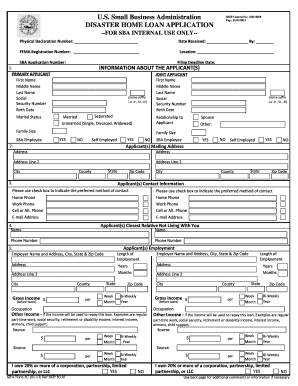

U S Small Business Administration DISASTER HOME LOAN SBA Sba Form

What is the U S Small Business Administration Disaster Home Loan?

The U S Small Business Administration (SBA) Disaster Home Loan is a financial assistance program designed to help homeowners recover from declared disasters. This loan provides low-interest financing to repair or replace damaged real estate and personal property. It is specifically intended for individuals whose homes have been adversely affected by natural disasters such as hurricanes, floods, or wildfires. The program aims to support recovery efforts and restore living conditions to pre-disaster levels.

Eligibility Criteria for the U S Small Business Administration Disaster Home Loan

To qualify for the SBA Disaster Home Loan, applicants must meet specific eligibility requirements. Homeowners must reside in a designated disaster area and have sustained physical damage to their primary residence. Additionally, the applicant must demonstrate creditworthiness and the ability to repay the loan. The SBA also considers the applicant's income and financial situation, ensuring that assistance is directed to those who need it most.

Steps to Complete the U S Small Business Administration Disaster Home Loan Application

Completing the application for the SBA Disaster Home Loan involves several key steps:

- Gather necessary documentation, including proof of identity, income, and property damage.

- Visit the SBA website or a local disaster recovery center to access the application form.

- Fill out the application accurately, providing all requested information.

- Submit the application online or via mail, ensuring it is sent to the correct SBA office.

- Await a response from the SBA regarding the loan approval status.

Required Documents for the U S Small Business Administration Disaster Home Loan

Applicants must provide various documents to support their loan application. Key documents include:

- Proof of identity, such as a driver's license or passport.

- Income verification, including pay stubs or tax returns.

- Documentation of property damage, such as photographs or repair estimates.

- Credit history information, which the SBA will review as part of the application process.

How to Use the U S Small Business Administration Disaster Home Loan Funds

Once approved for the SBA Disaster Home Loan, borrowers can use the funds for various purposes related to recovery. Eligible uses include:

- Repairing or replacing damaged structures, such as homes and garages.

- Purchasing essential personal property, including appliances and furniture.

- Covering costs associated with temporary housing while repairs are made.

Application Process & Approval Time for the U S Small Business Administration Disaster Home Loan

The application process for the SBA Disaster Home Loan can vary in duration. After submitting the application, the SBA typically reviews it within a few weeks. Applicants may receive a decision regarding approval or denial, often within thirty days. If approved, borrowers will be informed of the loan amount and terms, allowing them to proceed with recovery efforts promptly.

Quick guide on how to complete u s small business administration disaster home loan sba sba

Complete [SKS] effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides all the tools you require to generate, modify, and electronically sign your documents quickly and without interruptions. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and electronically sign [SKS] without hassle

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that task.

- Draft your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and press the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or disorganized files, tedious form navigation, or mistakes that necessitate reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign [SKS] and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to U S Small Business Administration DISASTER HOME LOAN SBA Sba

Create this form in 5 minutes!

How to create an eSignature for the u s small business administration disaster home loan sba sba

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the U S Small Business Administration DISASTER HOME LOAN SBA Sba?

The U S Small Business Administration DISASTER HOME LOAN SBA Sba is a loan program designed to help homeowners and businesses recover from disasters. It provides low-interest loans to cover repairs and replacement for real estate and personal property damaged due to disasters.

-

How can I apply for the U S Small Business Administration DISASTER HOME LOAN SBA Sba?

To apply for the U S Small Business Administration DISASTER HOME LOAN SBA Sba, you can visit the SBA website or consult a local SBA office. The application process usually involves filling out forms and providing documentation of damages and financial information to assess your eligibility.

-

What are the eligibility requirements for the U S Small Business Administration DISASTER HOME LOAN SBA Sba?

Eligibility for the U S Small Business Administration DISASTER HOME LOAN SBA Sba typically requires you to have suffered signNow damage from a declared disaster. Additionally, you must show the ability to repay the loan and meet personal credit standards set by the SBA.

-

What are the interest rates for the U S Small Business Administration DISASTER HOME LOAN SBA Sba?

Interest rates for the U S Small Business Administration DISASTER HOME LOAN SBA Sba are comparatively low, often around 2.75% for homeowners and 3% for businesses. The specific rate may vary based on the terms of the loan and your financial standing.

-

What can the U S Small Business Administration DISASTER HOME LOAN SBA Sba be used for?

The U S Small Business Administration DISASTER HOME LOAN SBA Sba can be used for a range of purposes including home repairs, replacements of appliances, and recovery of personal property damaged by disaster. It's a versatile financial solution that aids recovery from major setbacks.

-

Is there a deadline to apply for the U S Small Business Administration DISASTER HOME LOAN SBA Sba?

Yes, there is typically a deadline to apply for the U S Small Business Administration DISASTER HOME LOAN SBA Sba, which is usually set several months after a disaster is declared. It’s crucial to keep an eye on announcements from the SBA regarding deadlines to ensure your application is submitted on time.

-

Are there any fees associated with the U S Small Business Administration DISASTER HOME LOAN SBA Sba?

The U S Small Business Administration DISASTER HOME LOAN SBA Sba generally does not have any application fees. However, you may incur closing costs and other charges, which can vary, so it’s important to inquire during your application process.

Get more for U S Small Business Administration DISASTER HOME LOAN SBA Sba

Find out other U S Small Business Administration DISASTER HOME LOAN SBA Sba

- How To Fax Electronic signature PPT

- How To Complete Electronic signature Word

- Complete Electronic signature Word Free

- Complete Electronic signature Document Free

- Complete Electronic signature Word Fast

- How To Complete Electronic signature PDF

- How Can I Complete Electronic signature Document

- Request Electronic signature Word Online

- How To Request Electronic signature Word

- Request Electronic signature Document Free

- Request Electronic signature Form Easy

- Add Electronic signature PDF Online

- Request Electronic signature Presentation Free

- Add Electronic signature PDF Free

- Add Electronic signature PDF Mac

- How To Add Electronic signature PDF

- How Do I Add Electronic signature PDF

- Add Electronic signature Document Online

- How To Add Electronic signature Document

- Add Electronic signature Word Mac