These Forms Are Intended for Reporting Any Type of Securities and Security Related Cash Etax Dor Ga

Understanding the purpose of the forms for reporting securities

The forms intended for reporting any type of securities and security-related cash, such as the Etax Dor Ga, serve a crucial role in financial transparency and compliance. These forms are designed to provide regulatory authorities with detailed information about transactions involving securities, ensuring that all financial activities are accurately reported. This process helps maintain the integrity of the financial markets and protects investors by promoting accountability among businesses and financial institutions.

Steps to complete the reporting forms

Completing the forms for reporting securities involves several key steps. First, gather all necessary documentation related to the securities transactions, including purchase agreements, sale receipts, and any relevant financial statements. Next, carefully fill out each section of the form, ensuring that all information is accurate and complete. Pay special attention to details such as dates, amounts, and identification numbers. Once the form is filled out, review it for any errors before submission. Finally, submit the completed form through the appropriate channels, whether online, by mail, or in person, as specified by the regulatory authority.

Legal considerations for using the reporting forms

Using the forms for reporting securities is subject to various legal requirements. It is essential to understand the regulations governing securities transactions in your state and at the federal level. Compliance with these laws helps avoid potential legal issues, including penalties for non-compliance. Additionally, accurate reporting is vital for tax purposes, as discrepancies can lead to audits or other legal repercussions. Consulting with a legal or financial advisor can provide clarity on the specific obligations associated with these forms.

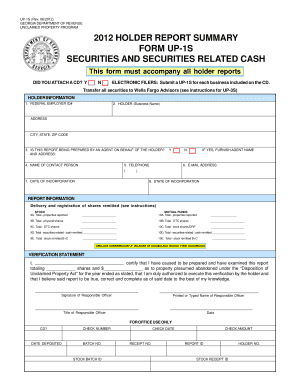

Key elements required in the reporting forms

When filling out the forms for reporting securities, several key elements must be included. These typically encompass the name and address of the reporting entity, detailed descriptions of the securities involved, transaction dates, and the amounts of cash related to each transaction. It is also important to include any relevant identification numbers, such as Social Security numbers or taxpayer identification numbers. Ensuring that all required fields are completed accurately is essential for the form's acceptance by regulatory authorities.

Obtaining the forms for reporting securities

The forms intended for reporting any type of securities and security-related cash can be obtained through various channels. Most regulatory agencies provide these forms on their official websites, where they can be downloaded and printed. Additionally, some financial institutions may offer these forms to their clients as part of their services. It is advisable to ensure that you are using the most current version of the form to comply with the latest regulations.

Examples of scenarios requiring these reporting forms

There are numerous scenarios where the forms for reporting securities may be necessary. For instance, if an individual sells stocks or bonds, they must report these transactions to ensure compliance with tax laws. Similarly, businesses involved in significant securities transactions, such as mergers or acquisitions, are required to report these activities to maintain transparency. Understanding when and why to use these forms is essential for both individuals and businesses engaged in securities trading.

Filing deadlines for the reporting forms

Filing deadlines for the forms intended for reporting securities can vary based on the specific regulations governing the transactions. Typically, these forms must be submitted by a certain date following the end of the tax year or the completion of the transaction. It is crucial to stay informed about these deadlines to avoid late fees or penalties. Keeping a calendar of important dates related to securities reporting can help ensure timely submissions.

Quick guide on how to complete these forms are intended for reporting any type of securities and security related cash etax dor ga

Effortlessly prepare [SKS] on any device

The management of documents online has gained popularity among businesses and individuals. It serves as an ideal environmentally-friendly substitute for conventional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow furnishes all the tools necessary for you to create, edit, and eSign your documents quickly without any delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

Steps to edit and eSign [SKS] easily

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive details with tools specifically provided by airSlate SignNow for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to deliver your form, whether by email, text message (SMS), invitation link, or download it to your PC.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to These Forms Are Intended For Reporting Any Type Of Securities And Security Related Cash Etax Dor Ga

Create this form in 5 minutes!

How to create an eSignature for the these forms are intended for reporting any type of securities and security related cash etax dor ga

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the benefits of using airSlate SignNow for These Forms Are Intended For Reporting Any Type Of Securities And Security Related Cash Etax Dor Ga?

Using airSlate SignNow for These Forms Are Intended For Reporting Any Type Of Securities And Security Related Cash Etax Dor Ga streamlines your signing process, improving efficiency and compliance. With a user-friendly interface, you can easily manage your documentation while ensuring that all legal requirements are met. Additionally, our platform supports secure document storage and tracking, which is essential for sensitive financial information.

-

How does airSlate SignNow ensure the security of These Forms Are Intended For Reporting Any Type Of Securities And Security Related Cash Etax Dor Ga?

Security is a top priority at airSlate SignNow. Our platform uses advanced encryption methods to protect all documents, including These Forms Are Intended For Reporting Any Type Of Securities And Security Related Cash Etax Dor Ga. We also offer features like two-factor authentication and audit trails, which provide an additional layer of security and transparency throughout the document signing process.

-

What pricing plans are available for airSlate SignNow when filing These Forms Are Intended For Reporting Any Type Of Securities And Security Related Cash Etax Dor Ga?

airSlate SignNow offers various pricing plans tailored to suit different business needs when dealing with These Forms Are Intended For Reporting Any Type Of Securities And Security Related Cash Etax Dor Ga. Our plans range from a basic free option to premium packages that provide additional features and support. This ensures that you can find the right fit for your budget and usage requirements.

-

Can I integrate airSlate SignNow with other software for These Forms Are Intended For Reporting Any Type Of Securities And Security Related Cash Etax Dor Ga?

Yes, airSlate SignNow seamlessly integrates with a variety of third-party applications, making it easy to work with your existing tools. Whether you need to link it with CRM platforms, project management tools, or accounting software, our integrations streamline your workflow for These Forms Are Intended For Reporting Any Type Of Securities And Security Related Cash Etax Dor Ga. This flexibility enhances productivity and improves overall management of your documents.

-

How long does it take to get started with airSlate SignNow for These Forms Are Intended For Reporting Any Type Of Securities And Security Related Cash Etax Dor Ga?

Getting started with airSlate SignNow for These Forms Are Intended For Reporting Any Type Of Securities And Security Related Cash Etax Dor Ga is quick and easy. You can set up your account in minutes, and our user-friendly tutorials guide you through the initial stages. This allows you to begin sending and eSigning your documents without lengthy onboarding processes.

-

Are there any limitations to using airSlate SignNow for These Forms Are Intended For Reporting Any Type Of Securities And Security Related Cash Etax Dor Ga?

While airSlate SignNow is designed to handle a wide range of documents, including These Forms Are Intended For Reporting Any Type Of Securities And Security Related Cash Etax Dor Ga, certain limitations may apply based on your chosen plan. Each plan has specific features and usage limits to consider, so it is essential to review them before making a decision to ensure it meets your needs.

-

What features of airSlate SignNow are most beneficial for These Forms Are Intended For Reporting Any Type Of Securities And Security Related Cash Etax Dor Ga?

Key features of airSlate SignNow that support These Forms Are Intended For Reporting Any Type Of Securities And Security Related Cash Etax Dor Ga include customizable templates, automated workflows, and electronic signatures. These functionalities simplify the preparation and signing process, allowing businesses to ensure compliance while saving time and resources. Furthermore, real-time tracking provides visibility into document status, enhancing communication and oversight.

Get more for These Forms Are Intended For Reporting Any Type Of Securities And Security Related Cash Etax Dor Ga

- First coast medicare form

- Annexure 1 kea form

- Sample letter performance improvement plan initiation on letterhead

- Foccus test online form

- Employee separation notice mail to landrum professional employer services inc form

- Cdph standard method v1 1 form

- Lcrs local conveyance form

- Dbq examining primary sources answer key form

Find out other These Forms Are Intended For Reporting Any Type Of Securities And Security Related Cash Etax Dor Ga

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile