax filing deadlines set by the IRS. Typically, individual taxpayers must file their returns by April 15 each year. However, if you are unable to meet this deadline, you may file for an extension. It is important to ensure that Form 8453 OL is submitted along with your e-filed return by the deadline to avoid penalties and interest on any taxes owed.

Digital vs. Paper Version of Form 8453 OL

The digital version of Form 8453 OL offers several advantages over the paper version. E-filing with the digital form is generally faster, more secure, and allows for immediate confirmation of receipt from the IRS. Additionally, using the digital version can reduce the likelihood of errors, as many tax preparation software programs include built-in checks. However, some taxpayers may still prefer to use a paper version for various reasons, including personal comfort or lack of access to digital tools.

Quick guide on how to complete form 8453 ol fill in capable u s individual income tax declaration for an irs e file online return

Effortlessly Complete [SKS] on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the right template and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven procedure today.

How to Edit and Electronically Sign [SKS] with Ease

- Obtain [SKS] and select Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign [SKS] to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8453 OL Fill In Capable U S Individual Income Tax Declaration For An IRS E file Online Return

Create this form in 5 minutes!

How to create an eSignature for the form 8453 ol fill in capable u s individual income tax declaration for an irs e file online return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 8453 OL Fill In Capable U S Individual Income Tax Declaration For An IRS E file Online Return?

The Form 8453 OL Fill In Capable U S Individual Income Tax Declaration For An IRS E file Online Return is a necessary document for electronically filing your IRS tax return. This form serves as an affirmation that the taxpayer has reviewed the return and authorizes e-filing. It's crucial for ensuring compliance with IRS regulations during the e-filing process.

-

How can I use airSlate SignNow to fill out the Form 8453 OL?

You can use airSlate SignNow to easily fill out the Form 8453 OL Fill In Capable U S Individual Income Tax Declaration For An IRS E file Online Return by accessing our user-friendly platform. Our solution provides various tools for document editing and e-signing, allowing you to complete your tax declaration quickly and efficiently. Just upload the form, fill in the required information, and e-sign to submit.

-

Is there a cost associated with using airSlate SignNow for the Form 8453 OL?

airSlate SignNow offers a cost-effective solution with various pricing plans designed to fit different needs. While there may be a nominal fee for premium features, many basic functionalities for completing the Form 8453 OL Fill In Capable U S Individual Income Tax Declaration For An IRS E file Online Return can be accessed at no cost. We recommend reviewing our pricing page for detailed subscription options.

-

What are the key benefits of using airSlate SignNow for tax forms like Form 8453 OL?

Using airSlate SignNow for the Form 8453 OL Fill In Capable U S Individual Income Tax Declaration For An IRS E file Online Return offers numerous benefits, including time savings, improved accuracy, and ease of use. Our platform simplifies the e-signing and submission process, reducing the likelihood of errors. Moreover, it allows you to manage your tax documents securely and efficiently, improving overall workflow.

-

Can I integrate airSlate SignNow with other applications for filing the Form 8453 OL?

Yes, airSlate SignNow integrates seamlessly with various applications to enhance your document management process, including popular tax preparation software. This integration allows you to streamline your workflow while preparing and submitting the Form 8453 OL Fill In Capable U S Individual Income Tax Declaration For An IRS E file Online Return. Check our integrations page for a list of compatible applications.

-

What support options are available if I encounter issues with Form 8453 OL on airSlate SignNow?

airSlate SignNow provides robust support options for users encountering issues with the Form 8453 OL Fill In Capable U S Individual Income Tax Declaration For An IRS E file Online Return. Our support team is available via chat and email to assist with any questions or technical difficulties. Additionally, our knowledge base offers tutorials and guides to help you navigate the platform effectively.

-

Is airSlate SignNow compliant with IRS e-filing requirements for Form 8453 OL?

Absolutely, airSlate SignNow is designed to be compliant with all IRS e-filing requirements, including those specific to the Form 8453 OL Fill In Capable U S Individual Income Tax Declaration For An IRS E file Online Return. We ensure that our platform meets all necessary regulations, providing peace of mind as you electronically submit your tax documents. Always check for the latest updates regarding compliance.

Get more for Form 8453 OL Fill In Capable U S Individual Income Tax Declaration For An IRS E file Online Return

Find out other Form 8453 OL Fill In Capable U S Individual Income Tax Declaration For An IRS E file Online Return

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template