Alaska Income Tax Education Credit Form 6310 for C 2013

Understanding the Alaska Income Tax Education Credit Form 6310

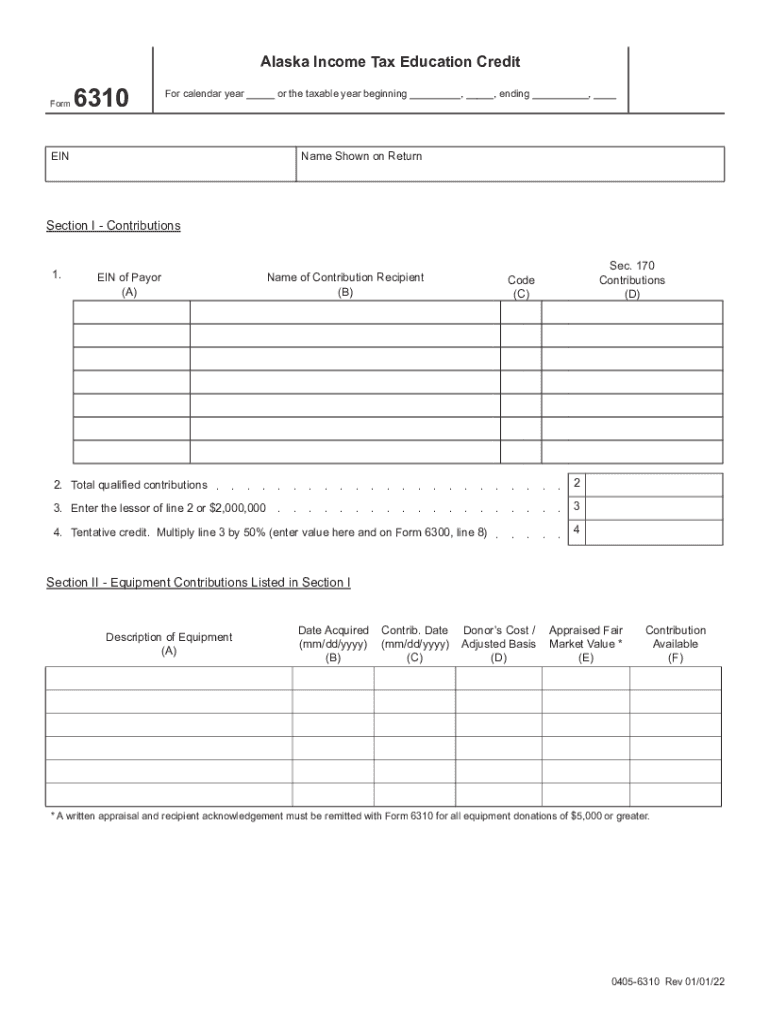

The Alaska Income Tax Education Credit Form 6310 is designed to help residents of Alaska claim a credit for qualified education expenses. This form is particularly beneficial for individuals or families who are incurring costs related to higher education. The credit can significantly reduce the amount of state income tax owed, making education more affordable for Alaskan taxpayers.

How to Use the Alaska Income Tax Education Credit Form 6310

To effectively utilize the Alaska Form 6310, taxpayers must gather all relevant information regarding their education expenses. This includes tuition, fees, and other qualifying costs. Once this information is compiled, it can be entered into the form, ensuring that all required fields are accurately completed. It is essential to follow the instructions provided with the form to maximize the potential credit.

Steps to Complete the Alaska Income Tax Education Credit Form 6310

Completing the Alaska Income Tax Education Credit Form 6310 involves several key steps:

- Gather necessary documentation, including receipts for tuition and fees.

- Download the form from the official state website or obtain a physical copy.

- Fill out personal information, including your name, address, and Social Security number.

- Detail your education expenses in the designated sections of the form.

- Review the completed form for accuracy before submission.

Eligibility Criteria for the Alaska Income Tax Education Credit Form 6310

To qualify for the credit claimed on Form 6310, taxpayers must meet specific eligibility requirements. Generally, the credit is available to individuals who have incurred costs for post-secondary education at accredited institutions. Additionally, there may be income limits and other criteria that affect eligibility, so reviewing the instructions carefully is crucial.

Required Documents for Alaska Form 6310 Submission

When submitting the Alaska Income Tax Education Credit Form 6310, certain documents are necessary to support your claim. These typically include:

- Receipts for tuition and fees paid.

- Proof of enrollment at an accredited institution.

- Any additional documentation that may be requested by the state tax authority.

Filing Deadlines for the Alaska Income Tax Education Credit Form 6310

Timely submission of Form 6310 is essential to ensure that you receive the education credit. The filing deadlines typically align with the general state income tax filing deadlines. It is advisable to check with the Alaska Department of Revenue for the most current deadlines to avoid any penalties or missed opportunities for claiming the credit.

Quick guide on how to complete alaska income tax education credit form 6310 for c

Effortlessly Prepare Alaska Income Tax Education Credit Form 6310 For C on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to find the correct template and securely keep it online. airSlate SignNow equips you with all the necessary tools to quickly create, modify, and eSign your documents without delays. Manage Alaska Income Tax Education Credit Form 6310 For C on any device with the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The Easiest Way to Modify and eSign Alaska Income Tax Education Credit Form 6310 For C with Ease

- Find Alaska Income Tax Education Credit Form 6310 For C and click Get Form to begin.

- Utilize the tools provided to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with the specialized tools that airSlate SignNow offers.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all details and click the Done button to save your changes.

- Select your preferred method to send your form, either via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, time-consuming form searches, or mistakes that necessitate reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Alaska Income Tax Education Credit Form 6310 For C and ensure clear communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct alaska income tax education credit form 6310 for c

Create this form in 5 minutes!

How to create an eSignature for the alaska income tax education credit form 6310 for c

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 6310 and how can it be used with airSlate SignNow?

Form 6310 is a specific document often required for various legal and administrative purposes. With airSlate SignNow, you can easily upload and securely eSign Form 6310, streamlining the process and ensuring compliance with necessary guidelines.

-

How does airSlate SignNow ensure the security of Form 6310?

AirSlate SignNow prioritizes security with advanced encryption and authentication measures. When eSigning Form 6310 through our platform, you can trust that your sensitive information is protected and that you are compliant with the latest legal standards.

-

What are the pricing options for using airSlate SignNow for Form 6310?

AirSlate SignNow offers various pricing tiers to accommodate different business needs. Whether you're a small business or a large enterprise, you'll find a plan that allows for efficient handling of Form 6310 at cost-effective rates.

-

Can I integrate airSlate SignNow with other applications for handling Form 6310?

Yes, airSlate SignNow offers robust integrations with many popular applications. This allows you to seamlessly manage Form 6310 alongside your existing workflows in tools like Salesforce, Google Workspace, and more.

-

What are the key features of airSlate SignNow that assist with Form 6310?

AirSlate SignNow provides features like customizable templates, automated workflows, and real-time tracking. These tools are particularly beneficial when managing Form 6310, ensuring that you can easily create, send, and eSign documents efficiently.

-

How does eSigning Form 6310 with airSlate SignNow benefit my business?

Using airSlate SignNow to eSign Form 6310 can signNowly speed up your document processes, reducing turnaround time. This efficiency not only saves your business resources but also enhances customer satisfaction by providing a quick and professional service.

-

Is there customer support available for queries related to Form 6310?

Absolutely, airSlate SignNow offers dedicated customer support for all users. If you have any questions or need assistance with Form 6310, our support team is available to guide you through the process.

Get more for Alaska Income Tax Education Credit Form 6310 For C

- Letter from landlord to tenant with directions regarding cleaning and procedures for move out maryland form

- Property manager agreement maryland form

- Agreement for delayed or partial rent payments maryland form

- Tenants maintenance repair request form maryland

- Guaranty attachment to lease for guarantor or cosigner maryland form

- Amendment to lease or rental agreement maryland form

- Warning notice due to complaint from neighbors maryland form

- Lease subordination agreement maryland form

Find out other Alaska Income Tax Education Credit Form 6310 For C

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself