Minnesota Dept of Revenue Tax Ig260 Form 2019

What is the Minnesota Dept Of Revenue Tax Ig260 Form

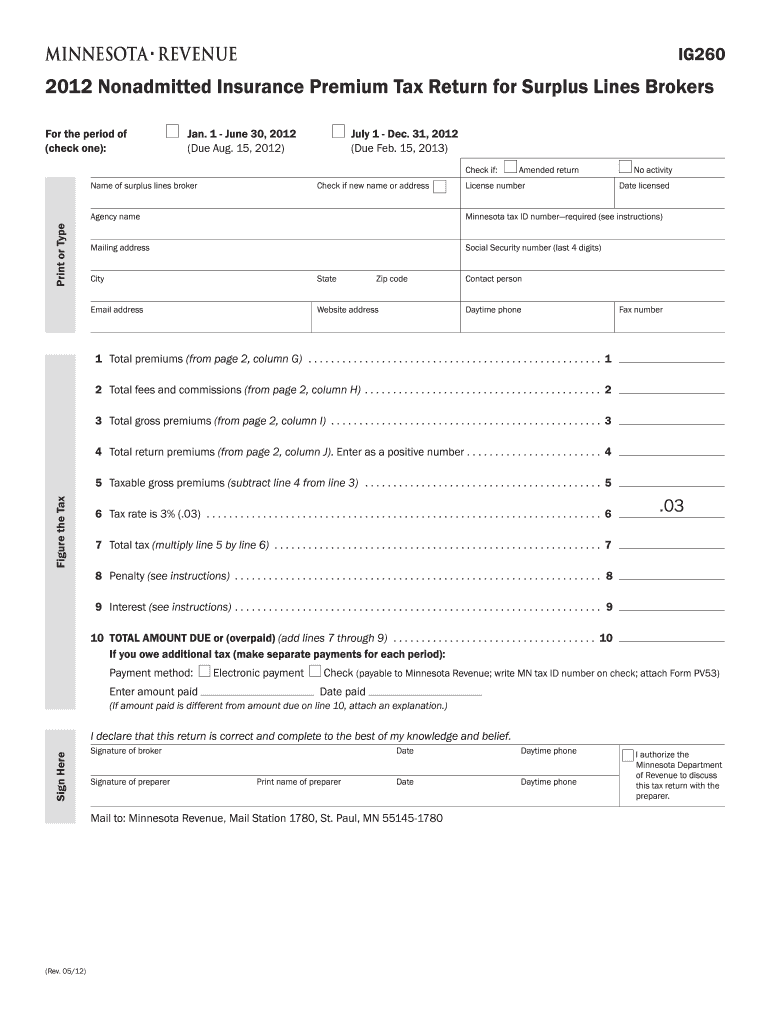

The Minnesota Dept Of Revenue Tax Ig260 Form is a specific document used for tax purposes in the state of Minnesota. This form is essential for individuals and businesses to report certain financial information to the state’s revenue department. It plays a crucial role in ensuring compliance with state tax laws and regulations. Understanding the purpose of this form is vital for accurate tax reporting and avoiding potential penalties.

Steps to complete the Minnesota Dept Of Revenue Tax Ig260 Form

Completing the Minnesota Dept Of Revenue Tax Ig260 Form requires careful attention to detail. Here are the key steps to follow:

- Gather necessary information, including your personal identification details and financial records.

- Access the form through the Minnesota Department of Revenue website or obtain a physical copy.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form via the preferred method, whether online, by mail, or in person.

Legal use of the Minnesota Dept Of Revenue Tax Ig260 Form

The legal validity of the Minnesota Dept Of Revenue Tax Ig260 Form hinges on its proper completion and submission. To ensure that the form is legally binding, it must adhere to state regulations regarding tax documentation. This includes providing accurate information and obtaining the necessary signatures. Utilizing a secure digital platform for signing can enhance the form's legal standing by ensuring compliance with eSignature laws.

How to obtain the Minnesota Dept Of Revenue Tax Ig260 Form

The Minnesota Dept Of Revenue Tax Ig260 Form can be obtained through several methods. Individuals can visit the Minnesota Department of Revenue's official website to download the form directly. Alternatively, physical copies may be available at local tax offices or public libraries. It is important to ensure that you are using the most current version of the form to avoid any issues during submission.

Form Submission Methods

There are multiple methods for submitting the Minnesota Dept Of Revenue Tax Ig260 Form. Taxpayers can choose to file the form online through the Minnesota Department of Revenue’s e-filing system, which is often the fastest option. Alternatively, the completed form can be mailed to the appropriate address provided on the form or submitted in person at designated tax offices. Each submission method has its own processing times, so it is advisable to consider deadlines when choosing how to submit.

Key elements of the Minnesota Dept Of Revenue Tax Ig260 Form

The Minnesota Dept Of Revenue Tax Ig260 Form includes several key elements that must be accurately filled out. These elements typically consist of:

- Taxpayer identification information, including name and Social Security number.

- Details regarding income, deductions, and credits applicable to the taxpayer.

- Signature lines for the taxpayer and any authorized representatives.

- Instructions for completing the form, which provide guidance on specific entries.

Quick guide on how to complete minnesota dept of revenue tax ig260 form

Effortlessly Complete Minnesota Dept Of Revenue Tax Ig260 Form on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to find the correct form and securely store it digitally. airSlate SignNow equips you with all the resources you need to create, modify, and electronically sign your documents quickly, without any hold-ups. Handle Minnesota Dept Of Revenue Tax Ig260 Form on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Edit and Electronically Sign Minnesota Dept Of Revenue Tax Ig260 Form with Ease

- Find Minnesota Dept Of Revenue Tax Ig260 Form and click Get Form to begin.

- Use the tools we offer to finish your document.

- Highlight important sections of the documents or redact sensitive information with specialized tools that airSlate SignNow provides for that purpose.

- Create your signature using the Sign feature, which takes a few seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious searches for forms, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Minnesota Dept Of Revenue Tax Ig260 Form to ensure clear communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct minnesota dept of revenue tax ig260 form

Create this form in 5 minutes!

How to create an eSignature for the minnesota dept of revenue tax ig260 form

The way to make an electronic signature for a PDF online

The way to make an electronic signature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

How to generate an electronic signature from your smartphone

The way to generate an eSignature for a PDF on iOS

How to generate an electronic signature for a PDF file on Android

People also ask

-

What is the Minnesota Dept Of Revenue Tax Ig260 Form?

The Minnesota Dept Of Revenue Tax Ig260 Form is a document required by the state of Minnesota for specific tax-related purposes. It facilitates the reporting of certain financial information effectively. Understanding this form is crucial for compliance with Minnesota tax requirements.

-

How can airSlate SignNow help with the Minnesota Dept Of Revenue Tax Ig260 Form?

airSlate SignNow provides a seamless way to electronically sign and manage the Minnesota Dept Of Revenue Tax Ig260 Form. Our platform allows you to fill out, sign, and send the form quickly, ensuring you meet all deadlines without hassle. Enjoy a smoother filing experience with our user-friendly solution.

-

Is there a cost associated with using airSlate SignNow for the Minnesota Dept Of Revenue Tax Ig260 Form?

Yes, airSlate SignNow offers a variety of pricing plans that cater to different needs of users handling documents like the Minnesota Dept Of Revenue Tax Ig260 Form. Our plans are designed to be cost-effective while providing the necessary features for efficient document management. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for the Minnesota Dept Of Revenue Tax Ig260 Form?

airSlate SignNow includes features such as secure e-signing, document templates, and real-time tracking, all of which enhance the handling of the Minnesota Dept Of Revenue Tax Ig260 Form. Additionally, the platform allows easy collaboration and integrates with various applications to streamline your workflow. Harness these features to improve your document processing.

-

Can I integrate airSlate SignNow with other applications for the Minnesota Dept Of Revenue Tax Ig260 Form?

Absolutely! airSlate SignNow supports integrations with numerous applications, making it easy to work with the Minnesota Dept Of Revenue Tax Ig260 Form across your existing tools. Whether it's cloud storage solutions or project management software, our platform ensures seamless connectivity to enhance your productivity.

-

What are the benefits of using airSlate SignNow for the Minnesota Dept Of Revenue Tax Ig260 Form?

Using airSlate SignNow for the Minnesota Dept Of Revenue Tax Ig260 Form offers numerous benefits, including improved efficiency, reduced processing time, and enhanced security. The electronic signing process helps you avoid the delays of traditional methods, allowing faster compliance with tax regulations. Experience convenience and peace of mind with our reliable solution.

-

Is airSlate SignNow compliant with Minnesota state regulations for the Minnesota Dept Of Revenue Tax Ig260 Form?

Yes, airSlate SignNow is compliant with all necessary regulations required for managing documents like the Minnesota Dept Of Revenue Tax Ig260 Form. Our platform is designed to adhere to legal standards for electronic signatures, ensuring your submissions are valid and secure. Trust in our compliance for your tax-related needs.

Get more for Minnesota Dept Of Revenue Tax Ig260 Form

- Tides worksheet pdf form

- Anna university medical fitness certificate format

- Ipv6 addressing and subnetting workbook answers form

- Name that nursery rhyme game answers form

- Cadastro individual form

- Example of a warranty deed form

- Where to mail mv 44 form pa

- Child care emergency basic plan doc name of facility form

Find out other Minnesota Dept Of Revenue Tax Ig260 Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors