Minnesota Form Ig260 2017

What is the Minnesota Form Ig260

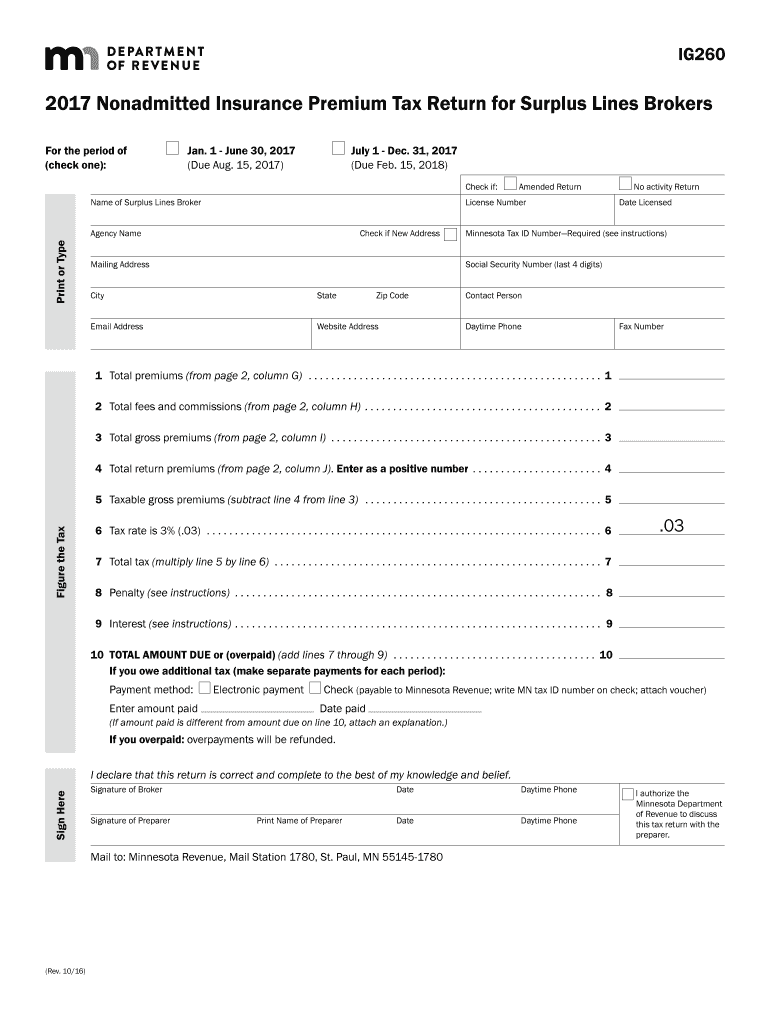

The Minnesota Form Ig260 is a tax form used by individuals and businesses in Minnesota to report specific tax information to the state. This form is essential for ensuring compliance with state tax regulations. It includes fields for personal identification, income details, and deductions, allowing taxpayers to accurately report their financial situation. Understanding the purpose and requirements of this form is crucial for timely and correct tax filing.

How to use the Minnesota Form Ig260

Using the Minnesota Form Ig260 involves several key steps. First, gather all necessary financial documents, including income statements and previous tax returns. Next, download the form from the official Minnesota Department of Revenue website or complete it online using a secure platform. Fill in the required information accurately, ensuring that all figures are correct. After completing the form, review it for any errors before submitting it to the appropriate tax authority.

Steps to complete the Minnesota Form Ig260

Completing the Minnesota Form Ig260 requires careful attention to detail. Follow these steps for a smooth process:

- Gather necessary documents, such as W-2s, 1099s, and receipts for deductions.

- Download the form or access it through an online eSignature platform.

- Fill in personal information, including your name, address, and Social Security number.

- Input income details from all sources, ensuring accuracy.

- List any deductions or credits applicable to your situation.

- Review the completed form for accuracy and completeness.

- Submit the form electronically or print it for mailing.

Legal use of the Minnesota Form Ig260

The Minnesota Form Ig260 is legally binding when filled out correctly and submitted according to state regulations. It is important to ensure that all information provided is truthful and accurate to avoid potential penalties. The form must be signed, either electronically or by hand, to validate the submission. Familiarity with the legal requirements surrounding this form helps taxpayers maintain compliance with Minnesota tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the Minnesota Form Ig260 are crucial for avoiding penalties. Generally, the form must be submitted by April 15 of each year for the previous tax year. However, if April 15 falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any changes in deadlines due to state-specific announcements or extensions, especially during unusual circumstances like natural disasters or public health emergencies.

Form Submission Methods (Online / Mail / In-Person)

The Minnesota Form Ig260 can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Use a secure eSignature platform to complete and submit the form electronically.

- Mail: Print the completed form and send it to the designated address provided by the Minnesota Department of Revenue.

- In-Person: Visit a local tax office to submit the form directly, ensuring it is received on time.

Quick guide on how to complete minnesota form ig260 2017

Your assistance manual on how to prepare your Minnesota Form Ig260

If you’re wondering how to create and send your Minnesota Form Ig260, here are some straightforward guidelines on how to make tax processing easier.

To begin, you just need to set up your airSlate SignNow account to change the way you handle documents online. airSlate SignNow is an extremely user-friendly and robust document solution that allows you to modify, draft, and complete your income tax forms effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures, and revisit to adjust responses as necessary. Enhance your tax management with advanced PDF editing, eSigning, and easy sharing.

Follow the instructions below to finalize your Minnesota Form Ig260 in just a few minutes:

- Establish your account and start working on PDFs in a matter of minutes.

- Utilize our library to obtain any IRS tax form; browse through variations and schedules.

- Click Get form to access your Minnesota Form Ig260 in our editor.

- Input the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to insert your legally-recognized eSignature (if required).

- Examine your document and rectify any errors.

- Save the modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Keep in mind that filing on paper can lead to increased return errors and delayed refunds. Of course, before electronically filing your taxes, check the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct minnesota form ig260 2017

FAQs

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

-

How do I fill out the UPSEAT 2017 application forms?

UPESEAT is a placement test directed by the University of Petroleum and Energy Studies. This inclination examination is called as the University of Petroleum and Energy Studies Engineering Entrance Test (UPESEAT). It is essentially an essential sort examination which permits the possibility to apply for the different designing projects on the web. visit - HOW TO FILL THE UPSEAT 2017 APPLICATION FORMS

-

How do I fill out the JEE Advanced 2017 application form?

JEE Advanced Application Form 2017 is now available for all eligible candidates from April 28 to May 2, 2017 (5 PM). Registrations with late fee will be open from May 3 to May 4, 2017. The application form of JEE Advanced 2017 has been released only in online mode. visit - http://www.entrancezone.com/engi...

-

How can I fill out an improvement form of the CBSE 2017?

IN the month of August the application form will be available on cbse official website which you have to fill online then it will ask in which you subject you want to apply for improvement…you can select all subjects and additional subjects also then you have to pay the amount for improvement exam which you have to pay at bank. take the print out of the acknowledgement and the e-challan and deposit the fees at bank… you also have to change your region when you type the pin code then according to that you will get your centre as well as new region means you region will change. it don't effect anything. after all these thing you have to send a xerox copy of your marksheet e-challan acknowledgement to the regional office which you get. the address will be returned on the acknowledgement after that you have to wait to get your admit card which you will get online on month of February…and improvement marksheet will be send to you address which you fill at time of applications form filling time. if you get less marks in improvement then old marksheet will be valid soAll The Best

Create this form in 5 minutes!

How to create an eSignature for the minnesota form ig260 2017

How to create an electronic signature for the Minnesota Form Ig260 2017 in the online mode

How to generate an eSignature for your Minnesota Form Ig260 2017 in Google Chrome

How to make an eSignature for putting it on the Minnesota Form Ig260 2017 in Gmail

How to create an eSignature for the Minnesota Form Ig260 2017 from your smart phone

How to create an electronic signature for the Minnesota Form Ig260 2017 on iOS

How to make an electronic signature for the Minnesota Form Ig260 2017 on Android OS

People also ask

-

What is the Minnesota Form Ig260 and how does it work with airSlate SignNow?

The Minnesota Form Ig260 is a crucial document for various administrative processes in Minnesota. Using airSlate SignNow, you can easily upload, edit, and sign this form securely. Our platform streamlines the signing process, making it simple to complete the Minnesota Form Ig260 digitally.

-

How much does it cost to use airSlate SignNow for the Minnesota Form Ig260?

airSlate SignNow offers a cost-effective pricing model tailored to meet diverse needs. You can access features for the Minnesota Form Ig260 starting with our basic plan, which includes essential eSigning capabilities. We also provide premium options for additional features that enhance document management.

-

What features does airSlate SignNow provide for managing the Minnesota Form Ig260?

airSlate SignNow includes various features to optimize the management of the Minnesota Form Ig260. You can utilize templates for repetitive tasks, add text fields, and ensure compliance through built-in security measures. These features help you create an efficient workflow for signing and managing your documents.

-

Are there any benefits to using airSlate SignNow for the Minnesota Form Ig260 over traditional methods?

Yes, using airSlate SignNow for the Minnesota Form Ig260 provides several signNow benefits over traditional methods. You’ll save time and resources with our digital solution, enabling quick and easy signing from anywhere. Additionally, electronic signatures are legally binding, ensuring compliance and reducing paperwork.

-

Can I integrate airSlate SignNow with other applications for handling the Minnesota Form Ig260?

Absolutely, airSlate SignNow offers seamless integrations with various applications that may be essential for processing the Minnesota Form Ig260. You can connect it to your CRM software, cloud storage, and other workflows to streamline your operations. This integration capability enhances efficiency and simplifies your document management process.

-

Is it easy to get started with airSlate SignNow for the Minnesota Form Ig260?

Getting started with airSlate SignNow for the Minnesota Form Ig260 is incredibly simple. Our user-friendly interface allows you to upload the form, add signers, and send it for eSignature within minutes. We also provide support resources and tutorials to help you navigate the platform effortlessly.

-

What security measures does airSlate SignNow offer for the Minnesota Form Ig260?

airSlate SignNow prioritizes security for all documents, including the Minnesota Form Ig260. We implement advanced encryption technologies to protect your data during transmission and storage. Furthermore, our platform complies with industry standards, ensuring that your documents remain confidential and secure.

Get more for Minnesota Form Ig260

- Af form 3215 1006327

- Ofa 112 application for parking form

- Refund form 1112998

- City of texas city building inspection department mygov us form

- Littleton profit shares form

- Theatricaltelevision taft hartley report background form

- Form 2500 124 mobility device access application and permit for department lands

- Old english game bantam club of america form

Find out other Minnesota Form Ig260

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free

- How To eSignature Wyoming LLC Operating Agreement

- eSignature California Commercial Lease Agreement Template Myself