Form 1041 Schedule K 1

What is the Form 1041 Schedule K-1

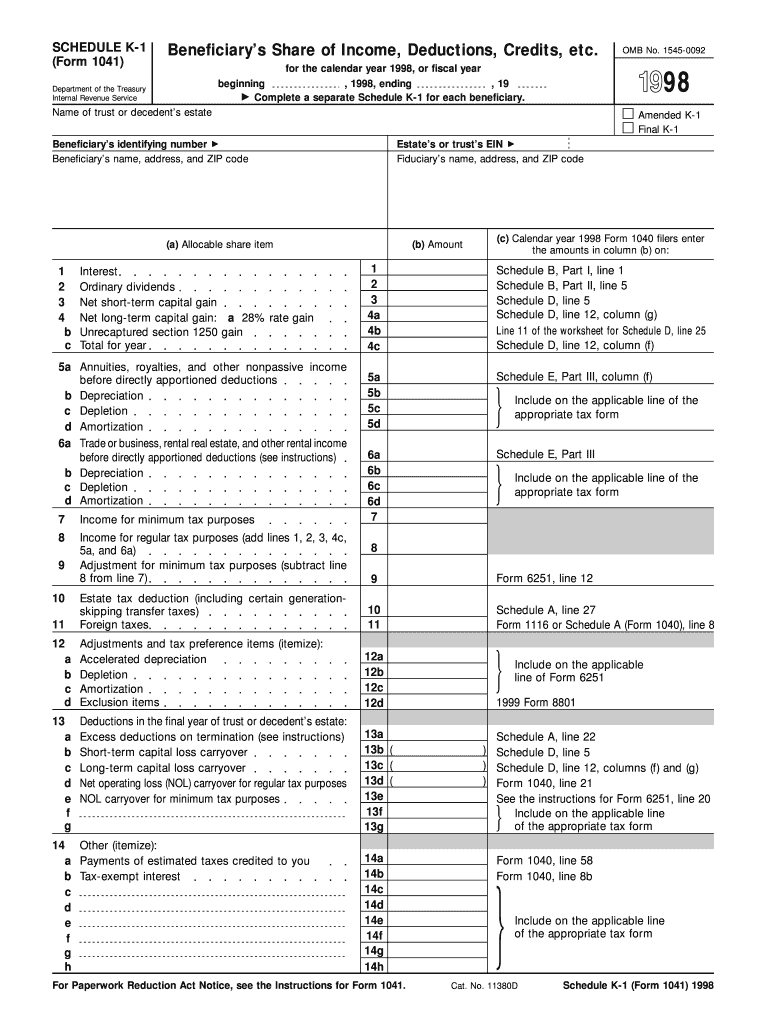

The Form 1041 Schedule K-1 is a tax document used to report income, deductions, and credits from estates and trusts. This form is essential for beneficiaries who receive distributions from an estate or trust, as it provides detailed information about their share of the entity's income. The Schedule K-1 is part of the Form 1041, which is the U.S. Income Tax Return for Estates and Trusts. It ensures that beneficiaries can accurately report their income on their individual tax returns.

How to use the Form 1041 Schedule K-1

Beneficiaries use the Form 1041 Schedule K-1 to report their share of income, deductions, and credits from the estate or trust on their personal tax returns. Once you receive your K-1, review the information carefully to ensure accuracy. The income reported may include dividends, interest, capital gains, and other types of income. It is important to include this information when filing your Form 1040, as it affects your overall tax liability.

Steps to complete the Form 1041 Schedule K-1

Completing the Form 1041 Schedule K-1 involves several steps:

- Gather necessary information about the estate or trust, including its EIN and the beneficiary's details.

- Report the estate's or trust's income, deductions, and credits accurately on the form.

- Distribute copies of the completed K-1 to all beneficiaries, ensuring they receive their respective shares.

- File the Form 1041 along with the Schedule K-1 with the IRS by the applicable deadline.

Key elements of the Form 1041 Schedule K-1

The Form 1041 Schedule K-1 includes several key elements that are crucial for accurate reporting:

- Beneficiary Information: This section includes the beneficiary's name, address, and taxpayer identification number.

- Income Types: The form details various types of income, such as ordinary income, capital gains, and dividends.

- Deductions and Credits: It outlines any deductions or credits that the beneficiary can claim based on their share of the estate or trust.

- Estate or Trust Information: This includes the name and EIN of the estate or trust, which is essential for proper identification.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1041 Schedule K-1 are crucial for compliance. The Form 1041 is typically due on the fifteenth day of the fourth month following the end of the tax year. For estates and trusts operating on a calendar year, this means the form is due on April 15. If the estate or trust has received an extension, the deadline may be extended by six months. Beneficiaries should be aware of these deadlines to ensure they report their K-1 income accurately and on time.

Penalties for Non-Compliance

Failure to comply with the filing requirements for the Form 1041 Schedule K-1 can result in significant penalties. If the estate or trust does not file the K-1 on time, the IRS may impose fines. Additionally, beneficiaries who fail to report the income from their K-1 may face penalties for underreporting their tax liability. It is essential to ensure that all information is accurate and submitted by the deadlines to avoid these consequences.

Quick guide on how to complete form 1041 schedule k 1 1668974

Complete [SKS] effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, edit, and electronically sign your documents quickly without delays. Handle [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest method to modify and eSign [SKS] with ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and holds the same legal standing as a conventional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Alter and eSign [SKS] to ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1041 Schedule K 1

Create this form in 5 minutes!

How to create an eSignature for the form 1041 schedule k 1 1668974

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Form 1041 Schedule K 1 and why is it important?

The Form 1041 Schedule K 1 is a tax document used to report income, deductions, and credits from estates and trusts to beneficiaries. This form is crucial for beneficiaries as it allows them to report their share of income on their individual tax returns. Understanding how to properly complete the Form 1041 Schedule K 1 can help ensure compliance with tax regulations.

-

How does airSlate SignNow help with completing Form 1041 Schedule K 1?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending documents, including the Form 1041 Schedule K 1. Our solution simplifies the process of gathering signatures and facilitates secure document sharing, ensuring that all necessary information is collected quickly and efficiently.

-

What features does airSlate SignNow offer for the Form 1041 Schedule K 1?

With airSlate SignNow, you can effectively automate document management for the Form 1041 Schedule K 1, featuring customizable templates and secure storage capabilities. Our platform also supports real-time collaboration and tracking, so you can ensure that all parties stay informed throughout the process.

-

Is there a free trial available for using airSlate SignNow with Form 1041 Schedule K 1?

Yes, airSlate SignNow offers a free trial allowing users to explore its features and functionalities, including those specific to managing the Form 1041 Schedule K 1. During the trial, you can experience the platform's ease of use and effective document management, enabling you to make an informed decision.

-

What are the pricing plans for airSlate SignNow?

airSlate SignNow offers a range of pricing plans to accommodate different business needs, starting with cost-effective options for individuals and small teams. These plans include features beneficial for handling the Form 1041 Schedule K 1, ensuring you get great value for your investment.

-

Can I integrate airSlate SignNow with other applications for managing Form 1041 Schedule K 1?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to manage the Form 1041 Schedule K 1 alongside your other business tools. This integration helps enhance your workflow and ensures that all documents are accessible in one place.

-

What are the benefits of using airSlate SignNow for Form 1041 Schedule K 1?

Using airSlate SignNow to handle the Form 1041 Schedule K 1 provides numerous benefits, including streamlined document management, enhanced security features, and time-saving automation. Our platform also helps reduce errors by ensuring that all necessary fields are completed before submission.

Get more for Form 1041 Schedule K 1

Find out other Form 1041 Schedule K 1

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template